The purpose of a rental investment calculator is to determine a property’s income potential. Investors should use one to ensure profitability.

Table of Contents

- Defining Residential Rental Property

- Does Investing in Rental Property Come With Rewards?

- Risks of Investing in Rental Property

- Understanding the BRRRR Method in Real Estate Investing

- Why You Should Use a Rental Calculator

- Where to Find the Best Rental Property Calculator

Investing in real estate remains one of the most profitable business ventures available, especially in the US market. Real estate continues to attract many investors interested in short term or long term rental properties and looking to increase their revenue. Other investors want to take advantage of the ability to earn passive income on top of their other businesses.

However, knowing which real estate markets offer the most lucrative investment opportunities is crucial because not all locations are good for investing. The opportunity to explore any real estate market without leaving your chair is already impressive. But what contributes to your success as an investor is using a tool known as the rental investment calculator.

Keep in mind, though, that the mere idea that your investment plan will generate lucrative returns is not enough. It also involves understanding how the market works. You also need to know the essential tools to help you decide which investment strategy is best for your chosen property. The good news is that such tools are all available with Mashvisor.

Mashvisor is a real estate analytics platform that helps you find the best investment property. Moreover, it also provides important tools like the rental investment calculator so you can make an informed decision. Through Mashvisor, you can find the best place to buy rental property and decide which investment strategy will help you generate the best profits.

Defining Residential Rental Property

We’ll start by covering the most important terms related to residential rental property. New investors should understand the definition of residential rental property, so they will know if this type of real estate investment is right for them.

In general, a residential rental property is a type of property (preferably a home) purchased by the investor (you) with the intention to rent out to tenants who will settle there for some time. The primary purpose of residential rental property is to rent it out to tenants so they will have a place to live in.

Typically, residential properties are zoned specifically as living or dwelling spaces for individuals or households. They are not to be confused with commercial rental properties, which are leased out for business purposes. Most commercial rental properties are explicitly zoned with the purpose of generating profits.

Types of Residential Rental Properties

There are different types of residential rental properties. As an investor, it’s important to be familiar with the different property types that can be used for residential rentals. Note that each type may come with different profitability potential. So, it’s crucial to learn the pros and cons of investing in each rental property type to decide which one will work best for you.

Single Family Homes

The most common type of property used as a rental investment is a single family home. Single family homes are free-standing residential buildings designed as single-dwelling units. Typically, single family homes are the most sought-after residential property by tenants. They offer privacy and a living space that reflects the usual idea of a home.

Aside from single family homes, you may also hear about single family detached homes. The US Census Bureau actually includes townhouses under the said definition—as long as they’re separated. In short, single family homes consist of the living space (the house) and the property around it (the land).

Real estate investors should be aware that such types of residential properties must not share utilities or heating systems with other buildings in their proximity. It is because such an arrangement would make it impossible for you to calculate the rent estimate.

Condos/Co-ops

Similar to single family homes, condos are a popular choice among tenants searching for a short-term residential rental property. Condos, a shortened term for a “condominium,” refer to privately owned individual units that are often part of a larger building complex. If you invest in a condo unit, you just own the unit and not necessarily the whole building.

You’ll probably hear both terms—condos and co-ops. The difference? Condo owners buy the unit and own a part of the property, while co-op owners own a share of the property. Co-ops refer to cooperative housing, which is a type of home ownership (typically a large building) that is shared among other co-owners.

As an investor, it’s important to know that co-ops tend to cost less per square foot. As such, they are popular investments in cities where living costs are higher than average, like New York City.

Multifamily Homes

Multifamily homes are another common type of investment property for investors with large budgets and those who are planning to grow an investment portfolio. They are complexes with units that can be rented out separately. Basically, you allow several families (tenants) to live on your property but in different dwelling units.

With a good analysis and a reliable rental property calculator, multifamily homes can provide high returns for the investor. In addition, it’s a smart choice for rental property investors who want to grow their investment portfolios and avoid applying for multiple loans. Some investors buy a multifamily home with the intention of living in one unit while renting out the rest.

Luxury, Vacation, and Getaway Homes

Luxury homes are pretty straightforward—they are usually apartments, but they can also be villas equipped with cutting-edge technology. Consequently, the occupancy rate in such types of properties is not high. It is because luxury homes are evidently expensive, and they only appeal to tenants who can afford them.

