Real estate investors have a key goal of securing a high passive income from their properties. A condo depreciation calculator can help with this.

Even beginner rental property investors have heard the term depreciation. However, many of them are not sure what exactly it means and how it works in their favor. Depreciation is a big money saver on your income tax and a profitability booster for your condo and other investments.

Table of Contents

- What Is Rental Property Depreciation?

- How Does Condo Rental Property Depreciation Work?

- When to Calculate the Depreciation of Your Rental Condo and Why

- How to Calculate Depreciation for Your Rental Property

- What Is a Condo Depreciation Calculator?

- What About Rental Property Depreciation Recapture?

- Other Ways to Analyze a Rental Condo Property

In this article, we will talk about depreciation in real estate and how it lets investors take a tax break on their investment properties. Then, we will discuss the condo depreciation calculator and how it benefits investors. Finally, we’ll look at the different strategies, metrics, and tools required to analyze the investment potential of rental properties.

What Is Rental Property Depreciation?

Before we look into real estate properties and condo investments, you may ask: What is depreciation?

Generally, depreciation is an object’s loss of value over time because of everyday wear and tear. It is an accounting term used to distribute the cost of a physical asset over its useful time.

In real estate investing, rental properties lose value over time because they are tangible assets. This includes condos, single-family homes, townhouses, and multi-family homes. Like any other property, they need to be cared for and updated to keep up with usage by tenants or short term rental guests. Regular maintenance also helps properties stay competitive in the housing market.

Condo rental property depreciation happens when investors deduct the costs of purchasing a condo and improving it to turn it into a competitive rental listing. Instead of taking a large tax break in the year of property purchase and improvement, depreciation returns the tax deduction over the property’s lifespan.

Related: Rental Property Depreciation: How It Works and Why It’s Great for Investors

What Is the Recovery Period for Condo Investments?

The timeline in which the depreciation value is returned to investors is known as the recovery period. This period can vary depending on the real estate property type and value.

Under the Modified Accelerated Cost Recovery System (MACRS), the IRS considers the recovery period for residential rental properties to be 27.5 years. It already includes condo units. This means that a typical condo depreciates at an annual rate of 3.636%.

The MACRS is the system that calculates depreciation in the US economy for tax purposes. Its predecessor was the Accelerated Cost Recovery System (ACRS) which existed until 1986.

Under the ACRS, which was implemented for assets purchased between 1980 and 1986, the useful time of assets was defined as between 3 and 19 years. As a result, these old depreciation methods allowed for a higher annual depreciation amount, providing investors and businesses with higher tax deductions and leaving more money in their pockets.

Additionally, according to the MACRS, commercial buildings, such as many multifamily real estate investing ventures, have an even longer recovery period of 39 years. It takes even longer for commercial rental property investors to recover the cost of buying and improving a rental property. A primary example of this is those who invest in entire condo complexes.

In most cases, investors use a condo depreciation calculator to calculate the real estate tax benefits for which they are eligible.

How Does Condo Rental Property Depreciation Work?

To get these tax reductions, real estate investors must convince the IRS that their condo has a purposeful life. After the IRS approves that your rental property indeed falls under the category of having a useful life, you then qualify for these tax breaks. Once approved, you can determine the amounts using a condo depreciation calculator.

While depreciation is one of the most significant advantages of investing in real estate properties, you should know that it is not optional; it is mandatory to depreciate the cost of obtaining and maintaining a rental property over time.

You should also know that land does not depreciate as it cannot wear and break down over time, even with maintenance. Land-related costs that you cannot claim include the purchase price of the land as well as the cost of clearing, grading, and planting land over the years.

How Do I Report My Property to the IRS?

The typical way to report the depreciation for your condo is by filing the 1040 Standard E form. Other forms may apply if your property has other circumstances that need consideration. For example, you may need to use a 4562 form to claim depreciation if you are filing the property the same year you are using it as a rental property.

It is also important to note that some rental properties require rental income reports in your taxes. The only way to go around this rule is if the property functions as a residential home and is only rented out for less than 15 days a year. But this also means you cannot deduct rental expenses from your taxes.

When working on your taxes, using a condo depreciation calculator to help you compute the annual depreciation based on all relevant factors is best.

If you have questions about claiming depreciation on a property, we recommend reaching out to your financial advisor or accountant to address any doubts. It is the best way to ensure that everything you do is according to the applicable laws and that it benefits you and your long term or vacation rental property in the best possible way.

When to Calculate the Depreciation of Your Rental Condo and Why

To start, rental property owners choose to claim depreciation on their investment properties because it saves them money in the long run. It is a great way to maximize the gains on your condo and allow you to generate more profits over time.

Overall, this tactic reduces the taxable income, so investors get to keep more of their rental income for themselves instead of paying it as taxes. The primary benefit of real estate depreciation is that it boosts cash flow and return on investment, which is the ultimate dream of every landlord or Airbnb host.

