If you’re looking for real estate software to help you with investing, Roofstock reviews can help you make a smart decision.

Table of Contents

- What Is Roofstock?

- Roofstock Reviews: How Does the Platform Work?

- Other Key Features and Services

- How Does Roofstock Compare

- What Is Mashvisor

- Is Roofstock Worth It?

Since time immemorial, investing in real estate has been a surefire way of generating positive cash flow and building wealth. For a long time, real estate was a preserve of the wealthy and well-connected individuals.

However, the emergence of new technology has revolutionized the way we do most things in our lives. Technology has also made real estate investing available to the common investor who may not be well-connected. Also, you can now get started even without a lot of capital.

Roofstock is one of the software solutions streamlining business operations for real estate investors. The software is for you if investing in real estate with as little as $5,000 seems like a great opportunity for you.

In this article, we look at Roofstock reviews, how you can benefit from the platform, and another solution that compliments it.

Find out what Roofstock is and how the platform can help real estate investors like you.

What Is Roofstock?

Roofstock is primarily an online real estate marketplace that focuses on single-family rental properties. For properties to be listed on the platform, they must be occupied by tenants who meet Roofstock’s tenant-screening requirements.

Roofstock’s main target market is busy professionals who are in search of highly profitable and successful properties for rent but don’t have the time to fully commit to landlord responsibilities or are not ready to put in the work themselves.

According to the three founders, namely Rich Ford, Gary Beasley, and Gregor Watson, their main goal was to build an online real estate marketplace that was cost-effective, radically accessible, and simple.

Unlike other online real estate investment marketplaces, Roofstock doesn’t own any of the listed properties. Instead, they focus on evaluating, negotiating, and closing real estate transactions.

Related: Mashvisor Property Marketplace

Roofstock Reviews: How Does the Platform Work?

As a first-time real estate investor, Roofstock will make it easier for you to make your first investment. While investors can also sell their properties on the platform, it makes it easier to start investing in turnkey properties.

So, how does it actually work?

Roofstock reviews the properties on its platform, with each property going through a certification process before it’s approved for listing. The process involves a home inspection where the Roofstock team gets a valuation report and conducts a housing market analysis. They also check the tenants’ rental payment history, disclosure reports, and lease terms. If the property requires any major repairs, they also estimate the expenses.

While Roofstock’s team does play their part to offer you some peace of mind, don’t forget to carry out some due diligence yourself before investing.

Once you’re on the Roofstock website, click “Buy” and you’ll be directed to the marketplace. Here, you can view listings under the following categories:

- Properties: For purchasing investment properties outright

- Portfolios: For purchasing multiple properties simultaneously

- Property shares: For purchasing fractions of a property

Since the three processes are quite similar, we’ll go through one to give you a glimpse of how they all work. If you’re just getting started in real estate investing, buying fractional property shares may be more suitable. Here’s how you purchase fractional shares on Roofstock:

1. Find a Property

Roofstock reviews show that the online marketplace provides an excellent user interface that allows you to browse through available rental property investment opportunities. You can filter the search results according to different criteria, such as markets (location), neighborhood rating, minimum investment amount, property condition, etc.

Roofstock is currently present in 25 real estate markets, including Florida, Alabama, Texas, Arizona, Georgia, and California. While pricing is based on many factors, you can expect to see prices ranging from $100,000 to $900,000.

If you see a property that arouses your interest, simply click on it, and you’ll get a detailed overview of the property. The rundown includes property photos (both exterior and interior), property inspection report, title report, total home price, valuation report, and share price.

Additionally, the platform also gives you an estimate of the return on investment, which is shown as the target annual distribution. The said amount is calculated based on the expected revenue, minus the estimated property expenses, mortgage payments, and reserve payments.

It also includes a calculator that allows you to see how much you can spend on the closing costs and how your cash investment may affect the expected returns.

Remember, all investments are risky. As such, the estimations provided are not a guarantee.