Similarly, getaway homes are of newer construction and located in remote areas, such as mountains and even islands, far away from everyday city life. They are unique properties that may not always appeal to the common crowd. Although not as popular as single family homes, investors still see and generate a good return on investment from getaway homes.

With luxury and getaway homes, you’ll really need to rely on your rental investment calculator simply because it’s not a common choice among tenants. By using an investment calculator, you will get an idea of how much income you can possibly generate from such types of investment properties.

The last option, vacation homes, is the most popular of all three. Vacation residential properties often attract families, couples, and young people during the summer or winter holidays. Vacation homes are used for short term rental investment strategy, which is also a good option for earning passive income.

The most common location for vacation rental properties would be the coastal areas. The Florida real estate market, for instance, is very suitable for this type of investment.

Related: The 10 Best Rental Markets in Florida

Coastal areas are perfect for vacation rental properties, which often attract entire families during summer or winter.

Does Investing in Rental Property Come With Rewards?

It’s time to delve into the question of whether owning rental houses pays off and discuss why potential investors should pursue them as a business opportunity. In general, rental property investments are one of the most common types of real estate investments because of the potential to receive high returns.

Investing in rental properties can be lucrative if you know where to invest. Some rental markets offer generous returns; however, there are other markets that are not ideal for investing in rentals. That is why location is the key if you want to be a successful rental property owner.

To ensure that you’re investing in the right rental market and that you’ll earn a good return on investment, make sure to consider the following factors when choosing a location:

- Economy: Generally, a location with a thriving local economy is best for rental property investing. It is because a place with a good economy attracts people to work and live there, which will increase the population. As the population grows, so as the need for housing.

- Price to rent ratio: Knowing the price to rent ratio in a certain area will help you determine whether there will be a high demand for rentals. Usually, a high price to rent ratio means that people would rather rent a home because house prices are too expensive for them.

- Job opportunities and amenities: A place that offers more job opportunities attracts workers, and most of these workers will need a home to live in. Also, you should consider the available amenities within or close to the location, such as schools, medical facilities, and public transport.

Benefits of Investing in Rental Properties

When you choose the right market to invest in, you will realize the benefits of investing in rental properties. Some of the proven benefits include the following:

Regular Cash Flow

Owning a rental property means you’ll have access to regular cash flow every month. While managing a rental business needs time and effort on your part, it can also be considered as a passive income once you’ll get the hang of it. You can make it a side hustle—an additional income stream on top of your other businesses.

Tax Benefits

We’re all trying our best to be diligent citizens and pay our taxes regularly. Still, when you’re a real estate owner and rent your property for residential purposes, you can count on certain tax benefits.

For starters, you can write off some expenses related to owning a rental property, such as follows:

- The mortgage interest on your loan

- Points paid on the loan

- Maintenance expenses

- Real estate taxes

- HOA dues

- Homeowner’s insurance

Appreciation

As a property owner, you’ll benefit from home appreciation if you invest in a thriving location. It means that your property will increase in value in a few years, allowing you to earn a huge chunk of profits should you decide to sell it later on. It is one of the most common investment strategies that can help investors earn a lot of money.

Now that we know the benefits of investing in rental properties, we should also find out the risks involved in this venture. We will discuss them in the next section.

Risks of Investing in Rental Property

Of course, if there are benefits to investing in rental properties, there are also risks that every investor should know about. Being aware of such risks allows investors to decide which strategy is best for them.

Here are the top three risks of investing in rental properties that you should be aware of:

1. Investing in a Wrong Location

Since location is the most important factor that can either make or break an investment, investing in the wrong location is the most common (and most dreaded) investing risk. A wrong location is an area that lacks sufficient demand to fill in vacancies. It can significantly affect your occupancy rate and your ability to generate income.

Also, a wrong real estate market does not appreciate quickly, which means your asset will not increase in value anytime soon. If you invest in the wrong location, it would be difficult to remedy the situation anymore. That’s why it’s crucial to choose your location wisely before finalizing your decision.

2. Going Overboard With Home Improvement

Most rental properties need to be renovated to make them ready for staging and occupancy. In fact, doing the necessary renovations is essential if you want to increase the value of your rental home. However, some rental property owners make the mistake of going overboard with renovations and home improvement that they fail to stick to their budget.

