As we stand less than two months away from 2023, many real estate investors are wondering how to find rental properties for sale near me.

Table of Contents

- Should You Invest in Rental Properties in 2023?

- 5 Qualities of a Profitable Rental Property

- 6 Steps to Finding Rental Properties for Sale Near Me

- What Else Do You Need to Start Investing in Rental Properties?

Investing in real estate remains a solid strategy to make money in the short and long term. Our US housing market predictions for 2023 show that it is likely to continue into the new year. As the market is stabilizing after two crazy years during the pandemic, investors are expected to be able to locate excellent opportunities in various states and cities.

Nevertheless, whether you make money from your real estate business depends largely on the market in which you invest and the property that you buy. Some locations and some rentals are just better predisposed to being profitable than others.

That’s why in this article, we will show you how to find the top listings for investment purposes, no matter if you’re interested in single family homes or multi unit properties for sale. We will cover the step-by-step process that you need to go through when selecting a rental property for sale.

We will also show you how the Mashvisor tools can support you at each step of the way to guarantee fast and profitable real estate investment decisions.

Let’s get started!

Should You Invest in Rental Properties in 2023?

Before figuring out how to find rental properties for sale near me, you need to establish whether investing in real estate is a good idea at all. After all, there are so many factors to consider when choosing the best investment strategy for your particular needs. Moreover, after the turmoil of the last two years, many are worried that 2023 might be equally unpredictable and shaky.

To help you make up your mind, we’ve put together a list of the most important pros and cons of investing in rental properties in 2023:

Advantages of Rental Property Investments

The most significant benefits that real estate investing provides include the following:

Low Barrier to Entry

While many stay away from investing in income properties because they think it requires a lot of initial capital, it is not necessarily the case. If you don’t have enough cash and need to opt for a conventional mortgage loan, you need to pay a minimum down payment of 20%.

With the median property value in the US residential real estate market reported at $357,810 by Zillow, the minimum down payment amounts to about $72,000.

Of course, you also need to account for closing costs, property fixes and repairs, property taxes, furniture (if buying a short term rental property for sale), and marketing. You need to incur all the said expenses before you can start generating revenue from your rental property investment.

First of all, the total investment cost is significantly less than what other investment strategies require. Moreover, savvy investors can make use of creative financing strategies to avoid taking a mortgage loan. In some cases, for example, you might qualify for a VA loan or an FHA loan. You can also try house hacking, real estate crowdfunding, syndication, or partnership.

Using some of these real estate investment strategies, you can start by investing as little as a few hundred dollars of your own money.

No Special Education Required

The second major benefit when you invest in rental properties is that you don’t need any specific formal education. You can get all the knowledge you need online for absolutely free. All you need to do is to read real estate investing blogs, watch real estate YouTube channels, listen to real estate podcasts, and read e-books on the topic.

Moreover, you can visit meetups of local real estate groups, participate in their discussions, and try to find a mentor there. Many experienced real estate investors are happy to help newbies get started.

So, even if you know nothing about investing in rental properties for sale at the moment, you can be an expert in a few months if you put in enough effort and diligence. Most successful real estate moguls are self-taught.

Ongoing Monthly Income

The ultimate purpose of any investment strategy is to make money, and rental properties are one of the best ways to do that. While with some strategies, you need to wait for months or even years to get revenue, with real estate, you can start generating rental income right away. As soon as your property is ready and you get your first renter, you will start pocketing cash flow.

To speed up the process, it is a good idea to invest in a property in good shape that is almost ready to welcome tenants or short term rental guests. You don’t want to spend all your time and money on repairing a fixer upper as a beginner real estate investor.

In the long term, you will be able to continue making money as long as you keep your rental occupied. Moreover, down the road, you can implement improvements on your single unit or multi unit property to increase income.

Long Term Capital Accumulation

With rental property investing, you get to make money not only in the short run but also for the long haul. One of the greatest benefits of real estate investments is that residential property value appreciation always exceeds the rate of inflation. The main reason is that land—where real estate is built—is a limited resource, so its price keeps going up.

It serves a dual purpose. First, you make money in the long term as you will be able to sell your property for significantly more than what you bought it for. Second, investing in real estate offers a hedge against inflation, as real estate appreciation is more than inflation.

After major home value spikes in 2020-2022, some worry that 2023 might see the beginning of a downfall. However, our forecast is that residential real estate prices will continue to go up in 2023, albeit at a slower pace.

