For a beginner investor, an SFH property is probably the safest and best choice when it comes to making a successful first investment. So, let’s find out why that is.

Table of Contents

- Investing in Real Estate for Beginners

- Why Beginner Investors Buy SFH Real Estate

- How to Invest in SFH Investment Properties

- Bottom Line – You Should Invest in an SFH

While the term “single-family home” is relatively new, the type of property that qualifies as an SFH has dominated the market for ages.

As real estate investing became one of the most popular roads to riches across the US, single-family homes maintained their status as the best entry point for beginner investors. But what exactly makes for a good investment that a beginner investor can successfully pull off?

And why are single-family homes such a good option for your first investment property?

In this article, I will answer the above questions and more about SFH investments and how you can start taking advantage of this excellent investment strategy today.

Investing in Real Estate for Beginners

When it comes to building up a fortune, investing in real estate is one of the best ways to do so.

It is not surprising that many of today’s richest people accumulated large portions of their wealth through real estate investments. What many don’t know is that most of the said wealthy people started their investment careers in real estate, and in many cases, in an SFH property.

But there are plenty of options to choose from when you want to invest in real estate. Whether it is different property types, investment strategies, or financing options – professional investors look at the market and see an empty canvas of opportunities in every property they see.

However, a beginner investor can quickly get overwhelmed when faced with all of these choices. It is one of the main reasons why single-family homes are the best option for beginners, as we will discover later on.

Related: The Ultimate Guide to Real Estate Investing for Beginners

But, for now, let’s look at an overview of the different aspects and choices that you should expect to face when starting your real estate investment career.

Investing in Real Estate – The Goal

Before making any choices, a real estate investor needs to understand one thing: the goal of investing in real estate is to make a profit. It goes without saying that for any investment to be a success, it must be profitable.

Many beginner investors seem to neglect or divert from this goal, and the reason is simple. Regardless of the strategy that you want to use, to make money in real estate, you will first need to spend money on a real estate property.

As they become the homeowners of that property, beginner investors can sometimes neglect the initial goal of making a profit and get attached to ideas about the property that might not be profitable. It is very common for first-time homeowners to get attached to their newly-bought homes, which leads them to make decisions that are counter-productive to their investment.

So, my first tip for beginner investors, although it is situational, is to always remain goal-oriented when aiming to make a profit from their investment.

With that in mind, and as we will later find out, many tools can help you stick to your original goal and make choices accordingly.

Property Types

Selecting the type of investment property is the most relevant choice that an investor needs to make about the topic of this article. One of the very first choices that you must make in real estate is the type of property that you want to invest in.

While SFH is the most common type of property in real estate, there are several other types that investors can choose from, each with its own pros and cons.

Generally, there are five main types of houses that you can invest in:

- Single-family home

- Multi-family home

- Condo

- Townhouse

- Co-op

The two most important ones to know about are single-family homes and multi-family homes. We will explore what they mean and the difference between them later on. For now, let’s look at the different investment strategies.

Investment Strategies

While there are plenty of property types to choose from, there are even more investment strategies that you can use in real estate.

Of course, as a beginner investor, you will want to stick to simple and less risky investment strategies that don’t require a great deal of knowledge about real estate investing. But knowing what your future options are can be a useful tactic to help you prepare and gain the necessary knowledge along the way.

Real estate investment strategies may include:

- Long-term rental

- Short-term rental

- Buy and hold

- Fix and flip

- House wholesaling

- REITs (Real Estate Investment Trusts)

- BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat)

In this beginners’ guide, I will be focusing on rental strategies for reasons that I will explain. However, it does not mean that beginner investors can only use the rental strategy.

In fact, buy-and-hold strategies are generally easier to pull off and plan for. But when it comes to growing your wealth and generating a passive income, rental strategies are favored.

Part of the reason is related to financing, as we will see now.

Mortgages and Financing

Financing your real estate investment is an excellent way to jump into the market when you don’t have a large amount of money available to do an all-cash purchase. It is rare to find first-time investors who use cash to purchase their first property.

Instead, what most homeowners and investors do is borrow money from a lender to finance their investment.

Mortgages refer to loans that are offered to real estate home buyers who either want to buy a house to live in or as an investment. There are many types of mortgages available to real estate investors, such as the HUD mortgage that the US Department of Housing and Urban Development offers.

The downside of using a mortgage, of course, is that you would need to pay it back over a set period with an interest rate. The interest rate varies depending on the type of mortgage, your credit score, and many other market-related factors.

However, when it comes to making your monthly mortgage payments, that is when rental properties truly shine.

