Let’s discuss Reonomy pricing, features, and benefits it brings to real estate professionals.

Commercial Real Estate (CRE) software is helpful to investors because it can provide a wealth of benefits and valuable data for your business. From customer retention to increased productivity, it can be a game-changer that can tell you how to invest in real estate properties.

What is CRE software and how can it help you? Well, the term itself has a wide breadth as it includes any kind of software solution providing data and insight that can help you improve your real estate processes and strategy. Some organizations might leverage workplace utilization analytics to track employee commute times, while others might use lease administration systems to keep track of rented properties.

Facilities managers, real estate teams, workplace leaders, commercial property managers, landlords, and tenants can all benefit from it.

Table of Contents

Reonomy: What Is It and How Much Does It Cost?

Reonomy is a commercial real estate database (or online data resource) with proprietary technology. It relies on machine learning and AI to locate property opportunities and is a handy tool for real estate appraisers.

Besides property details, Reonomy can provide information about the lender, occupants, tenants, mortgage, and contact info (names, addresses, emails, and phone numbers). Such data is especially useful for showing listings to buyers and pinpointing new potential clients. Reonomy can be integrated with a CRM platform, which allows you to access the information where it’s most convenient for you.

The machine learning and AI technology, which Reonomy uses, helps determine the likelihood of certain deals throughout entire real estate markets. It pulls data from exclusive partners, including geospatial providers, secretaries of state, census data, public sources, and more than 3,000 county assessors. By pointing out the most profitable areas and leads, such technology is designed to help its users be successful in the real estate business.

Related: Reonomy—What Is It and How Does It Help Real Estate Investors?

Pricing

If you decide to subscribe to Reonomy, an individual account will cost you $49 per month, while additional packages will equip you with features such as advanced filters and tenant details. When it comes to enterprise and team packages, they are negotiable.

There is a 7-day free trial offering through its website, but the Reonomy pricing is not transparent. There are no pages that show exact prices for any of its tiers. It seems that users must go through the trial period or contact customer support in order to access Reonomy pricing information. Fortunately, you won’t need to supply your payment information yet in order to start the free trial.

Reonomy pricing is not transparent, and we know that users of any SaaS software do not like that. Pricing directly affects our purchasing decisions because it makes it easier to decide between two similar products with different prices. Without knowing Reonomy pricing for all plans, you won’t be able to do a detailed comparison and find out any hidden costs.

Reonomy Feature Overview

Finding potential clients or generating warm leads manually can be a tedious task. But what was once a daunting task (completed by manually pulling comps while sifting through property records) is now possible with SaaS platforms and tools. Reonomy seems to offer the right solution for these needs, but is it right for you, and can its technology and database deliver? And is Reonomy pricing worth the investment? Let’s take a look at its features and what users have to say about it.

Reonomy Overview

Reonomy is a huge database of more than 50 million commercial real estate properties with information compiled from different sources. You can sort that information using different filters about the property, sales history, owners, etc. The platform can display up to 100 data points, including tax history, opportunity zone status, and renovation details.

On the other hand, commercial lease comps aren’t available. Commercial sales comps in non-disclosure areas are not listed, which means that you can’t see information like the cap rate and net operating income. And cap rate is one of the most crucial real estate metrics used for calculating return on investment that shows how much of the property value can be generated as a profit. These are all critical metrics for any real estate investor, so when calling to ask for exact Reonomy pricing, you should inform yourself of each of its plans and what it includes.

Features

For insurance agents, real estate investors, energy companies, and prospectors, Reonomy offers services and data coverage that can help anyone in the commercial real estate world. You access the tool via your Internet browser. Some of the features include:

- Transaction history, tenant data, ownership data

- More than 3,000 counties covered in its service area

- API access

- Real estate analytics and market research

- 100 data points per property

On Capterra, Reonomy has quite a good rating of 4.4 out of 5 stars (a total of 28 reviews). When it comes to customer service and ease of use, it scores well, and its users love the multiple filtering options and extensive database. But when it comes to the accuracy of data, Reonomy seems to fall short. There are users who complain of not getting accurate contact information for property owners, having their emails bounce, and having difficulties making offers.

