Given the different real estate software solutions available to real estate investors today, we’ve created this Roofstock vs Fundrise review to give you a deeper insight into the best software to choose.

Table of Contents

Real estate investing has, since time immemorial, been a surefire way of building a consistent stream of income and creating long-term wealth that can last generations. Did you know that 90% of millionaires worldwide got their footing in real estate?

Traditionally, real estate investing was a preserve of the elite. However, investment regulations have been changing the scene as new trends, such as technology, help lower the barrier to entry. Real estate investing is now available to the average investor who may not have that much capital.

In this post, we look at two of the most popular real estate investing platforms: Roofstock vs Fundrise.

What Is Roofstock?

Let’s begin the Roofstock vs Fundrise review by looking at Roofstock.

Roofstock is an online property marketplace that’s most suitable for investors who want to acquire direct ownership of residential rental properties. With Roofstock, you can purchase an investment property and leave the property management tasks to the Roofstock team. It is why this platform is popular with investors who want to own rental properties outright but are hesitant to shoulder the responsibilities that come with rental property management.

One unique thing about the properties listed on Roofstock is that they’re already occupied by tenants. It means that you immediately generate cash flow once you buy the property. You purchase the property on Roofstock Marketplace directly from the owner, following the same process you’d follow when buying any other rental property. Roofstock only acts as the facilitator.

Rental properties listed in Roofstock are all certified and come with a 30-day money-back guarantee.

Roofstock does not require a minimum investment amount. Your minimum investment amount is simply the property’s asking price. The properties listed on the marketplace range from as low as $25,000 to as high as $1,000,000+.

How Does Roofstock Work?

Roofstock doesn’t own the properties listed themselves; they source rental homes for investors. It simply acts as an intermediary between independent sellers and buyers. The platform acts as the seller’s agent during the entire transaction.

As we mentioned, properties on Roofstock are certified. It means that they go through a vetting process before they’re listed. The vetting process includes:

- An experienced third-party inspector carries out a walkthrough inspection. However, some properties may come with an inspection contingency that states that the inspection will take place after the seller’s acceptance of an offer.

- Roofstock’s team goes through the inspection report to ascertain that the repair costs won’t be more than 15% of the property’s asking price. Further, the investment property must meet certain standards for the HVAC system, with no electrical or health issues, and doesn’t need extensive roof repairs.

- After the needed repairs are identified, Roofstock’s team notifies the potential buyer so they factor in the costs before making an offer.

- The property seller must provide an impressive rent payment history.

- The seller is required to provide all the information and data that Roofstock collected on the listing page.

Each listing page on Roofstock includes the asking price, property photos, rental income, and estimated returns for different timeframes. It also lists important investment metrics, including cash flow, cap rate, annualized return, gross yield, and rate of appreciation.

Once you’ve purchased a property on Roofstock, the title is transferred to your name and you become the rental property owner. You may choose to become responsible for the property management, maintenance, repairs, and other landlord tasks. However, if you want hands-free ownership, Roofstock will recommend certified property managers.

Roofstock Features

Roofstock offers more features to include other investors who don’t want to buy the rental property outright or lack the capacity to do so. They include:

Roofstock One

Roofstock One is a product for real estate investors who may not wish to buy a rental property outright. Here, you can buy property shares instead of the whole property. However, you must be an accredited investor for you to invest in Roofstock One.

The minimum investment amount on Roofstock One is $5,000. As an investor, you can purchase a minimum of 1/10th of the property’s value. You can share the property ownership with other investors so that you can diversify on various properties.

Investors are entitled to equity ownership in the property and income generated after taking out property expenses. They also hold direct rights to the capital appreciation should they choose to sell the property.

Roofstock Academy

In Roofstock vs Fundrise, the latter may stand out due to its educational program that seeks to educate investors on investing in turnkey properties. The program is run by experienced investors who’ve been in the game for years and seek to share their experiences so newer investors can avoid the common pitfalls.

Roofstock Academy teaches investors how to invest in real estate, investment strategies, how to analyze opportunities, and how to submit a winning offer, among many others.

Self-Directed IRAs

With Roofstock, you can invest in properties within an Individual Retirement Account (IRA). you simply need to open a self-directed IRA or solo 401(K) and begin investing in Roofstock properties.

Is Roofstock a Good Investment?