Rental properties, when well-managed, can generate enough monthly rental income to cover the mortgage payments and still leave some leftover money at your disposal. It means that a beginner investor can borrow money, buy a rental property, rent it out and let it virtually pay for itself over time while also making a profit.

It’s important to remember, however, that most mortgage types will require you to make a down payment that can be around 10%-20% of the property’s price.

So, make sure to save some money, and keep it in mind when looking at the prices of investment properties that you want to buy.

Why Beginner Investors Buy SFH Real Estate

Now that we’ve covered the basics of investing in real estate and the different options you will be faced with, let’s talk about SFH real estate.

To start, let’s see what’s exactly the SFH meaning. The simple answer to the question “what is SFH” is that it’s a dwelling that can accommodate a single family. It is in contrast with multi-family homes, which are properties that include multiple units and can house multiple families at once.

The best example to understand the difference when talking about the SFH meaning real estate is to imagine an apartment building.

If an investor owns the entire apartment building, they own a multi-family property that consists of multiple apartment units, each with the ability to house a family. However, if an investor buys only one apartment in an apartment building, then they’ve bought a single-family home.

Simple, right?

Now, let’s take a look at the advantages of investing in an SFH house.

1. Affordability

While single-family homes can come in different shapes and sizes and can vary in their cost, they are generally more affordable than other types of properties. It is mainly due to their availability.

The majority of real estate properties in most residential markets consist of single-family homes. As you might expect, the availability means that the prices of single-family homes can only go so high.

If single-family homeowners decide to raise the prices of their properties, the demand for their properties will drop significantly as buyers have tons of other options to choose from. It also means that competition over them is far more forgiving and less fierce than with other types of properties.

All of the above factors make single-family homes a better option for beginner investors who might not have a large amount of cash available for investing.

In the US market, the median price of single-family homes varies in each market. Some markets have a median property price of around $200,000, which is considered cheap in today’s real estate market.

In other markets, however, and especially in metropolitan areas like Austin, you will find that the median price of an SFH has gone up to around $700,000 after the pandemic.

So, keep in mind that if a market is too expensive for you, it is possible to find and invest in a more affordable market.

2. Property Management

Another big advantage when it comes to investing in an SFH is property management. Simply put, managing a single property is much easier than managing multiple ones. If you’re buying a multifamily property, for example, and you’re renting out multiple units in that property, then you will have to manage each of them individually.

As a beginner investor, managing multiple properties can get overwhelming very quickly. So, when compared to multi-family properties, single-family homes are far more accessible to beginner investors.

Additionally, beginner investors might opt for hiring a property management service to handle the daily and routine tasks of managing their properties.

While property management services can be a bit expensive, they are more affordable to hire for single-family homes than for managing an entire apartment building.

Read: Why You Should Be Your Own Property Manager

3. Risk Mitigation

Perhaps, the biggest reason why beginner investors should invest in single-family homes is to mitigate risks. The SFH market is a very stable one, and it isn’t going to change for a very long time.

People need houses, and as long as new families are being created, the demand for single-family housing will exist. But that’s not the only reason why risk is lower when it comes to SFH investments.

The lower cost of a single-family home is yet another factor that further exacerbates their lower-risk aspect. And the last reason why single-family homes are a safe investment is that they’re flexible in terms of their use.

It means that if you own a single-family property, and that property isn’t doing well as an investment, you can simply move in and use it as your primary residence.

A single-family home can be used as a backup residence, and it gives you the flexibility of moving in or even using it as a vacation rental during certain times of the year.

How to Invest in SFH Investment Properties

So, now that we’ve seen why beginner investors should invest in an SFH home, let’s talk about the process of investing in such property.

When you want to buy investment properties, there are certain steps that any investor needs to take that will help them succeed and make a profitable investment. Beginner investors might struggle to realize the steps needed to invest in an SFH house.

Luckily, Mashvisor’s platform makes it much easier for beginner investors to find and invest in multiple types of investment properties, including SFH homes.

So, in this section, I will be talking about the different steps that you need to take while illustrating how Mashvisor can help you in each of these steps.

What Is Mashvisor?

Mashvisor is a real estate investing platform that was designed specifically with beginner investors in mind. The platform offers all the data and tools that are needed to pull off a successful real estate investment.

From providing data on properties for sale, search tools, to investment opportunity analysis – Mashvisor can help beginner investors throughout all stages of their investment journey.

With access to large amounts of data from the MLS, Airbnb, and other sources, Mashvisor’s sophisticated AI analyzes each market and property to provide easy-to-understand insights.

Now, let’s see how the platform can help you in the most important steps of your venture.

