Everybody wants wealth, but nobody wants to build it! We’re all looking for that quick hit, that big break, that sure-fired easy money. But here’s the deal; if you want to eat the delicious fruit, you need to till and mend the soil, plant the seeds, water, pull the weeds, water again, harvest, clean the fruit – then, you can finally eat the fruit. If farming isn’t your deal, then follow my proven rental property investment strategy – you’ll be able to buy all the delicious fruit you want.

Step 1: Get in the Game!

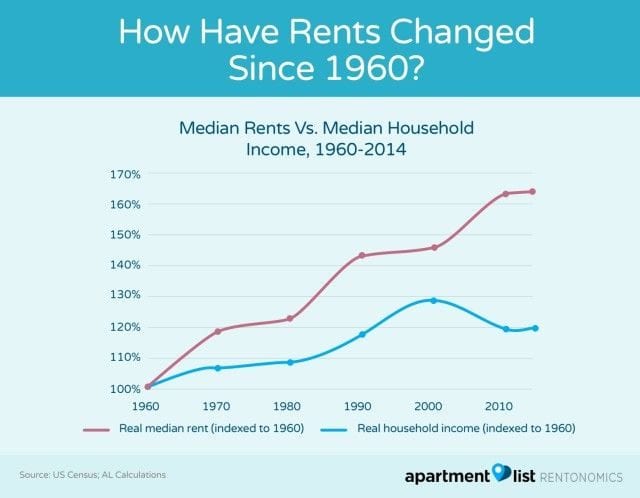

Housing market values and rental rates go up over time. This means that as your mortgage balance is going down, your equity and income are going up. That’s called wealth building. The sooner you get in, the sooner you’ve got wealth.

Step 2: Use Leverage

Leverage simply means to buy and do more with less. In this case, leverage is debt. You only need 30% down to buy your first rental property investment, which is the best part of this brilliant plan. You will borrow 70% of your total investment and get someone else, (your renter), to pay it off for you.

Check out this chart:

Over a 30-year historical average, rental rates go up about 60%, but the interest rate on your loan is locked in at a constant for that whole time – #winning!!! With rates at historic lows, the game is stacked in your favor. Also, since rents go up faster than income, fewer people can afford to own. That means there is always a demand for your product.

Step 3: Look for Investor Friendly Markets

But you can’t do it in high crime, high tax, or bad policy plan. You’ll be just fine assuming your property taxes aren’t too high. Invest in great areas, but the best income properties also have low property taxes.

Step 4: Buy Right

This isn’t as simple as buying a house and collecting rent. You are looking for the area in town where the rental market is strong, but purchase prices aren’t. Occasionally I’ll run into a prospective real estate investor who has spent too much time on Youtube who quotes the 1% rule as the basis of his real estate investment strategy.

An example: buy a property for $300,000 that you can rent for $3,000 per month. While this might be the golden rule for single family home investing, Wonka ain’t selling his goose no matter how much Veruca screams. You can find deals like this at the bottom of a cycle but remember, the game is about cash flow, leverage, and time. Getting in is more important than getting in at the bottom because over a thirty-year investment, the top and the bottom of a real estate market cycle aren’t that far apart.

Try to find properties that you can rent for, (purchase price x .006); I call it the John Crow Slightly More Than ½ of 1 Percent Rule of Rental Income – my marketing guys love it when I make up names for things.

Example: Buy a property for $300,000 that you can rent for $1800. If you ensure your major expense categories, (property taxes and maintenance) are in line, when the gray hairs on your head become too many to count, you’ll be sipping peach bellinis on the veranda, (no judging).

Step 5: Passive Income Is the Name of the Game

Another area of leverage provided in these types of rental property investments is the concept of passive income. This means you can be going about your career, making money, paying your bills, and being a great person, while wealth is silently building.

Hire a professional property management company. For around $100, they’ll collect the monthly rent, handle your tenant calls, keep you out of trouble with the lawman – heck, they’ll even pay your mortgage payments for you. P.S. These guys know where all the great deals on rental properties are, and they are even licensed to help you get one.

Step 6: Understand Tax Law

This is more than just tax deductions, which are freaking awesome! Uncle Sam lets you depreciate the asset, meaning you write off a percentage of the property each year while at the same time it is becoming more valuable, (God Bless America!!!).

You also get to write off any expenses, including your trips to the property. Assuming you bought in Phoenix, and I am your management company, we’ll go to the Phoenix Open where you can also get a tax-deductible Peach Bellini (I am not a tax advisor and I am not qualified to give you tax advice, and I’m not saying I like Peach Bellinis unless you do). The best part is that when the asset is fully depreciated, you won’t have to take the tax hit on it if we buy a like-kind or better property via a 1031 exchange.

In Summary: Build Wealth Over the Long Term

Everybody loves a “7 simple steps” to: health, wealth, weight loss, or great sex. I can only offer you two of these… and you’re not here for weight loss, so how about my:

3 Step Process to Retire Wealthy via Rental Investment Properties Instead?

- Get in the game as soon as you can

- Get in the game as often as you can

- Only sell when you can get a better property and avoid paying taxes (1031 Exchange)

Rental property investment is the only place where you can get tax breaks for 20 years, enjoy enormous gains on equity, create passive income, and uses someone else’s money to pay for it!!!

If you want help getting started or maximizing the return on your investment, call me. The Phoenix real estate market is always a good rental market, and the laws and tax environment are in your favor.

This article has been contributed by John Crow.