When you spend too much on home improvements, it can significantly affect your return on investment. It is because what you spend for home improvements will be considered as expenses, which will be deducted from your potential income. If your expenses are too big, it will take longer for you to realize a return on investment.

3. Accepting Problematic Tenants

Another common risk of owning a rental property is having to deal with problematic tenants. Bad tenants are those who do not pay their rent on a timely and regular basis. Also, some of them do not take care of the property as they should, or worse, they deliberately damage the property. Tenants who often encounter problems with their neighbors are also considered problematic.

As a rental property investor, it’s crucial to have a thorough tenant screening process in place to avoid undesirable tenants that will only cause stress and headaches.

Understanding the BRRRR Method in Real Estate Investing

There’s one thing all investors should be familiar with, and that’s the BRRRR strategy. If it’s your first time seeing this abbreviation, you’ll be interested in what we have to say next:

The BRRRR method, short for “Buy, Rehab, Rent, Refinance, Repeat,” is primarily an investment strategy aimed at house flippers. It’s all about investing in distressed houses, flipping or renting them out, and then refinancing future investments.

Here’s the BRRRR method explained in more detail:

Buy

Real estate investors search for distressed properties that require repairs and upgrades. As an investor, you should consider the lenders’ requirements. Most likely, they will require an appraisal of the house, which is more complicated with such types of properties.

As for financing the purchase of these properties, your options generally include HELOC and hard money loans. Another thing to remember when buying a distressed property is that you must calculate the After Repair Value (APV). It lets you know how much you will most likely earn once the property is renovated.

Rehab

Once your real estate calculator deemed it a profitable investment, now it’s time to make major improvements on your property. Each property’s needs are different—but it’s essential for you not to get ahead of yourself here. Focus on improvements that are needed and that will increase the property’s overall value.

In addition, stick to a realistic budget and timeline while you’re carrying out the rehabbing process. As mentioned, if you go overboard with the renovation and you spend beyond your budget, it can adversely affect your profitability potential.

Rent

A crucial step in the BRRRR method is finding tenants that will occupy the property because, otherwise, lenders will not approve refinancing. After all, a vacant property is not generating income (but you still have to pay for the expenses). As a rental property owner, you’ll want to get your property occupied so it can generate income as soon as possible.

Of course, you shouldn’t just settle for any tenants. Look for the following qualities if you don’t want your rehabbed investment property to go to waste:

- Clean credit record and timely payments

- Job/Occupation with a stable monthly income

- No criminal history

- No history of evictions

- Positive references from past landlords (if possible)

Refinance

Provided that you’ve found the right tenants with a stable income, you can now talk to lenders and apply for a cash-out refinance. It’s a type of mortgage that allows you to borrow more than you owe from your last loan and keep the difference.

You should ask for quotes from at least three lenders. Through this, you’ll get an opportunity to review your options and go with the lowest rates, which automatically means the best deal. Also, know that not all lenders are willing to offer favorable rates, so you might need to do a bit of research and compare rates first to get the best deal.

Repeat

You know all the steps—and now you can repeat them again and again.

With each new BRRRR investment strategy, you gain more experience and learn from your previous mistakes. And again, don’t forget to use your return on investment calculator to get the best possible deal.

Related: Does the BRRRR Strategy Really Work?

Why You Should Use a Rental Calculator

One of the critical steps for investing in real estate involves using the right investment tools.

With the development of technology and the continued expansion of the real estate market, it’s getting difficult for investors to keep up with current trends. Relying on such tools provides significant relief for investors searching for a lucrative location for rental property.

One of the most important tools that every investor should use before making any investment decision is the rental property calculator. Let’s discuss the benefits of using a rental investment calculator.

Benefits of Using a Rental Investment Calculator

If you’re sure about real estate investing and you’ve selected a few properties, the next step is to calculate their profitability potential to decide which one would suit you best. Using a rental investment calculator is essential in helping you make an informed decision.

Here are a few advantages of using a rental property calculator include:

Conduct a Thorough Property Analysis

Rental calculators have taken the investment world by storm, and it’s no wonder, given that they’re more reliable than the old-school method. You now have everything you’ll need in one place, available within seconds.