Now that we’ve seen what Roofstock has to offer, you may be wondering whether it’s worth your money.

Roofstock Pros

Here are some of the reasons why you may settle for Roofstock in the Roofstock vs Fundrise comparison:

- Direct property ownership: One of the main benefits of Roofstock is that it allows you to invest in a tangible asset that generates rental income. You can also follow the buy and hold strategy where you sell later once the asset has appreciated.

- Instant cash flow: Remember, Roofstock’s rental properties are already occupied by tenants. It means that you get a chance to earn positive cash flow immediately.

- Low fees: Roofstock relies on technology. It allows them to charge significantly lower commissions to the sellers, making real estate investing affordable. You also only need a 20% down payment to purchase a property.

- Low barrier entry: Other than Roofstock One, the platform doesn’t require you to be an accredited investor to invest in the property.

- Diversify your portfolio: Roofstock allows you to invest in single-family homes, small multi-family properties, and whole portfolios of residential rental properties. The properties can be in any housing market in the US.

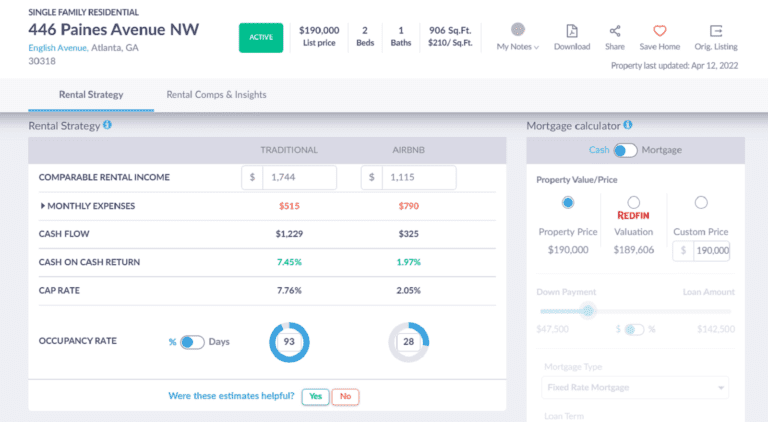

To maximize Roofstock’s benefits, you need to use Mashvisor’s Rental Property Calculator before investing. It is an online tool that lets you calculate an investment property’s profit potential. It’s simple to use since you’re only required to enter the property’s basic details, such as buying price, total cash investment, and financing option.

After entering the above details, the calculator generates important return on investment numbers, including cash flow, cash on cash return, and cap rate. The rental calculator generates the metrics for both traditional and short-term rental strategies so you can select the optimal strategy.

Book a demo to learn more about Mashvisor tools and how you can use them for your investment.

Mashvisor’s Rental Property Calculator is an online tool that lets real estate investors calculate an investment property’s profit potential, based on cash flow, cash on cash return, and cap rate.

Roofstock Cons

Every good thing comes with a few downsides. Here are the main cons of Roofstock:

- Illiquidity: Roofstock investment may not be the best investment option for you particularly if you foresee a tight spot in the near future. Selling the rental properties may take much longer than expected, which may not be a good experience when you need money fast.

- Landlord responsibilities: Unless you want to hand over the property management tasks to a property management agency, you must be ready to shoulder the landlord responsibilities, such as handling late payments and irate tenants or scheduling maintenance and repairs.

The next part of this Fundrise vs Roofstock review is looking at one of the fiercest Roofstock competitors.

Related: The Top 3 Roofstock Competitors Real Estate Investors Could Consider

What Is Fundrise?

Many people will look for Roofstock vs Fundrise when searching for real estate software. Fundrise is one of the companies that spearheaded the real estate crowdfunding wave in the 2010s. Since then, many similar real estate crowdfunding platforms have emerged, but Fundrise remains a leader in this niche.

Founded in 2012, Fundrise is an excellent option for real estate investors who wish to take the crowdfunding route of real estate investing. It’s a crowdfunded real estate platform that’s available to both accredited and non-accredited real estate investors.

Like other real estate partnerships or trusts, investors in Fundrise pool their resources together to invest in real estate assets they might not have access to individually. The assets then grow depending on the principal interest or generate income for the investors.