Meanwhile, if you’re wondering which site is best for selling property in the US? To benefit from long-term appreciation, the answer is Mashvisor.

You can list your home or investment property for sale on the Mashvisor Property Marketplace to attract the attention of investors looking for good deals. Selling to investors is better than selling to homebuyers, as the former is ready to close the deal as soon as they see a profitable opportunity.

Ease of Growth

While owning a single rental property is an excellent way to supplement your income, it’s not the way to build a real estate empire and retire early. To achieve that, you need to invest in multi units. The good news is that growing your investment portfolio is very easy with rental properties, and that’s one of the pros of the rental strategy.

You can use the equity you’ve built in your existing rental property to borrow against and buy another property. Moreover, you can save the positive cash flow that you generate from your rentals and invest it again.

As soon as you buy your first investment property, you should build a plan on how to grow. Experts recommend adding a new income property to your portfolio every 2-3 years.

Unlimited Portfolio Diversification

In investing, portfolio diversification is important in order to minimize risk and maximize return. With real estate rental properties, you can achieve great diversification. You can invest in different markets, in varying property types (single family homes vs multi unit properties), in various rental strategies (long term vs short term), and in multiple properties.

Such diversity is important. Even if one market goes down temporarily or one of your rentals stays vacant for a month, you can continue making money from the rest of your portfolio.

Disadvantages of Investing in Rental Properties

While real estate investment promises a lot of benefits in 2023, there are some drawbacks that potential investors need to take into consideration.

Here, we will look at the main ones and how they can be circumnavigated:

Massive Amounts of Real Estate Research and Analysis

Experts say that it takes an average of three months of market and property research and analysis to choose a profitable location and rental for sale.

It is a lot of time and effort that investors need to spend on something that doesn’t even promise optimal results. After all, those with more experience in the business might snatch an opportunity right in front of you―just because they have better ways of performing real estate market analysis and investment property search.

However, there is a way to go around this hurdle. The recent advancement of technology in real estate has produced many tools that allow beginners to compete with those who’ve spent decades in the industry. Later in this article, we will discuss how the Mashvisor platform helps you find the top neighborhoods and rental properties for sale near me for investment.

Recurring Expenses

When you invest in rental properties, you will need to spend money over and over again, month after month. It is known as recurring rental expenses or operating costs.

Some of the expenses include:

- Property tax

- Rental Home insurance

- Property maintenance, including fixes and repairs

- Property management, if you hire a professional

- Utilities and cleaning, if you invest in vacation rentals for sale

- Marketing and advertising

With other strategies like stock trading, once you buy an asset, you don’t really need to spend more money on it.

To avoid issues with the said recurring expenses, it’s important to conduct careful investment property analysis and ensure positive cash flow despite all rental costs. It means that your rental income should exceed your rental expenses for you to make money with real estate.

Vacancy Risk

Yet another cost you need to consider when investing in real estate properties is vacancy. Sometimes, you won’t be able to find tenants, and your property will remain unoccupied for a week or a month. It can majorly affect your return on investment and result in negative cash flow.

That’s why it’s crucial to factor in the vacancy risk in your rental property analysis before buying. Make sure you can sustain positive cash flow and good cap rate even if your property is vacant for a bit.

Active Engagement

Being a landlord or even more so becoming an Airbnb host is an active investment strategy. You need to market your property, deal with renters, inspect it, maintain it, clean it, change sheets, etc. Unless you are a full-time, in-state real estate investor, it might quickly turn into mission impossible.

But there is an easy way to transform your rental revenue into passive income by hiring a long term or short term rental property management company. Just make sure to choose one that offers comprehensive services and boasts a good reputation in your local rental market.

All in all, when we weigh the pros and cons of rental property investments for 2023, it looks like real estate will retain its position as the top investment strategy in the US market.

5 Qualities of a Profitable Rental Property

While 2023 promises to be a good time to invest in real estate, not all rental properties for sale near me are created equal when it comes to investment potential. Some make for profitable opportunities, whereas others will make you lose money.

To help you find the right income property, we’ve gathered the five most important features of money-making investment properties:

- Ready to rent: As a beginner, you want to buy a property that is nearly ready to be marketed and rented out. You don’t want to spend months of time and tons of money on fixing a distressed property. Instead, they are a better fit for house flipping.

- Cheap: It’s easier to turn a profit if you buy an affordable single unit or multi unit property. Your down payment and recurring costs will be less with a cheap rental.

