Wondering where to invest in real estate in the California real estate market 2018?

Most real estate investors want a piece of California real estate and it’s not puzzling why. The name of the state resonates with sunny beaches, celebrities, and the good life. And because of this, real estate investors stand to benefit greatly from buying an investment property in the California real estate market 2018.

But where to invest in real estate? Los Angeles? San Francisco? Really, there are so many good choices in the California real estate market this year. We want to highlight a great choice for real estate investors: the San Diego real estate market 2018. Why should you consider buying an investment property here? More importantly, in such a vast real estate market, where to invest in real estate exactly?

You have the questions and we have the answers.

San Diego Real Estate Market 2018 So Far

Economy and San Diego Real Estate

When discussing any real estate market in the US housing market, it’s natural that we first look at the health of the economy as it directly affects real estate investments. With growing industries, especially in the resilient sector of healthcare, San Diego real estate investors will be happy to know that the economy of the city is going strong. The unemployment rate as of March 2018 is 3.1%, far below the national rate of 3.9%.

While the job market may slow down a bit in terms of new jobs, the current industries will still drive population growth and an increased demand for rental properties. This means great things for San Diego real estate investing. In fact, it’s predicted that a whopping 47% of population growth in the US will take place in California, Texas, and Florida. San Diego County’s population is likely to reach 3.3 million. With the beautiful weather and job opportunities in the San Diego real estate market 2018, owners of investment properties are sure to get their cut of rental income from the massive growth.

San Diego Real Estate Market Trends

With the demand for rental properties on the rise, housing prices are consequently going up as well. All the while, the supply of real estate investment properties is decreasing. Even with efforts of construction in both single family homes and multi family homes, the San Diego real estate market 2018 will likely continue to be a seller’s market. However, as the US housing market is a seller’s market in most booming real estate markets, the San Diego real estate market 2018 is still a good choice among more expensive markets.

Let’s take a brief look at the median property price and a few return on investment metrics for the San Diego real estate market 2018, specifically for traditional rental properties. All of the data here is provided by Mashvisor’s investment calculator. To learn more about our investment calculator, click here.

Median Property Price: $745,055

Monthly Traditional Rental Income: $2,793

Traditional Cap Rate: 1.63%

Traditional Cash on Cash Return: 1.63%

Even with the median property price for real estate investments being so high, real estate investors can easily find more affordable investment properties with the right tools (we’ll show you how). Besides that, real estate investors can get a good cash on cash return from San Diego real estate investment properties.

Think the cap rate is too low? Then you need to read “Forget Everything You’ve Heard About What is a Good Cap Rate” right now. Once you do, you’ll rush to invest in San Diego real estate as that cap rate can’t be beat.

Rise in the Cost of Living? No Problem for San Diego Real Estate Investors

The combination of the positive trends in the economy along with the shortage of inventory for real estate investment properties spells out one thing: the ever-rising cost of living. It’s true the cost of living is on the rise in the San Diego real estate market 2018. But as we’ve shown you, it’s not deterring people from moving to the city and moving into rental properties, increasing the demand for San Diego investment property.

So why bring up the cost of living then? Because as a soon-to-be real estate investor of San Diego investment property, you need to understand what you stand to gain from this fact. Because of general inflation, cost of living is going up. As a real estate investor, inflation is your friend. San Diego investment property prices are going up as is rental income. Interest rates are high now as well but projected to keep growing. Take advantage of all of this now and protect yourself from inflation and get a great return on investment. Real estate investors only stand to gain value from appreciated San Diego investment property and increased monthly rental income.

Real estate investing then is a great option to protect yourself against inflation if you actually live in the San Diego real estate market. If you don’t, you need to be as savvy as other real estate investors and take advantage of the coming real estate appreciation, rise in rental income, and better overall return on investment.

Not convinced you need to buy a San Diego investment property?

As of January 2018, real estate investors made up 23.3% of San Diego investment property sales. This is up from 21.1% in January of last year. While that may not seem like much of an increase, it does tell us something important. More real estate investors are buying San Diego investment property. They know it’ll bring a great return on investment and now you do too.

A Few Recommendations for San Diego Real Estate Investors

You know to invest in the San Diego real estate market 2018 by now. But which type of San Diego investment property should you go for? We have three recommendations for San Diego real estate investors.

Affordable Investment Properties

What we mean is affordable housing. Not only are these investment properties cheaper for you but they are cheaper for the general population to rent. The reason we strongly suggest this type of San Diego investment property is not just because it will be wallet-friendly. It’s projected that the prices within the affordable housing sector of the market will rise in the San Diego real estate market 2018.

This means, for the time being, a San Diego real estate investor can enjoy rental income, as affordable housing is always in demand. By the end of the year, with San Diego real estate appreciation in this sector, you can sell and make a nice return on investment.