Typically, you would need to do these calculations as soon as your condo is available to be rented out, whether on a long term or short term basis. The reason for this is once your property is listed and ready for tenants or guests, you can claim depreciation.

Thus, it is best to do all calculations beforehand. You can work on all depreciation-related calculations on a condo depreciation calculator for rental property investments.

Related: 5 Things You Need to Know About Investing in a Condo

How to Calculate Depreciation for Your Rental Property

Before you can calculate depreciation for your rental condo, you must meet the qualifications for tax reduction.

The eligibility criteria include the following:

- You must have ownership of the property. There are very limited to no exceptions to this first rule.

- The condo property must produce a source of income.

- You must prove this property is functional and has a useful life. It will vary based on the property and various factors, but for rental listings and a lot of real estate properties, it is fairly standard.

- The condo is considered useful for more than a one-year lifespan. If it falls short of that, you will not qualify for depreciation.

Once you meet the conditions mentioned above, you can begin your calculations.

Basically, there are three essential steps to calculating depreciation in real estate. First, you must find your overall costs. Then, you need to divide these costs by your chosen depreciation plan or the lifespan of the property’s usefulness. Lastly, you have to calculate your specific depreciation schedule with the help of a rental condo depreciation calculator.

Below we will look more in-depth at these three steps:

1. Determine the Overall Costs

To start this process, you need to consider certain aspects of your cost basis. This includes the condo value and the closing costs when you buy a short term rental property or a traditional rental. It is likely that your property value is the purchase price of the listing. It is typical for rental investments.

However, if you have been living in a building and converted it into a rental property, you will need an appraisal to determine the current property value.

For closing costs, you need to take into consideration the following fees:

- Property taxes

- Fees for utility services

- Abstract fees

- Legal fees

- Transfer taxes

- Title insurance

- Recording fees

- Surveys

- Real estate agent fees (though in the US market, the seller usually covers the real estate commissions)

Remember to subtract the cost of the land from your property, as land does not depreciate. This step is important for filing your taxes. You must do this to calculate your depreciation correctly and avoid any potential legal issues.

Thus, it’s important to do careful condo rental property analysis. Doing this allows you to get an accurate estimate of how much it costs to acquire the property.

2. Divide the Cost by the Lifespan of the Condo

This step is straightforward once you’ve completed the previous one. All you need to do is to take your cost basis from step one and divide it by the years that your rental property is considered to have a useful life. Under the MACRS, this lifespan for residential condos is 27.5 years in real estate.

3. Calculate the Depreciation Schedule

Note that you can only claim depreciation when the property is actually in service. It means that if you purchase the condo in January but it’s not ready to be listed for rent until June, you cannot claim depreciation until you have listed the property. This sort of complicates things for the first year, as you can only make a claim once it is rented out.

In most cases, investors like to take advantage of a condo rental property depreciation calculator to help them with these calculations.

What Is a Condo Depreciation Calculator?

A much easier and more accurate way to calculate the depreciation of your condo investment property is with the help of a condo depreciation calculator. It is a special type of rental property calculator that focuses on calculating the annual amount that investors can claim back every year.

All you have to do is to input some basic data, such as:

- Type of property

- Original purchase price (cost basis)

- Years of property ownership

- Land price

- Cost of improvements to the property

The condo depreciation calculator’s outputs include the annual depreciation amount and the total accumulated depreciation size.

Such online calculators are available on various investment property websites.

What About Rental Property Depreciation Recapture?

A rental property depreciation recapture occurs when an investor decides to sell the condo on which they have claimed depreciation. The IRS requires that investors pay taxes for the depreciation expenses taken on the property. This requirement could impact the overall profits made from the rental property, as additional taxes must be paid after a sale.

A great way to find out the specific taxes you will pay if you sell your property is to use a condo depreciation calculator. This calculator also provides recapture estimates.

It is possible to defer or eliminate the depreciation recapture if you are looking to sell your investment property. Still, the process can be difficult, and you might end up losing more money in doing so. It is important to do diligent research and consult with a tax expert before selling an income property with depreciation. You might need more than just a regular calculator if you’re after the best saving approach.

Other Ways to Analyze a Rental Condo Property

Computing the expected depreciation of a rental with the help of a condo depreciation calculator is a must. There’s no doubt about this. It allows investors to save a significant amount of money over the useful life of a real estate asset. However, this is not enough to guarantee a profitable investment. There are other things and other metrics that rental property owners need to consider before investing.

Related: 8 Steps to Buying a Condo—What You Need to Know Beforehand

Analyzing the Rental Income of a Condo

Another crucial way to analyze a rental condo property is to look at the rental income which this property could generate on a monthly or annual basis. Knowing how much income a particular rental property can make regularly is crucial. It will determine the cash flow (money in your pocket) and ROI (profit you make from it).

If you plan to turn your condo into a long term rental, the income you make from it will simply be the rental rate that you charge for it. If you want to start an Airbnb business, the rental income will be the average nightly pricing multiplied by the occupancy rate. This is why rental property analysis is important, as it allows you to set reasonable yet competitive rental rates.