- Versatile: It’s a good idea to go for a property that can work both as a short term rental and a long term rental. Things can always happen to make you want to change your rental strategy down the road, so it’s good to have this option.

- Located in a strong market: Profitable rental properties are those found in markets with high rental demand, above-average rental rates, and major long-term real estate appreciation. In this way you will make money in the short and long run.

- Positive cash flow: You can make money only if your property generates enough cash to cover all expected and unexpected expenses. Thus, analyze it carefully before buying to guarantee positive cash flow from month one.

Now that you know what qualities to keep an eye for, let’s talk about how to find profitable rental properties for sale near me and far away in six easy steps.

6 Steps to Finding Rental Properties for Sale Near Me

If you’re new to the world of real estate investing, finding income properties for sale that promise a good return on investment may sound scary. After all, there are so many factors to take into account. Some include the location (city and neighborhood), property type (single unit or multi unit), the actual property, rental strategy, expenses, income, etc.

However, the truth of the matter is that the process of how to find good rental properties for sale near me (or anywhere else) can be brought down to a few simple steps. As long as you execute them in the right order and with the expected level of care and diligence, you are guaranteed to yield positive results each and every time.

In the following section, we will present you with a six-step guide on how to locate the best rental property investment opportunities in the US real estate market in 2023.

Step 1: Choose a Good Neighborhood

As you’ve probably heard already – more than once – location is the most important factor in real estate investing. The first important thing in finding good rental properties for sale is selecting the right market. It must be a place that not only offers good return on investment but one that is also in line with your preferred rental strategy and budget.

The most efficient way to choose where to invest in a rental property in 2023 is to:

- Check out the Markets section of the Mashvisor blog. There, we publish regularly updated information on the best places for buying single family homes and multi unit properties to rent out on a short term or long term basis. Sometimes your local market is not the best choice, so you need to look elsewhere.

- Visit the Mashvisor real estate heatmap. The heatmap is a real estate investing tool that uses color codes to highlight the top areas for investing in rental properties in any US city or town. As soon as you’ve chosen a good city market with the help of the Mashvisor blog, you should narrow down your market research to the neighborhood level.

Using Mashvisor’s Real Estate Heatmap

You can use the Mashvisor heatmap tool to search for areas with:

- Low median property listing prices

- High long term or short term rental income

- High long term rental and short term rental cash on cash return

- High short term occupancy rate

As a smart real estate investor, you want to focus your market search on areas that offer affordable home values coupled with above-average return on investment. The cash on cash return is one of the best ways to measure ROI in real estate. The CoC metric considers the method of financing, thus giving a detailed overview of opportunities.

Mashvisor’s real estate heatmap provides a color-coded representation of the investment potential of US neighborhoods based on several metrics, such as listing price, rental income, cash on cash return, and occupancy rate.

Step 2: Analyze the Local Rental Market in Detail

After finding a few areas that seem promising for your real estate investment aspirations, the second step is to conduct detailed analysis of them. The Mashvisor neighborhood analysis pages are particularly useful here. They provide all the real estate and rental data that you need in order to decide if an area fits your goals or not.

The available data and information include the following:

- Mashmeter: A Mashvisor-calculated dynamic score predicting the market’s future investment return based on past revenue and other metrics performance.

- Median property price

- Average price per square foot

- Long term and short term cash on cash return

- Long term and short term rental income

- Number of rental properties for sale

- Number of long term and short term rentals

- Short term occupancy rate

- Optimal strategy

- Walk Score

- Transit Score

- Bike Score

- Rental property type distribution

- Rental size distribution

Instead of performing manual rental market analysis, Mashvisor allows investors to get direct access to all the numbers and metrics they need to decide if a neighborhood is good. With this type of data, you can assess whether you can find profitable rental properties for sale in an area, what demand you will face, and what profit you will be able to generate.

Focus your rental property search on markets with reasonable property prices, strong rental income, not too many existing rental listings, and good occupancy. Aim for market-average cash on cash return of at least 5%. Of course, within the market, you should aim to find a property for sale that offers a minimum of 8%, preferably even a double-digit ROI.

Step 3: Search for Profitable Rental Properties for Sale Near Me

The third step in finding good income properties to invest in is the actual investment property search. Traditionally, investors used a variety of sources like agents (to access the MLS database), newspapers, banks (for foreclosures and other off market homes), and their network.