Related: 7 Reasons Why Mashvisor Is the Best Real Estate Platform for Investors in 2022

Finding an SFH Rental Property for Sale

The first step when you are looking to buy investment properties is to find properties that you can invest in. It means obtaining access to a real estate database where you can find properties listed for sale.

Traditionally, it is done by:

- Hiring a real estate agent with access to the MLS (Multiple Listings Service)

- Joining local or online forums and real estate communities

- Driving around and looking for “for sale” signs in your local market

- Looking for ads in newspapers or on social media

While all of the above methods can give you some access to listings that you might be interested in, a successful investment requires you to compare and choose from as many listings as possible.

Mashvisor’s investment property search tool is a great and superior alternative that offers flexibility and utility to help investors find the perfect property for them in the least amount of time.

Since the platform gathers data from the MLS and other trusted sources, it allows the user to sort through these properties based on their search criteria and investment strategy.

The tool features a map interface with several filters that allow you to find properties based on:

- Price

- Rental rate

- Cap rate

- Type of property (single-family, multi-family, townhouse, co-op/condo)

- Property size

- Property age

- Number of bedrooms

- Number of bathrooms

However, while the above filters are used to find properties listed for sale, the tool provides you with much more in terms of investment property analytics and insights, as we will see now.

Analyzing Rental Properties

When you find a property for sale that you like, Mashvisor allows you to analyze the value of investing in that property and compare it to other properties around it to see if it’s the right fit for you.

The platform places a heavy emphasis on metrics like the cap rate or cash on cash return, which are used to project the rate of return of a rental property.

It means that beginner investors can obtain clear insights about the value of investing in each property, and they can use the insights to help them make their decision. For example, if you find two properties that are very similar and with around the same price, the best way to compare them would be based on their projected rate of return.

When clicking on any property on Mashvisor, you will be taken to that property’s rental analysis page. The page includes all the important data that can help you understand what the future will look like if you invest in a particular property.

The page will also include a rental property calculator and a mortgage calculator. Both calculators are customizable and let you modify the values based on your investment criteria.

The rental property calculator includes all the costs and expenses related to the property, which are filled based on the market’s averages by default. It is a very helpful feature for beginner investors who might not know what recurring expenses or closing costs they should expect.

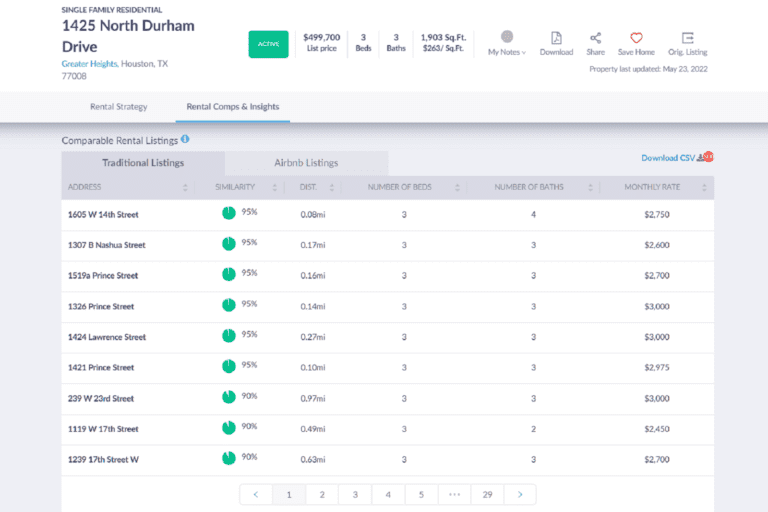

The page will also include a section for rental comps, which compares the property you’re analyzing with all similar properties within the same market to help you understand how it fares compared to them.

Mashvisor’s Rental Comps feature allows investors to find similar properties within the same market and compare their performance in relation to one another.

Bottom Line – You Should Invest in an SFH

Beginner investors who are looking to start their careers with a low-risk property that promises long-term profits will find that SFH properties are the perfect fit for them.

What is SFH? SFH meaning real estate refers to single-family homes that can house a single-family.

Single-family homes offer several advantages when it comes to real estate investing, especially for beginner investors who might get overwhelmed by multi-family homes and other types of properties. An SFH house can provide affordability, stability, and flexibility not often found in other types of properties.

Additionally, if you decide to buy investment properties in any market in the US, you’ll be happy to know that Mashvisor is a platform that can help you throughout your investment journey and beyond.

Whether you’re trying to find properties for sale or analyze rental properties for their rate of return, Mashvisor is an invaluable tool for beginner and professional investors alike.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.