If you’re a buyer, and you want to buy a property but you don’t have enough credit score to qualify for a traditional mortgage, then seller financing might be for you!

Watch our video below to learn all you need to know about owner financing as a beginner real estate investor:

Seller financing is a method of financing that is used by buyers and sellers in real estate to overcome certain obstacles that might otherwise stand in the way of closing the deal.

In this article, I want to talk about what seller financing is, how it works, its types, and the advantages/disadvantages for buyers and sellers using this method of financing.

What is Seller Financing?

Seller financing, also known as owner financing, refers to a deal where the seller of the property finances the purchase of the property for the buyer instead of a traditional mortgage.

Therefore, a real estate purchase agreement with seller financing is somewhat similar to a traditional mortgage in that the buyer is borrowing money and paying it back over a period of time with interest. The difference is that in this case, the seller is the lender.

There are two main advantages that buyers and sellers might be seeking when opting in for this form of financing:

Buyers who have a bad credit score and are unable to get financing from a traditional lender might struggle to find other options of financing. However, with owner financing, buyers might find a seller who is willing to finance their purchase of the property regardless of their credit score.

Sellers, on the other hand, might want to offer this option when they’re trying to sell their property in order to attract more buyers. Additionally, sellers who finance the purchase of their own property can ask for a higher selling price or higher interest rates than a traditional lender due to the higher risk that they are taking.

Read: 7 Types of Investment Loans for Real Estate Property

How Does Seller Financing Work?

The way seller financing works is actually quite simple – in fact, it’s simpler than with a traditional mortgage financed deal.

This is because one of the most underrated advantages of owner financing is avoiding the cumbersome process of buying/selling a house in a traditional manner.

Going through a mortgage provider or a bank can lead to unexpected significant closing costs in addition to taking a much longer time to go through property appraisal, credit score check…etc.

When a buyer and seller agree on this form of financing, they will negotiate the terms, including the down payment, the duration of the agreement, and the balloon payment’s due date. This agreement will become their promissory note.

While the terms of the agreement can be whatever you agree on during the negotiations, there are a couple of terms that are very common in seller financing agreements:

- Typically, they are shorter term than traditional mortgages (5 years duration).

- They usually include a down payment – although it is more flexible than a traditional loan.

- They include a balloon payment after a certain period of time.

Since sellers offering this form of financing are taking high risks (they suffer most of the consequences if the buyer defaults on their payments), they might ask for a higher selling price or a higher interest rate than a traditional lender.

For this reason, buyers will often use the period of the agreement to improve their credit score and build some equity on the house, allowing them to get a traditional mortgage to pay the rest of the money to the seller and move to a more favorable mortgage term.

This is typically done at the time of the balloon payment in case the buyer doesn’t have the amount available to be paid to the seller at that point.

Types of Seller Financing

As with any other type of financing, there are multiple types of owner financing that I’d like to briefly mention:

Seller-Financed Mortgage

This is the standard type of seller financing that we’ve talked about so far. But there are multiple types of seller-financed mortgage:

- Properties owned free and clear: this is the simplest scenario where the seller doesn’t have any overstanding mortgages on the property, meaning that the property is completely paid off. The buyer and seller are free to set the terms of this agreement.

- All-Inclusive Trust Deed (AITD): If there’s a mortgage on the house that the seller is still making payments for, an AITD allows the seller to keep making these payments from the buyer’s payments. This isn’t a common type, however, since most conventional mortgage lenders have a “due on sale clause”, which means that the seller can’t actually sell the property until they have fully paid off their mortgage.

While there are other types of seller-financed mortgages out there, these two are the most common.

It’s important to note that an AITD type of mortgage can be very hard to secure, and it is often recommended not to do seller-financing if you already have a mortgage on the house. This is also true for buyers, as it is recommended to avoid buying a property with an outstanding mortgage on it.

Read: What Are the Best Real Estate Investment Loans?

Rent-to-Own Agreements

A lease-option agreement is a type of rent-to-own seller financing in which a lease agreement will be signed between the buyer and the seller, allowing the buyer to live in the property and make rent payments that will count toward rent credit, which can then go toward a down payment or a traditional mortgage.

At the end of a lease-option agreement, the buyer can decide whether to buy the house or not. If they want to buy the house, they will have to pay the rest of the property’s price to own it.

A lease-purchase agreement, on the other hand, is a very similar agreement with the difference being that the buyer will not have the option to opt-out of buying the house once the lease ends. This means that the buyer will be committing to buying the house when they sign the agreement, making it a much risker deal for the buyer.

Why Use Owner-Financing?

There are several advantages and disadvantages to using this type of financing as opposed to other types that are available.

Buyers and sellers, however, have different reasons for opting into using this type of financing, and both will also have situations in which this type might put them at a disadvantage.

