Are you looking for the best way to make money in 2020? How about investing in rental properties for sale? This strategy comes with many important benefits including generating rental income in the short term and capital gains in the long run. But how do you make sure to buy profitable investment properties? The answer is: With the help of a reliable investment property calculator, like Mashvisor’s.

In this article we will show you how to use Mashvisor real estate investment app to buy the best rental properties for sale in any US real estate market.

All it takes to become a successful real estate investor is to sign up for Mashvisor and complete the 5 easy steps outlined below:

Step 1: Find the Best Neighborhoods for Investing in Rental Properties for Sale

Profitable rental property investing begins with locating a good place for this purpose. Everyone in real estate investing knows that location is one of the most important factors in the business. Where a rental property is located determines the sale price, the demand from tenants or Airbnb guests (depending on the rental strategy), the rental rate, the recurring monthly expenses, and ultimately the rate of return. This means that in order to buy positive cash flow income properties with a high return on investment, you have to find one of the best places to invest in real estate.

Related: 10 Best Places to Invest in Real Estate in 2020

Moreover, location is not limited to the city only but also includes the neighborhood in a specific real estate market. Different areas within the same housing market can offer drastically different property prices, rental income, vacancy rate vs. occupancy rate, cash on cash return, cap rate, and optimal rental strategy. This is particularly true for large cities like the New York real estate market, the Los Angeles real estate market, and the Chicago real estate market.

In order to help even beginner real estate investors with zero previous knowledge and background pinpoint the exact top location for buying rental properties for sale, Mashvisor’s investment property calculator conducts detailed neighborhood analysis. This real estate investment analysis is available for areas in all US cities and towns, no matter how big or small.

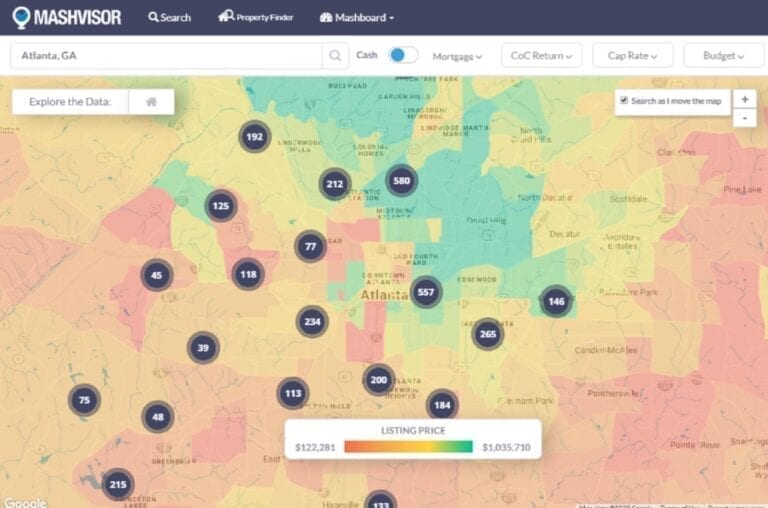

The first factor which determines whether a neighborhood is a good choice for an investor or not is the median property price there. Investors can use the Mashvisor real estate heatmap to find areas with low and high home values in a housing market. They just need to remember that on our heatmap red means low, while green means high. You can see an example of the Atlanta real estate market below.

Mashvisor’s Heatmap Analysis: Listing Price

In each of the circles, providing a summary of the respective area, you will find how many investment properties for sale are available there and what the median listing price is. This allows you to focus on neighborhoods within your budget which are a buyer’s market (with a high number of rental properties for sale) to avoid excessive competition.

On the heatmap, you should also check out which neighborhoods offer a high traditional or Airbnb income, good cash on cash return, and the best Airbnb occupancy rate. Which filters exactly you will use depends on your preferred rental strategy: traditional vs. Airbnb.

Related: Airbnb Rentals: Finding Income Properties Using a Heatmap

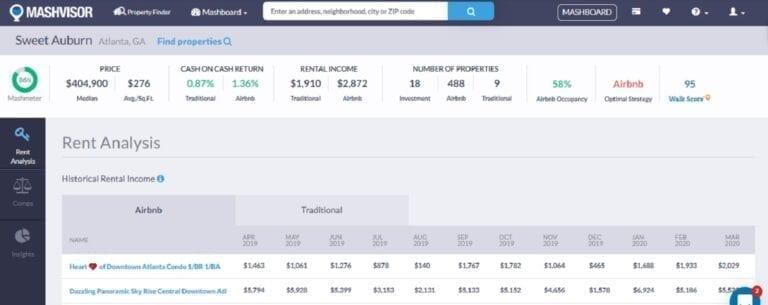

Next, it is time to focus your neighborhood analysis on a few areas which match your property search criteria. Click on the name of any neighborhood you are interested in to be taken to the neighborhood page. At the top of the page, you will find a summary of all the key real estate investment analysis indicators which you need in order to select the best neighborhood for buying traditional or Airbnb rental properties for sale. These include:

- Mashmeter score: This is an evaluation score developed specifically for the Mashvisor real estate investment app which tells investors how good a neighborhood is for investing in income properties. This score is expressed as a percentage.