Using rental calculators while searching for the ideal residential rental property will help you gain insight into up-to-date, accurate information. What’s best about the tool is that you can wrap up your research much faster. It’s all made possible by features such as personalized filters.

Know the Property’s Cash Flow

At first glance, investing in real estate may seem risky. However, it can provide you with regular cash flow every month.

Of course, when we say that investing can help you gain profit, we’re not referring to taking up every investment opportunity that you come across on the market. You should know how to locate a profitable one—and a rent calculator can help you get the location right.

Using a rental property calculator can help you determine a property’s potential cash flow. Through this, you’ll know if such an investment will generate sufficient cash flows to cover the expenses associated with owning and operating a rental home. It will be automatically solved for you without the need to use a spreadsheet or an Excel file.

Calculate the Expenses

A good rental investment calculator offers information about the property’s expenses, such as property taxes, insurance, HOA dues, and others. Using a rental calculator allows you to deduct the said expenses from the expected monthly income. It’s best to use a calculator that allows you to customize the expenses so you’ll get a more accurate result.

Calculate Your Income

We don’t know if you’re familiar with this fact, but almost 37% of American households prefer renting out a property to buying a house. By this logic, it pays off for you, as investors, to invest in a rental property located in a stable real estate market and secure a regular passive income.

However, since not all markets are good for rental investments, a rental investment calculator can help you determine which one will generate more profits. That is why it’s important to use a rental property calculator when evaluating a property.

When you use a rental property calculator, you’ll be able to compare the potential rental income from one property to another. This way, it would be easy to decide which property can help you earn a higher return on investment.

Consider Your Mortgage

Investors, especially those at the beginning of their careers, may find it harder to decide how to finance their next investment project. Luckily, rental calculators are here to solve this dilemma, too. You don’t need to use a spreadsheet like Excel to calculate how much you’ll pay for interest or how much will be your mortgage payments.

For those unaware, using a real estate calculator helps you decide whether it’s better to invest in the property with your savings or you should apply for a loan. We believe it is a key feature because it can save an investor from unnecessary debts and keep them on the right track.

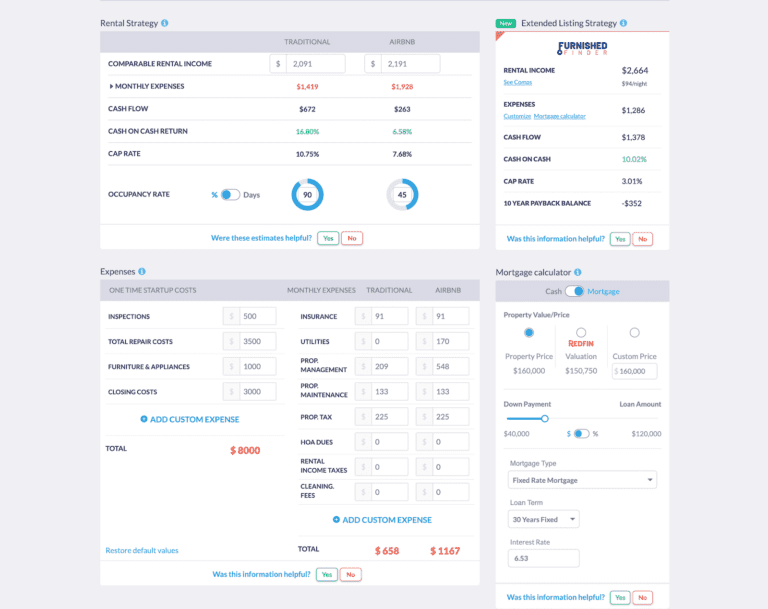

The best rental property calculator should consider how you’ll pay for the purchase of the property. For example, Mashvisor’s calculator allows you to input your financing option, including the terms and interest rates. Then, the calculator will consider your monthly mortgage payments, so you’ll know how much cash flow you need to generate to realize a return.

Where to Find the Best Rental Property Calculator

The best features of a rental investment property calculator are all available with Mashvisor’s rental property calculator. The tool was developed to help real estate investors locate their next investment project. At the same time, it also helps investors to assess its profitability and realize a good return on investment.

Here’s what Mashvisor’s rental property calculator can calculate for you:

Cash Flow

As investors, your goal is to achieve a positive cash flow. In real estate, cash flow is the difference between the income you earn from your tenants during the month and the expenses you must pay.