So, let’s look at the pros and cons of using seller-financing for buyers and for sellers:

Pros and Cons for Buyers

These are the pros and cons of using owner-financing when it comes to buyers:

Pros

- It’s a financing option for people who aren’t able to obtain a conventional mortgage.

- The process of closing the deal will be faster, cheaper, and requires less effort.

- Flexibility when it comes to negotiating the down payment – you’re not stuck with the 20% down payment of a traditional mortgage.

- Gives buyers the opportunity to improve their credit score and financial situation before applying for a traditional loan.

Cons

- Sellers will typically charge a higher interest rate due to them taking on a higher risk. A traditional loan will almost always be a better option in this regard.

- The balloon payment can be a big hurdle and you will need to secure the money to be able to pay it in time.

- Nothing stops the seller from checking your credit score and disqualifying you based on it.

- You as a buyer won’t be as protected as if you were using a traditional mortgage. Depending on your local laws and the terms of your contract, the seller might be able to evict you if you miss out on any payments.

Pros and Cons for Sellers

Sellers have the following pros and cons for offering this type of financing:

Pros

- The process of selling a home is much faster this way as sellers won’t have to wait for appraisals and approvals…etc.

- The seller has more control over the price of the property.

- The payments that the buyer makes will turn into a passive income stream for the seller.

- Sellers can get an interest rate that’s higher than traditional lenders, making this a good investment in the long term.

Cons

- The seller carries all the risk by providing seller financing, especially since most buyers they will encounter will be people with credit scores that are too low for a traditional mortgage.

- If a seller already has a mortgage on the house, the process becomes more complicated and might lead to further consequences.

- If a buyer defaults and fails to pay in accordance with the terms of the contract, the seller will be responsible for going through the eviction and/or foreclosure proceedings.

- The seller won’t get the money in a single lump, but will instead have to wait and get their money in payments over time.

Read: A Guide to Creative Financing for Real Estate Investors

Looking for a Seller-Financed Property?

So, now that you know what a seller-financed property is, you might be wondering where to find seller financing homes for sale?

Firstly, I want to note that since this type of financing is something that the seller offers when they’re trying to sell a property, they will most likely mention it on their listing’s details.

This will generally lead to more interested buyers, but it also means more competition to you as a potential buyer to get the property.

So, even if you find a property that doesn’t have “seller-financed” on it, that shouldn’t stop you from bringing it up with the seller to see if that’s an option that they’re willing to consider. In this case, you will have far less competition and might get more favorable terms from the seller.

Regardless, if you’re looking for the best place to find seller-financed properties for sale, I recommend checking out Mashvisor!

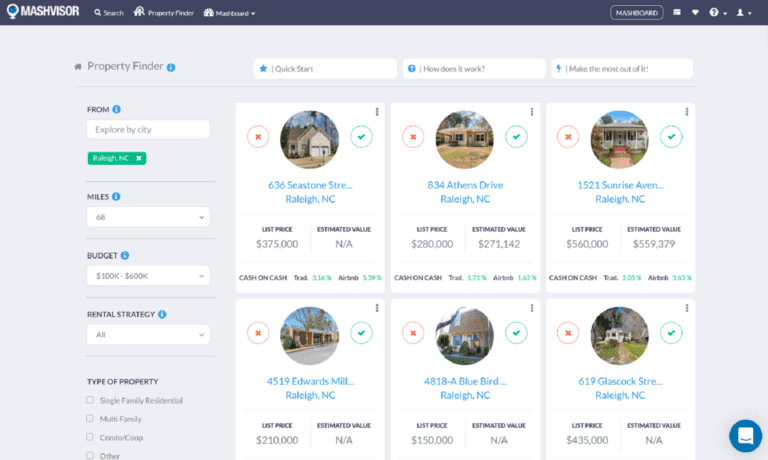

Mashvisor is a real estate platform that was designed to help buyers like yourself find investment properties with ease using a wide set of tools.

Using the property finder tool or the property marketplace, you will be able to search for investment properties for sale based on your criteria and the type of property you’re interested in.

Using Mashvisor will also allow you to see all of the property’s historical data and the owner’s details, and will also let you contact the owner directly to negotiate the terms of the deal with them and see if you can reach a seller-financing agreement.

Bottom Line

Seller or owner financing is a unique way to facilitate the purchase or selling of a real estate property as long as you’re aware of the advantages and disadvantages that it offers.

While a traditional mortgage may be the better option in most cases, in some cases seller financing might be a great idea, especially between sellers and buyers who might know each other on a personal level.

If you opt for buying a seller-financed property, make sure to use Mashvisor’s platform to search for and analyze real estate properties and make smart investment decisions based on accurate data and calculations to help you become a better real estate investor.