When it comes to investing in real estate, there are a lot more choices than you may think. You have many strategies to choose from. There are passive real estate investment strategies like investing in REITs, crowdfunding, and buying real estate stocks. And there are more active strategies that involve buying properties – either to flip them for a quick profit or to rent them out. For beginners, buying a rental property investment is the first strategy that comes to mind when thinking about making money in the industry. It’s true that this is a great route to take when it comes to real estate investing for beginners. At the same time, however, there’s so much a newbie needs to learn and understand before buying rental property. This guide provides you with the basics of investing in rental properties that you absolutely need to know.

What Is a Rental Property Investment?

A rental property is a type of real estate that is offered up to tenants as their living or working space for a certain amount of time set in an agreement between owner and tenant. There are two types: residential rental properties and commercial rental properties. Because residential rental properties are more accessible to beginners, this guide will focus on investing in these rentals. Remember when we said you have so many choices when it comes to investing in real estate? Well, there are actually a few different kinds of residential rental properties including single-family homes and multi-family homes (such as duplexes, triplexes, and fourplexes).

There are two ways in which you can rent out a residential rental property investment:

- Traditional long-term rentals: These are rented for long periods of time, typically from several months to several years.

- Short-term rentals (vacation rentals): These are rented out on sites like Airbnb or VRBO for short periods of time, usually on a nightly or a weekly basis.

You can learn everything about each property type and rental strategy by reading our blogs in the Rental Property Types, Traditional Rentals, and Airbnb Rentals categories.

Is Rental Property a Good Investment?

One of the most commonly asked questions by beginners is how to tell if a rental property makes for a good investment. The answer generally depends on where you’re buying rental property and the property itself (we’ll discuss this in detail later in the blog). However, there are many benefits to investing in rental properties that make them a good investment overall.

One benefit is that rental property investment has the possibility to provide two types of returns. When real estate investors buy rental properties, typically their main goal is to make money immediately by generating positive cash flow (when the monthly rental income exceeds monthly expenses). The second type of return is appreciation over the long run. Another benefit of investing in rentals is that they provide tax breaks and write-offs. For example, you can write off the interest on the mortgage, depreciation, repairs, maintenance, and more! In addition, real estate is known to act as an inflation hedge. This means that real estate values and rent prices usually increase in the same proportion with inflation – if not at a faster rate.

Having said that, it’s important to understand that, just as with any investment, rental properties carry the risk of loss and there are no guarantees of a return. Plus, owning a rental property is not a passive income investment. As you’ll quickly find out, there’s a lot of work involved in every step of the process- from finding deals to analyzing them to closing on the deal and running a rental property business. Becoming a landlord simply isn’t for everyone. So do you think buying an income property is the right path for you? If so, then keep reading to learn more about the entire process.

#1. Finding Rental Properties for Sale

Beginners looking for an investment rental property often want to find one in the same area as their residence. But, this may not be the best choice depending on where you live. Perhaps rent and housing costs don’t allow for positive cash flow properties in your hometown or you don’t even have the initial capital to make an investment. In that case, it’s wise to search for your first rental investment in other housing markets. To find the best cities to buy rental property, look for areas where:

- Rental demand is high (and occupancy rates are high as well)

- Inventory is low

- Economic, job, and population growth are stable or growing

- The average rental income is high enough to justify the amount you will be paying for the rental property

Once you’ve chosen a real estate market, it’s time to take a closer look at the local areas. Find neighborhoods to start your property search in, keeping in mind trends like housing inventory and demand, average real estate value, average rent, crime rates, etc. After identifying your local market of choice, now you can start your search for rental property investment. There are many different ways to find rental property for sale. Many property hunters start by searching the MLS. But, a better way is by using an investment property search engine like Mashvisor. We provide a number of tools that make this process easier.