Logically, your monthly income should be higher than your expenses. Still, it is sometimes not apparent until an analysis is done with the help of your rental property cash flow calculator. On that note, Mashvisor’s calculator will provide you with all the numbers that you need. You will know what you can expect from a particular property—either a positive or negative cash flow.

Capitalization Rate

The capitalization rate, also known as the cap rate, helps investors estimate the potential return on their investment. It is calculated by dividing the ratio of the NOI (net operating income) by the property’s value.

Mashvisor’s cap rate calculator helps investors get a clear picture of their property’s estimated returns. However, the cap rate should not be used as the only indicator of the return on investment from your property. To make the right investment decision, it’s important to use the cap rate along with other measures to determine if the property will be profitable or not.

Cash on Cash Return

Cash on cash return is a significant long-term indicator available within our rental property calculator that provides insight into a real estate investor’s annual return. It’s easy to calculate, and it’s one of the most critical indicators of a successful real estate investment. It’s proven to be the most useful for long-term borrowing.

To calculate the cash on cash return or a particular property, you need to divide the annual pre-tax cash flow by the total cash invested. The figure can help you in evaluating the property’s potential for generating a return on investment, as well as its potential to increase in value over time.

In general, a cash on cash return of 8% or higher is considered good. However, some markets experience very quick and high appreciation rates that a cash on cash return of at least 2% is considered profitable.

Keep in mind that in order to get the correct figure for cash on cash return, only the amount paid in cash will be considered. It means that if you purchase the property through a loan, only the portion that you paid in cash (such as the down payment and closing costs) will be taken into account.

Real estate investors can use Mashvisor’s Rental Property Calculator to assess a property’s profitability and realize a profit.

Mashvisor’s Other Features

We’ve already mentioned the three major C’s of Mashvisor’s rental property calculator—but that’s not the end of what it can offer. If you sign up to use Mashvisor’s tools, you’ll enjoy the benefit of exploring and using some of the following features, too:

- Neighborhood Analysis: This allows you to compare properties within the neighborhood, so you’ll find out how the properties within your chosen area are performing. It also lets you determine the demand for rentals in this neighborhood.

- Rental Comps Analysis: This refers to rental comparables so you can see how your future competitors are doing. Rental comps include properties that are similar in size and type to what you are eyeing. By analyzing the rental comps, you’ll also know how to position your property to stand out among the rest.

- Rental Property Analysis: Once you select a property that interests you, you’ll be taken to a page where you can view all the important information about that property. You’ll see its physical and financial details, including certain metrics that can help you identify whether or not it will make a good investment.

- Optimal Rental Strategy: Another important feature of Mashvisor’s platform is the optimal rental strategy. With Mashvisor, you’ll be able to see side-by-side how the property will perform as a short term rental versus a long term rental. This way, it would be easy for you to decide which strategy is best and can generate the most profits.

Related: The Beginner’s Guide to Rental Property Analysis

Start Investing in Rental Properties

Investing in a residential rental property is one of the most lucrative opportunities in the US housing market. To be successful, you need to gain a broad knowledge of the real estate market and keep up with current trends and data. The good news is that a rental investment calculator will make the process a lot easier and more straightforward.

Using rental property calculators allows investors to perform a detailed analysis of the real estate market. The best rental property calculator also calculates the important metrics that can help determine a property’s profitability, such as cash on cash return, cap rate, and cash flow. The best thing is that you can find all the above features and more with Mashvisor’s calculator.

Mashvisor offers tools that are necessary to find the right investment property. To start, you can search for a property using our database, which includes hundreds of thousands of listings available for sale across the US. The database is easy to use because you can customize the filters to find properties that meet your preferred criteria.

Then, when you select a property you want, you’ll be provided with a thorough analysis that gives you an overview of the property’s profitability potential. Mashvisor’s rental property calculator will help you decide whether or not the property that you’re eyeing will generate sufficient profit to cover your expenses and mortgage.

Moreover, the platform’s calculator will also help you decide which investment strategy is optimal for a certain property. So, if you’re keen on making your investment strategy a reality, Mashvisor is here to help you put that plan into action.

Sign up for Mashvisor’s 7-day free trial, followed by a 15% discount on your quarterly (or annual) subscription.