As an investor on Fundrise, there are two main investment options:

- eREITs: If you invest in the eREITs option, you buy into equity and debt real estate investment opportunities that match the particular eREIT goal. The goals may be long-term growth or consistent cash flow.

- eFUNDs: The eFUNDSs option allows investors to directly invest in a wide-range portfolio of listed properties in high-growth neighborhoods. The neighborhoods are located in major US metro areas.

Related: REIT vs Real Estate Rental Property Investments

Fundrise Minimum Investment

Initially, Fundrise’s minimum investment amount was $500. However, they recently lowered this amount to $10 since they noticed more young investors are looking for ways to invest in the stock market.

That said, Fundrise offers different account levels that you invest in depending on your investment goals and objectives. The accounts are:

- Starter: The Starter account gives you access to Fundrise’s Starter portfolio whose minimum investment is $10. The account exposes you to various investment properties across the country.

- Basic: The Fundrise Basic account also allows you to invest in the Starter portfolio with the addition of investing in an IRA. You can also create and manage personal investment goals. The minimum amount for the account is $1,000.

- Core: Fundrise Core account gives you access to all standard portfolios, including supplemental income, balanced investing, and long-term growth. The minimum investment amount is $5,000. The account gives you access to 40-80 different real estate projects.

- Advanced: The Advance account gives you access to everything in the Core account plus opportunities to invest outside standard portfolios. The opportunities are more strategic and also subject to more change. The minimum investment amount is $10,000.

- Premium: The Premium account gives investors access to all features in the Advanced and Core accounts. In addition, Premium investors may invest in projects outside the standard Fundrise fund. The projects are of longer durations and are less liquid. The minimum investment amount is $100,000. At the premium level, you can book calls with the Fundrise team to discuss your investment strategy and also look for advice on your investments.

Fundrise Portfolios

Investors can buy shares by investing in one of four portfolios:

- Starter Portfolio: The Starter portfolio is Fundrise’s basic package created for individuals who want to try a hand at investing. The minimum required investment amount is $10. The portfolio is made up of 50% income and 50% growth-oriented shares. You can upgrade to an advanced portfolio later for free.

- Supplemental Income: The Supplemental Income portfolio consists of income-oriented holdings. Investors in the portfolio earn returns through dividends from income-generating real estate. Dividends are earned through interest and rental payments.

- Balanced Investing: As the name suggests, the Balanced Investing portfolio incorporates 50% income and 50% growth-oriented investments. The portfolio contains both Fundrise eREITs and eFUNDs.

- Long-Term Growth: The Long-Term Growth portfolio’s main goal is to leverage asset appreciation and generate returns. The portfolio purchases real estate with high growth potential and generates returns from selling underlying properties.

Is Fundrise a Good Investment?

At this point, you may be wondering whether it makes sense to invest in Fundrise. Let’s look at some of its pros and cons.

Fundrise Pros

Here are some of the Fundrise advantages to consider in Roofstock vs Fundrise:

- Low investment requirement: You can get started in Fundrise for as low as $10.

- Low barrier entry: Besides the low investment amount requirement, you don’t need to be an accredited investor to invest in Fundrise.

- Passive income: Fundrise is one of the best options for investors who wish to invest passively. You won’t need to think about managing rental properties or scheduling maintenance and repairs.

- Transparency: Fundrise lets all investors know exactly what they’re investing in.

Related: Passive Income vs Active Income: Real Estate Strategies

Fundrise Cons

These are some of the downsides of investing in Fundrise:

- Complicated fees: Besides the investment requirement amounts, you’ll be required to pay 0.15%-1% annual advisory fees and 0.85% yearly asset management fees. While the stated fees are relatively low, there are other hidden fees. Such fees may make things more complicated for unexpecting investors.

- Highly illiquid: Investors must be willing to sit with their investments for about five years before they can realize significant returns.

Roofstock vs Fundrise: The Verdict

After looking at this Roofstock vs Fundrise review, we can now tell what both platforms are used for. Roofstock is ideal for investors who want to own rental properties outright. You can also use the platform if you don’t intend to be directly involved in property management tasks.

Fundrise, on the other hand, is better for real estate investors who wish to take the crowdfunding route. It’s a passive investment since the team takes over portfolio management.

Whichever platform you choose to use for your investments, make sure you use Mashvisor tools. Sign up to access a 7-day free trial of our tools.