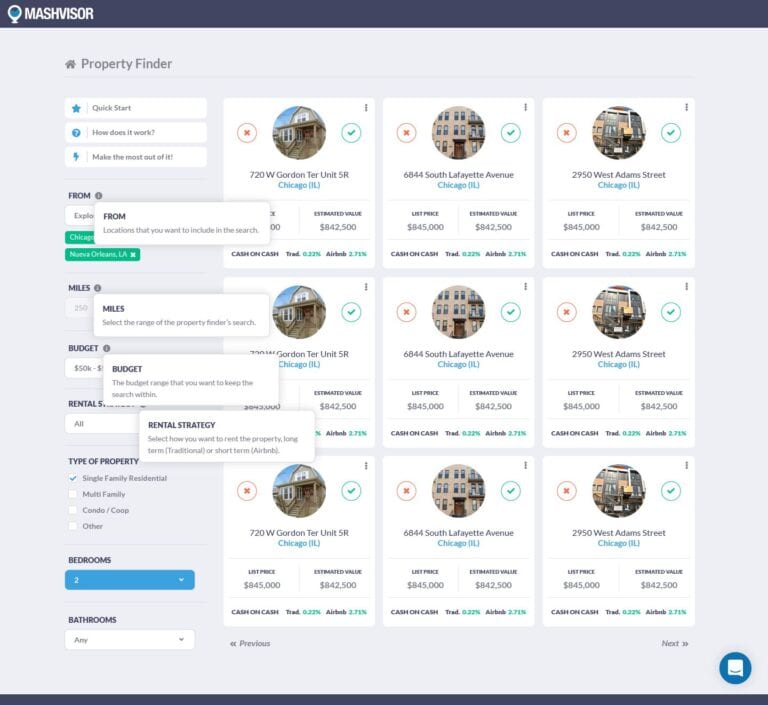

First, we have the Real Estate Heatmap that allows you to analyze different neighborhoods in a city to find the best one for investing in rentals. Second, we have the Property Finder which identifies the best properties for sale that match your investment criteria. All you’ve got to do use filters to determine your criteria including property type, number of bedrooms and bathrooms, and more. The tool will then use AI and machine learning algorithms to find rentals that best fit your wants. Sign up for a free Mashvisor account to start using our tools.

#2. Analyzing Real Estate Investments

After finding a potential investment rental property, the next step is to analyze it by running some basic calculations to determine whether it works for you. Simply, you need to have an estimation of the rate of return on a rental property to make sure you’re buying a profitable one. But, things can get complicated when conducting a rental property analysis. This is because there are a lot of variables that can affect both the income potential and the expenses of the property. When done by hand, you need to make estimates bases on historical data on rental rates, vacancy rates in the area, ongoing expenses, and other variables that can change at any time.

Related: The Beginner’s Guide to Rental Property Analysis

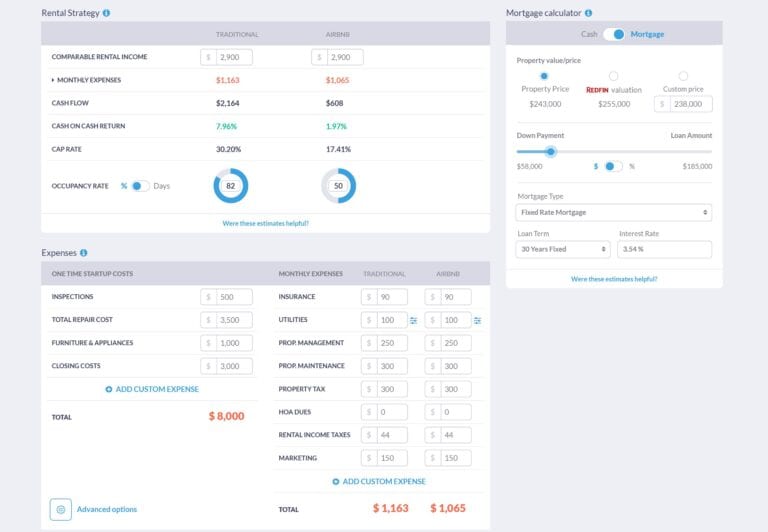

Mashvisor has an online Rental Property Calculator that solves this issue! This tool provides you with a rental property analysis of any property in the US housing market. This analysis comes with pre-calculated estimates of the property’s ROI including the comparable rental income, cash flow, cap rate, cash on cash return, and occupancy rate. Furthermore, it provides a breakdown of costs. You’ll find all necessary property data like tax history property characteristics, neighborhood analytics, and 10-year payback balance.

Mashvisor’s predictive analytics are accurate as they’re based on real estate data provided by reliable sources like Zillow, MLS, and Airbnb. What’s more, you’ll get an estimation of the rental property’s return on investment both as a traditional and an Airbnb rental. This makes it a lot easier to determine the best and most profitable way to rent out the property: a long-term or a vacation rental investment property. Give our calculator a try and you’ll see why it’s a must-have real estate investment tool for beginners!

Only interested in Airbnb rental analysis? Use our free Airbnb calculator.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

#3. Financing an Investment Property

If buying the rental property with cash is not an option, you’ll need financing. Financing an income property is typically more difficult than financing a primary residence. The major difference is the size of the payment you’re required to put down. While you can put a little down payment on a primary residence, most banks will ask that you put down at least 20%. The more down payment you put, the better rental property mortgage rates you’ll get. This is another thing to keep in mind – interest rates tend to be higher on rental property loans.