Enter Mashvisor

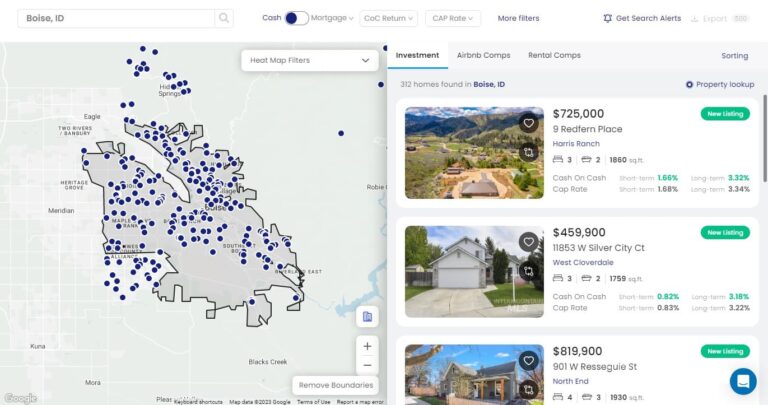

The most efficient way to get accurate estimates of this number, regardless of your investment strategy, is to use the Mashvisor rental property calculator. This tool allows investors to perform a detailed analysis of condo property investments across the US market. The platform’s rental property calculator also works well as an Airbnb calculator for computations that applies specifically to short term rentals.

Suppose you don’t have a specific property in mind. In that case, you can use the Mashvisor Property Finder to search for condos for sale that would make profitable rental properties for either strategy. For each available property, you can view the analysis conducted by the Mashvisor calculator. If you already have a property you are considering, you can enter the address and get access to its expected performance.

Mashvisor’s Property Finder works well with a condo depreciation calculator, as it allows you to look for the best investment properties that meet your needs and goals as an investor.

In this way, with just a few clicks of a button, you can know the potential monthly revenue your condo can make. Mashvisor uses the performance of comparable properties in the same area as its basis for analysis. This ensures that you only get very accurate and reliable results.

To start analyzing the rental income potential of condo investments across the US market, sign up for a 7-day free trial of Mashvisor.

Analyzing the Cash Flow of a Condo

Yet another way to analyze a condo rental property—in addition to depreciation—is the cash flow. It refers to the difference between the property’s rental income and the operating expenses. The importance of the cash flow analysis is that this is the money that an investor pockets from a given income property.

Rental property owners should always aim for positive cash flow as this means they make more money from the property than it costs to maintain and operate it. Eventually, this means they are generating a profit and not losing money to a real estate deal.

Calculating the cash flow of a condo investment is more complicated than estimating the monthly income, as you have to factor in rental expenses too. And their value varies majorly between markets, property types and sizes, and rental strategies.

But once again, investors can use the Mashvisor calculator to analyze opportunities. Mashvisor’s investment property calculator computes the expected operational costs as well as the revenue to provide the estimated cash flow. In this way, you can be sure that your property will help you make money in the short and long term.

Analyzing the Return on Investment of a Condo

Last but not least, every rental property analysis should consider the ROI. Whether you look at the cap rate or the cash on cash return, you should ensure that your condo will bring good profitability before buying it.

The ROI analysis includes even more metrics than the cash flow analysis, such as the property purchase price and the startup costs. So, using the right calculator is a must to find profitable opportunities.

The Mashvisor tool also operates as a cash on cash return calculator and a cap rate calculator as it estimates these two measures of return on investment in real estate. As soon as you choose a property for sale on our platform or enter the address of your selected condo, the analysis provides you with these numbers.

So, when you look for the best condo investment to start a rental business, remember to include these three forms of analysis in addition to the one provided by your condo depreciation calculator.

To Recap

A rental condo depreciation calculator can be a great tool for investors looking to determine the depreciation value of their rental property. Depreciation is a tax benefit that allows investors to save money on their income properties. It considers the purchase price of the property as well as the cost of making improvements to it to make it truly useful.

It is essential to have a fully-functional and useful property in depreciation, as that is how the IRS approves this tax break. For rental properties, it is pretty standard to have a recovery period of 27.5 years in which you can claim depreciation. During these years, you will slowly get back the costs of purchasing, maintaining, and keeping a rental property through your tax returns.

Condo property owners typically use an online depreciation calculator to help make these tricky depreciation estimations. But if you want to make them yourself, you can follow the three steps outlined above.

When investing in a condo, note that depreciation is a great way to save money, but it’s not a way to make money from your real estate investment. You’d need to conduct other types of analysis to ensure a profitable investment, including rental income, cash flow, and return on investment.

The best way to analyze available opportunities is with the help of the Mashvisor rental property calculator. Our calculator will help you estimate the actual performance you can expect from your condo property, whether you rent it out on a short term or long term basis. You will know what revenue, expenses, cash flow, cash on cash return, and cap rate to expect.

To learn more about how the Mashvisor calculator can help you find and analyze profitable condo rental investments, schedule a demo with our team of experts.