Search via Origination Date or Maturity Dates

One of the key features of this platform is the ability to search via origination dates or maturity dates. Since Reonomy has a large base of more than 50 million properties across the U.S, the feature is helpful for real estate professionals in capital markets. Besides filtering your searches for maturity dates, there are other filters available, such as mortgage size and mortgage origination date. You can also filter by property type (e.g., single-family) or geography (e.g., particular county).

Related: The Ultimate Investment Property Search Tool

Search via Lender

Commercial debt brokers find this search filter quite useful. You can find, for example, a lender portfolio search to find loans in New York, where the lender was PNC and the loan originated in 2014. Users rely on this tool when looking for lenders with known interest rates. With interest rate information, real estate investors can detect lenders with the lowest interest rates.

Find Ownership Information

When you locate properties you’d potentially want to invest in, you can get owner information for those properties. You can get the names, emails, and numbers of people behind the reported LLCs. Most commercial properties have multiple people you can contact as well as different ways of reaching them.

Likely to Sell

Opportunities in real estate markets always vary, depending on the geographic area you are searching in. Market history has been different, and demographics and industries change over time. In some cases, defining a general rule for identifying real estate properties that will sell soon might be well suited. But in other cases, that can exclude hidden opportunities.

For example, the interaction between a property’s intrinsic attributes, history of a property, and neighborhood-level trends is complex. Real estate investors need to take sales history into account, but they also must consider the type of asset in combination with the current market situation. Some of these factors can be easily pulled together in a small area, but it’s difficult to solve this problem for all commercial real estate properties nationwide.

Reonomy Machine Learning can help in capturing nationwide market trends and in using local county-level geographic attributes of the real estate market. This way, it can assign a likelihood for each property to be sold in the near future. Users get a unique likelihood score for each investment property, helping them in identifying and ranking market opportunities.

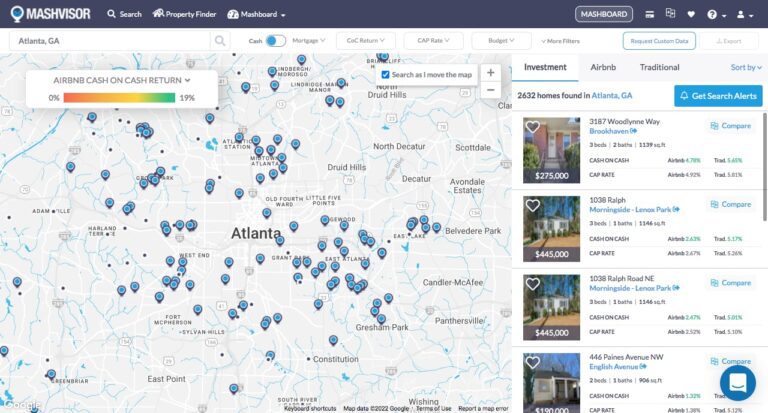

When it comes to searching for residential investment properties and choice of filters at your disposal, Mashvisor stands as a viable and cost-effective choice. Our platform offers tools such as Real Estate Heatmap, Rental Property Finder, Property Marketplace, and Investment Property Calculator. Not only will you find real estate properties anywhere in the U.S. market, but you will also find the ones that provide a high rate of return. And you can find them by using location, listing price, property type, and property characteristics filters.

Real estate investors who use Mashvisor would first see the Investment Property Search upon logging in. This tool provides an overview of the available properties for sale in a city of their interest.

Pros and Cons

To sum it up, let’s take a look at our shortlist of Reonomy pros and cons:

Pros

- AI tools accurately predict deals

- Easy-to-use interface

- 200+ search filters

Cons

- No free plan

- Exact Reonomy pricing is not transparent

- No mobile app

- Costs can add up for teams

Additional Features

- 7-day free trial

- Customized reports

- Mortgage and lender data

- Over 50 million commercial properties

- CRM software integrations

- Access to ownership data and contact information

- Customer service is available via phone, email, and live chat

If you decide to search for user experience online, you’ll find both good and bad ones.

Some users like Reonomy, believing that the platform is in its infancy and has huge growth potential. What many users agree on is that contact information pulled from its database is often inaccurate. More often than not, they’d get the contact of the lawyer acting as a filer of the LLC that bought the property. In other cases, users report that they were able to get owner names, emails, and addresses.