- Median property price

- Average price per square foot

- Average traditional cash on cash return

- Average Airbnb cash on cash return

- Average traditional rental income

- Average Airbnb rental income

- Number of investment properties for sale including MLS listings, foreclosures, bank-owned homes, short sales, and other off market properties

- Number of Airbnb rental listings

- Number of traditional rental listings

- Average Airbnb occupancy rate

- Optimal rental strategy: traditional vs. Airbnb

- Walk Score

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Mashvisor’s Neighborhood Analysis

All these measures and numbers are calculated based on the performance of actual traditional and Airbnb listings in the neighborhood. Mashvisor obtains real estate, rental, and Airbnb data directly from the MLS, Zillow, and Airbnb.com and crunches all the numbers with its unique investment property calculator.

Related: Where to Find Airbnb Data in 2020 for Real Estate Investing?

After having a look at all these numbers which constitute an indispensable part of the real estate market analysis which Mashvisor’s tools provide at the neighborhood level, even beginner real estate investors can decide whether a certain area is good for investing in rental properties for sale or not.

Sign up for Mashvisor now to start analyzing the potential investment of neighborhoods in all US housing markets.

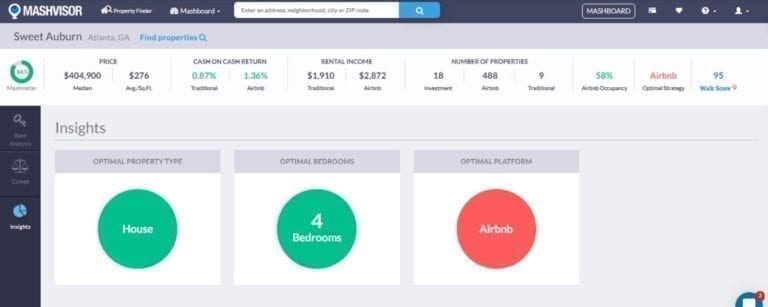

Step 2: Figure Out the Optimal Income Property Type in the Local Market

After deciding which neighborhood is optimal for their real estate investment strategies, investors can continue with the next step in the rental market analysis process to identify a few other important factors.

With Mashvisor’s investment property calculator, you can find out the:

- Optimal property type: single family home, condo, apartment, townhouse, multi family home, etc.

- Optimal number of bedrooms

- Optimal rental strategy

for buying investment properties for sale in any neighborhood within the US. All this real estate data is available in the Insights section of the neighborhood analysis page.

Mashvisor’s Neighborhood Analysis

This feature of our real estate investment software platform helps investors focus their income property search on listings which match these criteria in order to end up with positive cash flow properties each and every time, regardless of their location and budget.

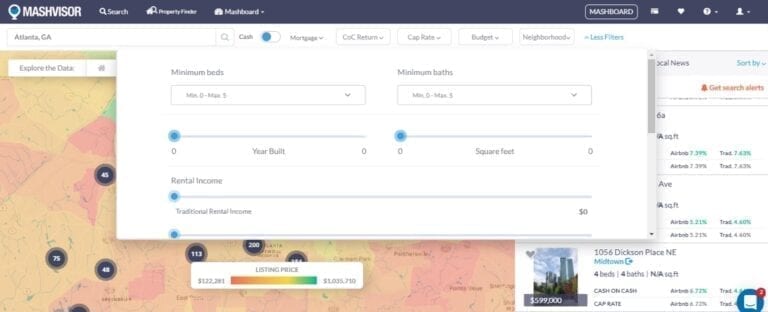

Step 3: Search for Investment Properties for Sale Matching Your Criteria

Now that you know what rental properties for sale to focus on, the real fun begins. The property search process is the most exciting part of real estate investing. Moreover, it is particularly easy and efficient when you have all the right real estate investment tools such as an investment property calculator.

With the search engine on Mashvisor’s real estate investment app, you can focus your income property search on the characteristics which are optimal for your selected city and neighborhood. You can choose from a wide variety of filters including:

- Financing method: cash vs. mortgage

- Cash on cash return

- Cap rate

- Budget range

- Neighborhood

- Number of bedrooms

- Number of bathrooms

- Year built

- Traditional rental income

- Airbnb rental income

- Property type: single family home, condo, townhouse, multi family home, or other

- Property status: for sale, pending, or foreclosure

Mashvisor’s Property Search

This will provide you with a complete list of rental properties for sale in your selected real estate market which match all your expectations and requirements as an investor. These include both traditional and Airbnb for sale properties.