2. Select Shares and Reserve

If you’ve made up your mind to invest in the property, it’s now time to select how many property shares you want to buy. To the right of the property photos, you’ll find an area where you can reserve the shares.

For starters, a reservation is simply a claim to the number of shares you choose to invest in from what’s available. To complete a reservation, you must pay a refundable fee within 24 hours.

If you see “All Shares Sold,” it means that there are no available shares. Otherwise, select the number of shares you wish to purchase and add them to the cart.

3. Sign and Invest

You can view your cart and proceed to checkout. Here, you’ll need to go through a few steps to complete your reservation and purchase the shares. If you’re funding your investment, you have an option to upload a pre-approval letter. You must also input your credit card information to facilitate Roofstock’s 0.5% marketplace fee.

Once you’ve paid the fee, Roofstock reviews your application by verifying your identity and official investor status using the documentation you’ve uploaded. Afterward, you may now sign the subscription agreement and carry out an ACH transfer to fund your investment.

4. Receive Passive Income

Once you’ve completed your investment, you may now sit back and enjoy the rental income coming in from tenants living in your property investment. Roofstock’s property shares free you from the trouble of being a landlord and property manager. A professional in-house team takes care of property management.

If you’re looking to invest in the entire property, you may choose to go the real estate agent route. However, Roofstock reviews show that the platform beats them when it comes to prices. An agent’s commission fee is typically 6%, while Roofstock only charges $500 or 0.5% of the purchase price. Also, if you’re looking to sell property on Roofstock, the expense is $2,500 or 3% of the sale price (whichever is higher).

The best part about it is that you can invest in properties around the country, regardless of where you live. It opens you up to many investment opportunities.

Related: Can Airbnb Investment Properties be Passive Income Investments?

Other Key Features and Services

Here’s a breakdown of other vital services that Roofstock offers:

Roofstock One

Basically, Roofstock One is the platform’s property shares section. It’s quite different from the Roofstock marketplace. However, you need to be an accredited investor to access it. Accredited investors can invest in single-family homes portfolios, similar to other real estate crowdfunding platforms.

You need to place a minimum investment of $5,000 to get started on Roofstock One. Afterward, Roofstock’s team takes over everything, including the property management of all homes included in the Roofstock One portfolios. It is an excellent option for investors who want exposure to a wider variety of properties but also desire a hands-off property investment approach.

However, you must note that Roofstock One properties are highly illiquid. Also, investors must have an investment background of five years, and currently, there’s no third-party market to sell Roofstock property shares.

Roofstock’s remained quiet on how much it costs to use Roofstock One. However, from online Roofstock reviews, we’ve been able to gather that property share investors are charged an asset management fee starting at 0.50% of the home price. The rate is adjusted at the same rate as the gross rate changes.

Roofstock Academy

The direction your real estate investment takes depends on who you know and what you know. Roofstock Academy is one of Roofstock’s latest products. It is a real estate course that teaches investors how to master turnkey investment properties. The program is created by a team of seasoned real estate investors who’ve seen it all and are happy to share their experiences with newbie investors.

Other than learning how to invest in real estate, you also learn the following:

- Real estate investment strategies you should know about

- How to analyze investment deals

- The pros and cons of investing in local markets and long-distance

- How to build $100,000 in passive income

- Types of risks in real estate investment and how to manage them

- How to negotiate and submit a winning offer

- How to select a good lender and property manager

One good thing about Roofstock Academy is that it combines online learning with one-on-one coaching sessions. You also get access to a private network of other accomplished real estate investors.

Roofstock Academy packages are as follows:

- Self-Study: Th Self-Study package gives you access to 50+ hours of exclusive lectures for a $399 fee or 12 monthly payments of $39.

- Workshop: The Workshop package provides investors with exclusive lectures, access to the private investor community, group coaching, and one-on-one coaching, and a Roofstock Marketplace fee credit of $1,000. The charges are $999 or 12 monthly payments of $99.

- Mastermind: The Mastermind package includes everything in the Workshop and Self-Study packages with a Roofstock Marketplace fee credit of $2,500. You’ll have to part with $5,000 or 12 monthly payments of $499 to access this package.

