Having an idea of which real estate comps website to check out for the most accurate rental comps data will do you a lot of good as an investor.

Table of Contents

- How to Price Your Rental

- What Are Rental Comps?

- How to Calculate the Value of a Rental Property Using Rental Comps

- Why Mashvisor Is the Best Rental Comps Website for Investors

- Wrapping It Up

In this article, you will learn how to use real estate comp data to calculate a property’s value and set the right rental rate. This is why it is important for you to know where to look for the most accurate comps. As an investor, it is something you should take seriously, especially if you plan to venture into either a traditional or an Airbnb business.

As far as comps are concerned, countless investors have found Mashvisor to be very helpful in providing the most accurate rental market data. Find out why they consider Mashvisor as the best rental comps website as we talk more about rental benchmarking below.

How to Price Your Rental

When it comes to pricing rental properties, one needs to first know what factors determine rental rates in an area.

Investment Goals

Rental properties are classified into two main categories: long-term or traditional rentals and short-term or vacation rental properties. Your rates will depend on your investment strategy since there is a huge difference between the two strategies.

A traditional rental property is a house that is rented out for longer periods, usually six months or longer. Vacation rentals, on the other hand, are typically meant to be rented out for several days to a few weeks. However, the pandemic has somewhat extended that period to a few months since folks are now able to travel more due to remote work arrangements.

Landlords charge on a monthly basis, while Airbnb owners and hosts charge nightly rates for their rentals. According to Mashvisor’s latest data, the median traditional rental income in the US is $1,872, while the median for daily Airbnb rates is $204.

So before you come up with a rental rate, you first need to determine which rental strategy you are going to use.

Property Price

Generally, landlords can set their rental prices according to the property’s value. Some choose to go with the fair market value, while others simply go with how much they purchased the property. Either way, the property price can give you a good idea of how much you should be charging for a long-term rental.

There is what we call the 2% Rule, which dictates that the rate for a traditional rental should be 1%-2% of the property’s value. The said rule isn’t set in stone and is only meant to lead you in the right direction in terms of pricing. It is no substitute for due diligence.

The 2% Rule might not be a good pricing consideration for short-term rental properties. Be sure to look for Airbnb pricing guides to make sure you set reasonable and competitive rates.

Related: 10 Steps to Setting the Right Airbnb Pricing Strategy

Seasonality

When it comes to rental rates, seasonality matters. Across the board, it has been found that the demand for rental properties goes up during spring and summer. It is also the time when buyers are out looking for income properties for sale. Regardless of whether an investor is looking to buy or rent a house, the demand for rentals plateaus around wintertime. The reason for the decline is it is quite inconvenient to move houses during the colder months.

Apartment List reports that 25% of renters who look for properties during the summer move in within 30 days. They also say that 90% of those who find properties to rent in January take around 90 days to move in.

As such, fewer renters are out looking for properties during the winter months. It leads to landlords lowering their rates to attract renters. The takeaway is this: listing your property on the rental market during the winter season will limit your ability to charge accordingly.

Cost of Expenses

More often than not, landlords only use the first three factors mentioned above in pricing their rental properties. However, it hurts their income-generating potential. They fail to factor in the recurring expenses that maintaining a rental business entails. For this reason, you need to take into account how much it will cost you to operate your business and provide your tenants with a pleasant experience.

Some of the most common expenses in running a rental property business are:

- Mortgage payments

- Regular maintenance

- Repairs and updates

- HOA fees, where applicable

- Cost of vacancy periods

- Taxes

- Property management fees, if any

Of course, you don’t want to just break even from your business. You also need to consider how much profit you want to make. A reasonable range is around 1%-6% of your rental rate.

Amenities

If your property comes with certain features that can boost your traditional or Airbnb occupancy rate, factor them into your computation as well. Certain amenities can significantly affect your rental rates, so you need to know which ones they are. Some of the most notable amenities that can boost your rental rates are:

- On-site parking

- Swimming pool or hot tub

- Washer and dryer

- Dishwasher

The above amenities cost a lot, and property owners can charge up to 15% more in rent. Other additional features that add to your rental rates include accessibility to public transportation, nearby dining and shopping options, security, and walkability.