Now, the question “Where can I buy property in the US?” comes with a more efficient response than applying the traditional methods. Namely, real estate investors can use a wide range of websites with listings.

3 Websites That List Rental Properties for Sale Near Me

There are numerous online marketplaces with real estate listings throughout the US market. Below are the three leading ones:

1. Zillow

Zillow easily boasts the largest database of residential real estate properties for sale in the US. It covers different property types, sizes, and price points. However, Zillow homes for sale are not particularly useful for investors because they generally meet the needs of homeowners.

In other words, Zillow doesn’t come with features and functionalities that help rental property investors in specific. So, the website would need to be used in conjunction with another tool to help investors search for profitable opportunities.

2. Auction.com

Auction.com offers one of the biggest selections of off market homes, including foreclosures, bank-owned homes, REOs, and others. It means that investors can find income properties for sale at highly discounted rates.

But once again, they will encounter the same challenge as with Zillow. Namely, the Auction.com website is not specifically designed to target the needs of rental property investors.

3. Mashvisor

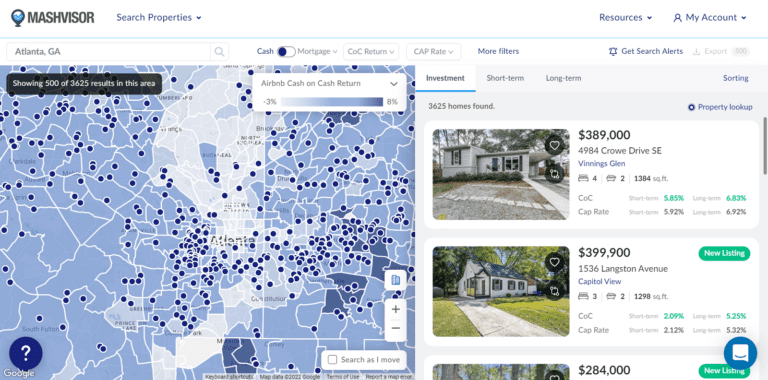

The best website for rental properties for sale is Mashvisor because in addition to MLS listings and off market properties, it also provides a search engine targeted at real estate investors.

You can use the Mashvisor rental property search engine or rental property finder tool to find properties for sale that match your exact requirements and expectations. You can enter criteria like location, price, strategy, property type (single unit or multi unit) and size, expected rental income, and expected return on investment.

Our platform will return all results that match your specifications, which you can then organize by price, size, income, cash on cash return, and cap rate. You can search for properties that are ideal for the long term or short term rental strategy.

Our tools have eliminated the need to flip through thousands of pages or talk to dozens of agents before finding a profitable rental property for sale near me.

Step 4: Conduct Rental Property Analysis

After locating a few potentially profitable opportunities, the next step in the investment process is to analyze the expected performance of each of the listings to choose the best one. The analysis requires locating comparable rental properties in the same area, also known as rental comps.

You need them in order to base your rental property analysis on them. The idea is that the property that you buy is expected, generally speaking, to perform similarly to comparable existing rentals in the same market.

However, manually searching for long term or short term rental comps and finding their performance metrics is a very time-consuming and tedious process. Moreover, it requires access to reputable long term and short term rental data that are usually not available to beginners investors.

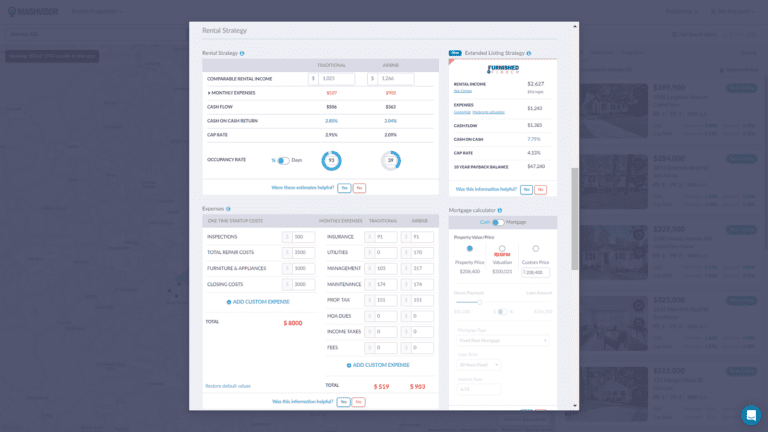

But the Mashvisor rental property calculator provides readily available analysis of all properties for sale listed on the Mashvisor platform, as well as other residential properties. It refers to side-by-side comparison of the investment potential of properties when rented out on a long term vs short term basis.