The good news is that there are other financing options available besides obtaining a loan – some are quite creative. For example, an investor can ask for seller or owner financing, where the property’s owner serves as the bank and the investor places a little down payment and pays a certain amount on a monthly basis. Other creative financing options include subject to real estate, master lease agreement, hard and private money lenders, and more which you can learn about by reading our blogs in the Financing Tips category.

#4. Determining the Rental Price

The next thing you need to know about real estate rental property investment is how to decide the rent price. Unless you’re buying a rental property with tenants and can ask the current landlord how much they charge for rent, you’re going to have to make a calculated guess. Start by analyzing the average and median rental rates based on your property’s location, size, and type. Consider whether your investment property is worth a bit more or less, and why. Of course, the best way to do this is by comparing your property to similar ones in the area. These are known as rental comps.

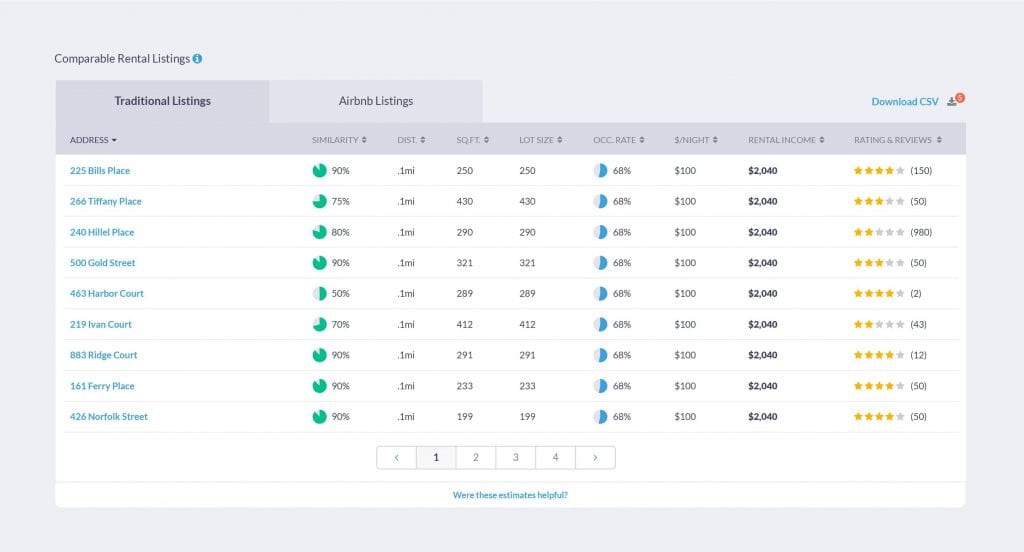

The more similar the rental comps are to your property, the more accurate the rent estimate will be. There are many ways you can find rental comps in your area including asking local real estate agents or property managers and simply going around the neighborhood. However, such methods can be time-consuming for a real estate investor. Fortunately, Mashvisor’s Rental Property Calculator can make your work much easier. Once you’ve checked all the data for the rental property investment, simply go to the “Rental Comps & Insights” tab. There, you’ll find a list of comparable properties in the area already available along with their monthly rental rate and more data.

Related: How Do I Determine Fair Market Rent for My Rental Property?

#5. Managing Your Rental Property

As mentioned, a lot of work is involved in the rental property investment strategy. After finding, analyzing, and making the purchase, you now need to know how to manage the rental property business. You have two options when it comes to rental property management: managing the property yourself or hiring a third party. Hiring a professional manager is a good way to turn your rental property into a passive income investment. Your manager will handle everything, but of course, you will have to pay a monthly fee in return. Landlords pay either a flat fee or 8%–12% of rents, but each management company has a different structure.

On the other hand, managing an investment property by yourself can be a good way to cut costs. If you decide to go the DIY route, consider using online property management tools. Such tools will allow you to handle all your management responsibilities as a landlord, including:

- Screening new tenants

- Handling leases and move-ins

- Handling maintenance requests

- Communicating with tenants

- Collecting rent

- Sending notices like late payment and eviction notices

- Move-out inspections, and more

The Bottom Line

To sum up, Investing in rental property can definitely be lucrative for beginners. You just need to do your due diligence on properties, markets, and everything involved with this strategy. If the thought of doing a housing market research, looking for the best rental property investment, and calculating your rental property returns sounds like more than you’re willing to take on, Mashvisor’s tools are what you need. With the help of our real estate investment software, you’ll be able to make wise and educated decisions like the pros! Start your 7-day free trial with Mashvisor to get access to our tools and data analytics.