Rental Comps

And then there’s what we call rental comparables. They allow you to find out what other similar properties are going for in the market. A lot of investors use this data to see whether an investment property is worth getting or not based on how similar properties are performing.

As a rental property investor, you will need to look at how other properties are doing in the neighborhood of your choice. It allows you to set reasonable and competitive prices that will make tenants take notice of your property.

Related: 4 Effective Ways to Increase Your Airbnb Revenue

What Are Rental Comps?

Rental comparables are basically properties in the immediate vicinity that have very similar qualities and characteristics to the subject property. These are simply real estate comps that focus on rental properties.

As an investing tool, they are important to any rental property investor for several reasons. One, it allows them to see whether a particular property is reasonably priced or not. Two, it also helps them pit a subject property against other similar properties in the market.

For instance, you’re considering investing in a 3-bedroom single-family home in a particular neighborhood. You plan to convert the property into a rental property. You can check out other 3-bedroom properties in the immediate vicinity with the same characteristics. We’re talking about the area in square footage, property price, and the number of bathrooms, among others.

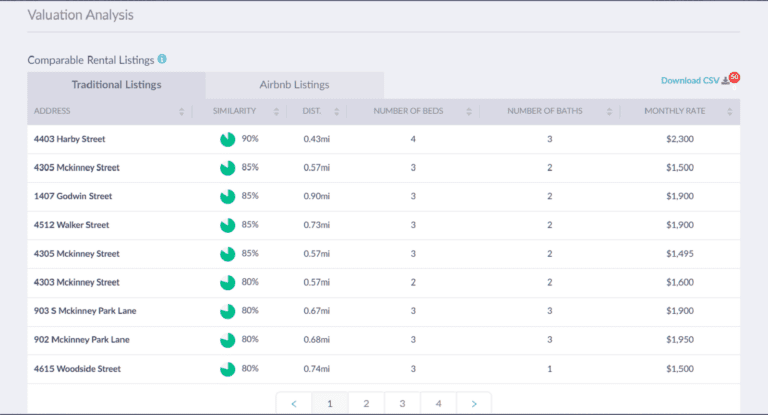

You can perform your due diligence by going around the neighborhood and asking around for the information that you need. However, it would be quite tiresome and time-consuming. The easiest way is to use technology and visit a rental comps website like Mashvisor. Accessing the website will allow you to gather the data you need in a matter of minutes, compared to the conventional way of driving around town.

However, you must also know which rental comps website to visit as not all of them are created equally. While rental listings can provide you with some general information, you still need to have that information analyzed to see if you can make a good return on your investment. The right website will help you spot the right properties that align with your investment goals.

As a rental property investor, you will find rental comps useful in finding whether a property is reasonably priced or not.

How to Calculate the Value of a Rental Property Using Rental Comps

If you’re a rental property owner, you may have had moments when you thought you were probably undercharging. You don’t want to be impulsive about it and set higher prices that may not be right for the market you’re in. So you’re left in a conundrum. How do you ensure that you’re charging enough rent to cover your expenses and make some decent profit?

This is where comps can come in very handy.

As mentioned a while ago, rental benchmarking is essential for any rental property investor as it allows you to compare your properties with other similar houses in the area. You can see what the actual numbers are for the market you’re in – property prices, profitability, and actual rental rates.

The process of putting together real estate comps is quite comparable to creating a comprehensive market analysis (CMA). They typically come in a table format or Excel sheet for easier comparison. As an investor, you use real estate comps to see how a particular subject property stacks against other similar properties in the area. It means looking at the following:

- Location

- Property Size in Square Footage

- Property Type

- Number of Bedrooms

- Number of Bathrooms

- Date of Construction

- Overall Property Condition

- Amenities

It is typically recommended to look for three to five comps within a three-mile radius before proceeding to the next step: performing a rental market analysis.

Rental Market Analysis

Conducting a rental market analysis can be quite confusing, especially if you don’t have any data to work with. But if you have the right comps, you will end up with fairly accurate numbers.

Below is a simple breakdown of the process:

1. Neighborhood Evaluation

First, you need to make an objective assessment of the neighborhood. Get as much information as you can about the location. Even if a certain city is doing quite well as a real estate market, the performance of each of its neighborhoods varies.