Reonomy’s sense of predicting future trends can be used by real estate investors as well as marketers or anyone in need of CRE to compile local leads. With Reonomy, you can filter businesses by a range of property characteristics and get extensive information (which you’ll have to verify because it may or may not be accurate). Reonomy pricing is still a “secret” for anyone trying to find info about it online. However, we found Reonomy pricing information on a few user review sites, with users mentioning that the starter subscription price is $49 per month. As for higher subscription plans, there are mentions that Reonomy cost goes up to $249, but you’ll have to contact the company to confirm.

Reonomy Alternatives

There are other software solutions for both commercial and residential listings information. Many of them offer different solutions and features that might fit your needs better, which depends on the nature of your business. Many of them can be used by retailers, service providers, and corporate real estate departments.

Some of the most notable alternatives include:

- CoStar Real Estate Manager

- ProspectNow

- Juniper Square

- Re-Leased

- Shape

To go deeper into detail, we encourage you to do your research about Reonomy vs CoStar, Reonomy vs ProspectNow, and other commercial real estate software.

Mashvisor: Reonomy’s Residential Counterpart

Reonomy is there to provide CRE experts with a simple and quick way to identify prospects and find the most relevant insights for them.

But if you’re a real estate investor or agent looking for residential properties to invest in, Mashvisor is a seriously good counterpart equipped with useful tools. After all, you need something that will help you buy investment properties, scan the neighborhood for similar properties, determine their ROI potential, check the latest prices, and build a real estate strategy.

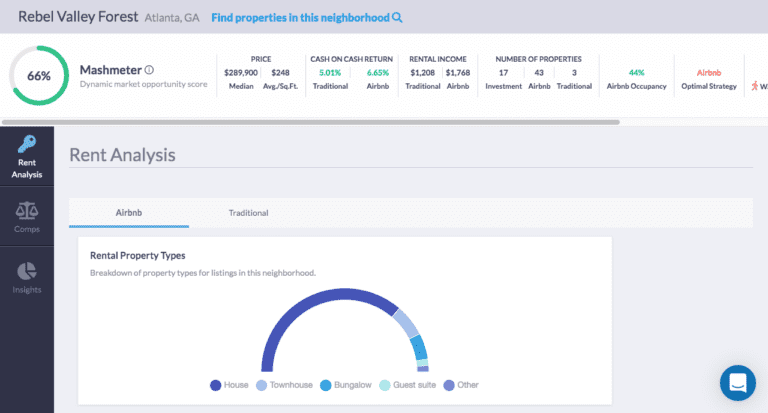

With Mashvisor’s Professional subscription plan being only $79.99 per month, you can get powerful real estate analysis tools even if you are on a budget. Our Lite plan costs $17.99 and lets you find and pick lucrative properties (by investment opportunity scores determined by the machine learning platform infrastructure), project rental ROI, and estimate long-term and short-term rental.

If you’re new to the business or on a budget, you can get a free trial to do a test run. The benefits you can get include:

- Learning more about the real estate business (beneficial for beginner investors). You need to know how to invest in real estate and how to create a successful investment strategy. Mashvisor has a knowledge center filled with relevant guides to help you learn its tools.

- Analyzing investment potential of particular neighborhoods

- Searching for profitable investment properties

- Getting info about the number of listings for sale, median property price, traditional and Airbnb monthly rental income, cash on cash return, occupancy rate, and Airbnb daily rate. This all helps in calculating cap rate, cash flow properties, and other essential real estate metrics.

- Analyzing the return on investment and rate of return on investment properties

- Selecting the optimal rental strategy

- Accessing homeowners data

- Generating and qualifying buyer and seller leads

- Matching leads with properties

- Helping with digital real estate marketing

Related: The Best Real Estate Investment Software

Mashvisor lets users analyze each neighborhood of their city of interest to help in their market analysis.

Conclusion

Now you’re equipped with the information about Reonomy’s commercial real estate software functionalities to know whether you can use it to your benefit or not. The 7-day free trial is great for you to check its features. On the other hand, the non-transparency of Reonomy pricing will probably make your purchase decision more difficult. That’s why we advise you to contact the company directly and ask about it.

As for Mashvisor, our platform is a great solution for finding residential investment opportunities. It stands as a viable and affordable solution in case you decide to enter the residential part of the real estate industry. We are sure that it will help you experience increased productivity and better-informed decision-making.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.