How Does Roofstock Compare?

We’ve looked at Roofstock reviews and have seen what it does for real estate investors. Now, let’s look at how it compares to another platform of its kind.

There are few companies online that can match what Roofstock offers real estate investors. While there are many crowdfunding platforms that may allow you to invest in non-traded REITs, most don’t offer you an individual rental home to invest in.

Of the few companies that can match, Mashvisor stands out.

Let’s look at what Mashvisor is and a breakdown of what it offers.

What Is Mashvisor?

Founded in 2014, Mashvisor is an online real estate platform that aims to provide investors with accurate, reliable, and up-to-date property data to help you find traditional and Airbnb rentals throughout the US housing market. The website gets its data from reliable sources, such as Airbnb, Auction.com, Zillow, and Roofstock itself.

It then uses machine learning and AI algorithms to turn that data into helpful information. It saves you a lot of time and energy when looking for and analyzing rental properties for sale.

Here are some investment property search and analysis tools that you’ll find at Mashvisor:

Property Finder

The Mashvisor Property Finder tool uses predictive analytics to help you search and find lucrative traditional and short-term rental properties in just a matter of minutes. You can use various criteria, such as property listing price, property type, number of bedrooms and bathrooms, and ideal rental strategy, to filter through the results.

The Property Finder is special since it helps you find properties based on financial patterns, behavioral patterns, and social patterns.

Related: The 4 Steps of Airbnb Market Research

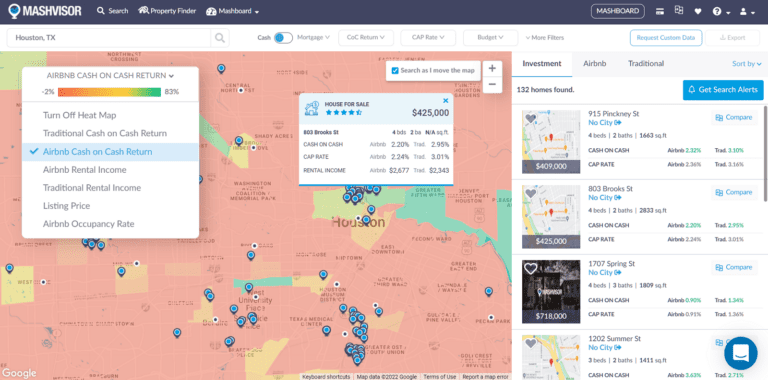

Real Estate Heatmap

Mashvisor’s Heatmap tool is a housing analysis tool that uses colors and visual cues to show you top-performing neighborhoods in a certain area. The map uses green to show active neighborhoods and red to represent dormant ones. With the heatmap tool, you can also use various metrics, such as cap rate, cash on cash return, rental income, and Airbnb occupancy rate, to analyze the neighborhoods.

Mashvisor’s Heatmap tool provides a color-coded map of the best-performing neighborhoods in a certain location.

Investment Property Calculator

Mashvisor’s Investment Property Calculator, also referred to as the Rental Property Calculator, is useful for both traditional and Airbnb property analyses. You simply input your financial costs and the tool shows you what to expect in terms of rental income, property expenses, cap rate, occupancy rate, cash flow, and cash on cash return. This tool also gives you access to rental comps for all listings.

Is Roofstock Worth It?

Roofstock reviews have shown us that it works out well for real estate investors, especially newbies, since the provided information is easy to understand. While you may need to do some work when researching the properties, it’s a potentially lucrative investment opportunity for you.

Property sellers also stand to benefit from Roofstock since the platform provides a connection to homebuyers looking for income-generating opportunities. If a seller wants to sell a single-family home that’s already occupied, they don’t have to remove the tenants before selling the home.

Mashvisor is an excellent online platform that you can also use. It was developed with the main aim of helping real estate investors make smart investment decisions. Book a demo with us to learn more about how you can use Mashvisor tools for your investments.