You need to ensure that more than just being a good neighborhood, it is desirable to tenants. The right neighborhood will attract the right tenants, and by “right tenants,” we mean the good ones. Listed below are several qualities to look out for:

- High walkability score

- Access to public transportation

- Access to public amenities and attractions

- Good educational institutions

- Easy access to dining, entertainment, and shopping

- Thriving business establishments

- Clean and safe environment

2. Rental Comps Gathering

Once you’ve found a good neighborhood, it’s time to take a look at the available properties. As soon as you have a property or two in mind, it’s time to compare them with real estate comps. You can identify comps by the qualities we listed in the previous section.

You can find this data in several ways. One is going around town listing down all the comparable properties you see and writing down all the information in a ledger. Such a method isn’t as effective and is both costly and time-consuming.

Two, you can pay for a professional real estate appraiser’s services. While these people have access to a wealth of local real estate information, getting home appraisals also costs a lot of money.

Three, you can go online and look for a rental comps website for the data you need. However, you need to also do your research on which website you should use as not all of them can get as much done for the fees they’re charging. At this point, you need to make sure that the website you’re getting your rental data from is not just accurate in terms of data but can also help you crunch the numbers for a more accurate ROI projection.

3. Rent Calculation per Square Foot

As we’ve repeatedly mentioned, one of the main things to look for with real estate comps is the size per square foot. It will give you a good idea of how much livable space is on the property as well as its lot size.

To get the number, you just need to take the average rental rate for your comps data. From there, you can determine how much the fair market rental rate is.

Of course, you will need to factor in other variables, such as income-boosting amenities, but generally, they should point you in the right direction. You may adjust your initial rental rates accordingly to not short-change yourself and remain competitive in the market.

4. Costing

Lastly, having a pretty good idea of how much rent you can make on a property, regardless of whether it’s a traditional or vacation rental, will make it easier to identify which income property to buy. You will need to look at the inventory if there are enough properties to go around and if they can have a good cap rate for rental property and good cash on cash return.

Why Mashvisor Is the Best Rental Comps Website for Investors

Instead of just going to rental listing sites, we highly recommend using Mashvisor as your go-to website for your real estate investment concerns.

As a real estate website, Mashvisor has helped countless investors make the best investment decisions. The platform provides access to a massive real estate database and several investment tools, including comprehensive market analysis. By far, it is a reliable and easy-to-use source of information and data necessary for high-quality real estate analysis.

Related: 7 Reasons Why Mashvisor Is the Best Real Estate Platform for Investors

As a real estate platform, you can use it to find data anywhere in the 2023 US housing market. More importantly, you can use its investment property calculator to show you the data and analytics for each comparable property. It will give you a quick overview of the property’s cap rate, cash on cash return, and occupancy rate. Mashvisor users get access to all the said data on the state, city, and neighborhood levels, making it a lot easier to locate the right investment property.

Subscribers may also download the above information using the Export Neighborhood Report feature. You may set up different filters to further customize your search results. Once done, you may download the CSV file.

Mashvisor’s database is regularly updated based on the hundreds of MLS nationwide through ListHub. Other sources include reputable sites like Redfin, Trulia, Airbnb, and Vrbo. Having these as sources ensures the quality of data provided by Mashvisor is highly accurate.

With a 4.6 rating on TrustPilot, it’s no wonder investors continue to trust the website for their investment needs.

To find the best real estate comps for faster and smarter real estate investment decisions, click here.

Wrapping It Up

As a rental property investor, you need to understand how valuable real estate comparables are. If you already own a rental business, you don’t want to find out that you’re charging way below fair market rent. On the other hand, you also wouldn’t want to charge too much so that you no longer attract tenants.

Now, if you’re in the market still hunting down properties, comps come in pretty handy in determining whether a subject property is worth buying or not. Either way, Mashvisor can help you not just get market-accurate information but also do the math for you.

Mashvisor’s investment property calculator will help cut down the process of looking for rental properties and performing data analysis in just minutes. It will not only save you time but lots of money as well. This makes Mashvisor the best real estate comparables website for both new and seasoned investors who are serious about starting a rental property business.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.