Step 4: Use Mashvisor’s Investment Property Calculator to Analyze Possible Deals

Depending on how specific or general your requirements are, you will end up with a certain number of listings. Now it’s time to conduct detailed investment property analysis on them. You don’t have to worry about having to find rental comps as all needed information, data, and analysis is provided by the best investment property calculator.

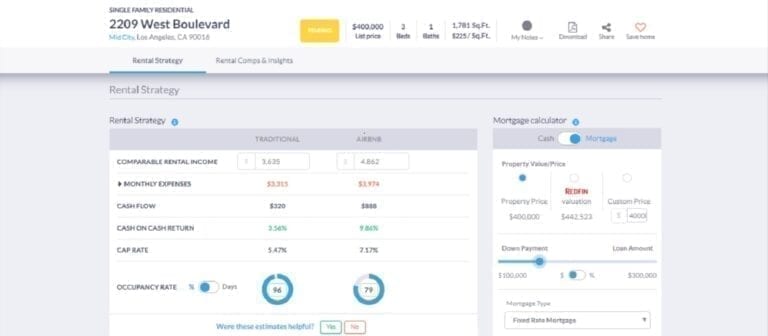

Each rental property analysis will provide real estate investors with the following details:

- Property address

- Property type

- Listing price

- Number of bedrooms and bathrooms

- Basic property description

- Name and contact information of the listing agent

- Property photos

- Property characteristics: days on market, year built, owner occupied or not, heating and cooling system, and others

- Comparable traditional and Airbnb rental income

- Cash flow

- Traditional and Airbnb cash on cash return

- Traditional and Airbnb cap rate

- Traditional and Airbnb occupancy rate

- One-time startup costs

- Home inspection

- Repair costs

- Furniture and appliances (if you rent out a furnished apartment or an Airbnb investment property)

- Closing costs

- Recurring monthly expenses

- Property insurance

- Utilities (when renting out an Airbnb income property)

- Property management (whether you are a DIY landlord or Airbnb host or hire a professional property management company)

- Property maintenance

- Property tax

- HOA fees (if investing in a condo)

- Rental income tax

- Cleaning fees (when investing in an Airbnb property)

- Financing method: cash or mortgage

- Down payment

- Mortgage type: fixed rate mortgage, interest only mortgage, or adjustable mortgage

- Loan term: 15-year fixed or 30-year fixed

- Interest rate

Mashvisor’s Investment Property Analysis

All figures presented in the rental property analysis are based on the performance of traditional and Airbnb rental comps in the neighborhood or the average values for the area. However, our investment property calculator is highly interactive, so all numbers can be changed and customized according to the expectations of the investor. For example, if you have excellent marketing skills and strongly believe that you can raise your Airbnb occupancy rate above the average for the neighborhood and property type, you can increase the number in the analysis. This will make Mashvisor’s calculator recompute all other numbers and provide you with an updated investment property analysis.

Moreover, Mashvisor’s rental property calculator incorporates a mortgage calculator. This helps investors find the optimal method of financing rental properties for sale, depending on their budget and income.

In the Rental Comps & Insights section of the real estate investment analysis, you can find a list of traditional and Airbnb rental comps. In addition to the property address, you can also see how similar each rental listing is to the income property you are currently analyzing and how far it is located from it. For traditional rental comparables, you can see the number of bedrooms and bathrooms and the monthly rental income. For Airbnb rental comps, you have readily available Airbnb occupancy rate, nightly rate, Airbnb income, and Ratings & Reviews. This saves you tons of time and effort as it eliminates the need to conduct comparable rental market analysis on an Excel real estate investment spreadsheet.

Looking for a free tool to estimate the potential Airbnb rental income of a specific property? Use our Airbnb calculator.

Step 5: Choose the Optimal Rental Strategy

Buying rental properties for sale with a high rate of return in terms of both cash on cash return and cap rate does not end here. The final step required in order to optimize your return on investment and assure positive cash flow income properties is to set the best rental strategy for your city, neighborhood, and specific property.

Once again, Mashvisor’s investment property calculator can help with this. For each income property, investors get to see the rental income, cash flow, occupancy rate, cash on cash return, and cap rate generated through both rental strategies: traditional and Airbnb. As soon as you compare the two sets of numbers, you are ready to decide whether operating a long term rental or a vacation home will help you make more money in real estate.

If you decide to invest in Airbnb for sale, keep in mind that many US real estate markets – especially major cities – have imposed strict Airbnb laws and regulations. That’s why it is a must to study the local short term rental rules and regulations before choosing to start an Airbnb business.

Related: 20 Cities with No Airbnb Legal Issues in 2020

These are the 5 steps to buying traditional and Airbnb rental properties for sale with a high rate of return in any US city or town. All you need to do now is to sign up for Mashvisor to gain immediate access to the investment property calculator available on the platform.