Rental Property Metrics

The metrics that the Mashvisor real estate investment ROI calculator supplies include the following:

- Property price

- Startup costs

- Rental income

- Recurring rental expenses

- Occupancy rate

- Cash flow

- Cash on cash return

- Cap rate

All the data inputs come from reliable nationwide sources like the MLS, Airbnb, Redfin, Rent Jungle, and public records. The analysis is based on the recent performance of actual rental comps in each market.

Looking at the cash on cash return and cap rate measures gives investors a direct response to the question whether a rental property for sale will be able to generate good profit. A good cash on cash return is considered anything above 8%-10%, while a good cap rate is in the range of 8%-12%.

Mashvisor’s rental property calculator offers readily available analysis of all properties for sale listed on the platform using different real estate metrics.

Step 5: Select the Optimal Rental Strategy

When buying rental properties for sale near me, you need to take into consideration the rental strategy that’s best for your specific market and property. The reason is that different locations and different properties are better suited for different rental strategies. It depends on the local economy, environment, demand, and other factors.

While it is hard to say which strategy will yield better results with a certain property without performing detailed rental property analysis, Mashvisor helps you figure it out right away. As mentioned above, the Mashvisor calculator compares the two rental approaches and shows investors all numbers for both.

In this way, you can decide whether a short term or a long term rental will bring you a higher return on investment. Of course, you also need to account for the local short term regulations, and Mashvisor assists you in this regard, too. On the link above, you can find out if a location allows non-owner occupied vacation rentals or not.

Once you make sure that your preferred rental strategy and chosen single family home or multi unit property for sale are aligned, you’re ready to move forward with the purchase.

Whether you work with an agent or buy on your own depends on your previous experience, negotiation skills, and personal preference. However, it’s generally advised for first-time investors to hire a real estate agent who can usually reach better terms and speed up the closing of the deal.

Step 6: Decide on Rental Management

The last step when finding a rental property to invest in is deciding how you will manage it. You have two basic options: becoming a DIY landlord or short term rental host or hiring a professional property manager.

If you opt for the second, you need to factor in the associated cost in your investment property analysis. But keep in mind that in most cases rental property management companies are able to optimize rental rates, occupancy rates, and rental expenses.

Usually, the extra income which they generate and the savings they bring are more than enough to offset their management fees. It ultimately leads to better cash flow and enhanced return. Moreover, working with a property manager allows investors to make passive income, which is one of the main benefits of investing in rental properties.

Alternatively, you can manage your rental property on your own if you have enough time and skills. Just remember that it may take a good chunk of your time, especially if you run an short term rental business and/or buy a multi unit rental property.

What Else Do You Need to Start Investing in Rental Properties?

Now that you know the steps to find profitable rental properties for sale, is there anything else you need in order to get started?

Just two things.

First of all, you should check out your personal finances and find the best way to finance the purchase of your income property.

How you pay for your property – in cash, with a mortgage, with private money, with hard money, or in any other way – will impact your ROI. It will also affect the long term sustainability of your investment. After all, you want to make sure you don’t go bankrupt and end up in foreclosure in a couple of months or years because you planned your financing strategy poorly.

Second, you should get access to the top real estate investment tools in the US market. As we showed above, using a digital property finder and investment property calculator can significantly boost your efficiency and profitability.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Final Words

Investing in rental properties for sale remains one of the most robust investment strategies in 2023. It helps investors make money both in the short term and long run without incurring unnecessary risk.

However, just buying any property does not guarantee profitability. You must choose a market and a listing with the potential to outperform competition, bring in a high occupancy rate, generate strong income, and result in good ROI.

Finding investment properties for sale that meet the above requirements takes six steps:

- Choosing a good neighborhood

- Analyzing the local rental market in detail

- Searching for profitable rental properties for sale near me

- Conducting rental property analysis

- Selecting the optimal rental strategy

- Deciding on rental management

While it sounds like a lot of hard work, it can all be easily and efficiently completed in a few minutes with the help of the top real estate investing platform for 2023—Mashvisor. With Mashvisor, you can locate the top neighborhoods and the best-performing long term and short term rentals across the US market.

To see all the capabilities of Mashvisor, schedule a free demo now.