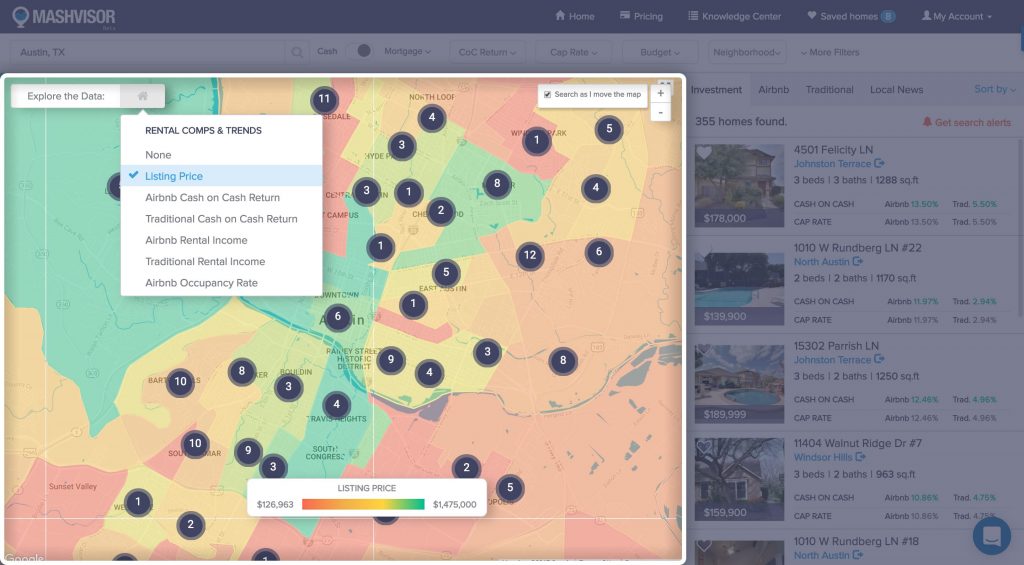

With such a high median price, you may be thinking it’s impossible to find affordable investment properties in the San Diego real estate market 2018. Well, with a feature of Mashvisor’s investment calculator, real estate investors have no trouble at all. This feature is the heatmap. With the heatmap you can quickly find more affordable investment properties in any real estate market. Take a look.

Mashvisor’s Heatmap Analysis

More affordable investment properties are in locations marked in red! How easy is that?

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

To learn more about heatmap analysis in real estate investing, read “Heatmap Analysis: The Secret to Successful Real Estate Investing.”

Multi Family Homes for Sale

For this suggestion, it goes back to the fear some real estate investors have of buying an investment property in a seller’s market. While construction to increase residential real estate properties is not strong, it’s strongest with multi family homes. Multi family homes for sale should see an added inventory of over 6,000 and possibly more plans are to come as the year continues.

With an increase in inventory in this type of San Diego investment property, it’s likely the strong seller’s market may balance out here.

Did you know you can use Mashvisor’s investment calculator to find multi family homes for sale in the San Diego housing market 2018? Not only can you find these investment properties, but you can analyze them to find ones that bring the best return on investment!

To start looking for and analyzing the best multi family homes for sale in San Diego, click here.

We Can’t Forget About Airbnb San Diego!

We’ve left this type of San Diego investment property for last, simply because it’s the best. A study done by smartasset.com named San Diego and Miami as the most profitable cities for Airbnb investment 2018. This makes sense as a top industry in San Diego is tourism. Not only is the tourism industry already on top of its game, but the local government has shown great interest in upping the tourist traffic to the city. The reason is to create more jobs, bringing it all full-circle for successful real estate investing.

Let’s take a look at the kind of return on investment you can get with Airbnb San Diego:

Monthly Airbnb San Diego Rental Income: $1,501

Airbnb San Diego Cap Rate: 1.03%

Airbnb San Diego Cash on Cash Return: 1.03%

For a more tangible reason as to why Airbnb San Diego hosts do so well, take a look at all of the events and attractions the city has to offer to guests. One worthy of mention is San Diego Comic-Con International. Don’t forget, at cheaper nightly rates, Airbnb investment property trumps the hotel industry in major cities when it comes to tourism.

Always make sure to check out Airbnb regulations by city before buying an investment property to use with the Airbnb rental strategy. Read “Airbnb Regulations by City Part 1 – Austin, Nashville, and San Diego.”

The Best Neighborhoods in San Diego for Real Estate Investing

Want to invest in a San Diego investment property? You really should know by now that it is a great option for real estate investing. Now, you need to know where to invest in real estate for the best return on investment. Here’s a list of the best neighborhoods in San Diego for real estate investing:

Golden Hill

Median Property Price: $695,000

Traditional Rental Income: $3,769

Traditional Cash on Cash Return: 2.82%

Traditional Cap Rate: 2.82%

Airbnb Rental Income: $1,859

Airbnb Cash on Cash Return: 3.99%

Airbnb Cap Rate: 3.99%

Hillcrest

Median Property Price: $651,944

Traditional Rental Income: $2,828

Traditional Cash on Cash Return: 1.9%

Traditional Cap Rate: 1.9%

Airbnb Rental Income: $3,899

Airbnb Cash on Cash Return: 3.57%

Airbnb Cap Rate: 3.57%

University City

Median Property Price: $575,000

Traditional Rental Income: $2,423

Traditional Cash on Cash Return: 1.37%

Traditional Cap Rate: 1.37%

Airbnb Rental Income: $3,514

Airbnb Cash on Cash Return: 3.02%

Airbnb Cap Rate: 3.02%

East Village

Median Property Price: $556,900

Traditional Rental Income: $2,493

Traditional Cash on Cash Return: 2.17%

Traditional Cap Rate: 2.17%

Airbnb Rental Income: $2,778

Airbnb Cash on Cash Return: 2.64%

Airbnb Cap Rate: 2.64%

Gaslamp Quarter

Median Property Price: $639,900

Traditional Rental Income: $3,073

Traditional Cash on Cash Return: 2.91%

Traditional Cap Rate: 2.91%

Airbnb Rental Income: $3,347

Airbnb Cash on Cash Return: 2.46%

Airbnb Cap Rate: 2.46%

Any potential Airbnb San Diego real estate investors will want to know about the Airbnb occupancy rate as well for each of the best neighborhoods in San Diego. All of these neighborhoods enjoy an Airbnb occupancy rate over 54%, some reaching as high as 69%. For this data, sign up to Mashvisor for a free trial and use the investment calculator.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

Choose any one of these neighborhoods (or others using Mashvisor’s investment calculator) and you’re sure to prosper within the San Diego real estate market 2018. There’s no doubt.