Short term rentals are real estate investment properties that are bought specifically to be rented out as vacation rentals. They allow investors to generate income by renting out their properties for shorter periods of anywhere from a few days to a few months.

Table of Contents

- The Complete Guide to Investing in Short Term Rentals

- 10 Cities With Cap Rates That Make Them Ideal for Short Term Rentals

- The Bottom Line: Short Term Rentals

This article aims to guide interested individuals into real estate investing, particularly short term rentals.

The Complete Guide to Investing in Short Term Rentals

Short term rentals are again in demand now as more people are taking advantage of the relaxation of travel restrictions.

The latest springtime trend includes long-term Airbnb rentals as more people embrace the “live anywhere” lifestyle. Retirees and the millennial workforce are choosing to adopt a nomadic lifestyle and lie life on the road, untethered to their homes and offices.

As the trend continues to swing upward, short term rental property owners should expect an increase in bookings this season. It may also be a good time for investors to consider investing in STRs.

Investing in Short Term Rentals?

Like any other business or investment, investing in short term rentals comes with certain risks and rewards.

The Good

Greater flexibility. STRs give owners and hosts the flexibility to make the property available whenever they want. They can adjust the prices anytime they need to. And if they’re working with property managers, they don’t need to be on-site the entire time. Such a setup works especially well when you want to take vacations at the drop of a hat or if you’re an out-of-state investor.

Inexpensive and more private alternative to hotels. People are always looking for ways to save money whenever they can. For those who like to travel or are frequently on the go, STRs are the perfect alternative to the more expensive hotels and resorts. It puts STRs on the map, making them extremely popular among travelers who are looking to save money.

Greater income-generating potential compared to traditional rentals. Generally, STRs offer the potential to earn twice or thrice as much as traditional rentals, depending on the location.

Tax breaks and deductions. STR owners enjoy certain tax breaks and deductions that most traditional rental property owners don’t. With the right deductions, STR owners can record losses and lower (or avoid) their taxes.

More interaction with interesting people. One of the perks of owning a short term rental property is that it gives owners the chance to interact with different types of people, build connections, and expand their network.

The Not-So-Good

Less payment consistency. Unlike traditional rentals, where owners know how much they will be getting monthly, STR owners see far less consistency when it comes to payments. While peak seasons may be financially rewarding, there may also be seasons when they are not getting enough bookings.

Utility payments. Generally, long-term tenants take care of the monthly utility bills. Unfortunately for STR owners, they are the ones paying for all utilities, whether they get bookings or not.

Greater risks involved. Letting complete strangers into your property involves certain security risks. It also increases the chances of property damage. It is something that most long-term rental owners don’t need to worry about.

More legwork than traditional rentals. Between marketing, entertaining guests, collecting payments, and maintaining the property, an STR owner’s hands are always full. STR owners put in more effort on a weekly basis, unlike traditional rental property owners who only need to check in occasionally.

A Step-by-Step Guide to Short Term Rentals Investing

The pros of investing in short term rentals still outweigh the cons. If you’re serious about it, here are a few simple steps to get you started:

Step 1: Have a Clear Set of Investment Goals.

In any business venture, goals play a very crucial role. It’s pretty much the same thing with real estate investing. A serious investor needs to set the right goals to help them keep track of their progress and basically, just to keep them on track.

A long-term overarching goal needs to be set to determine the smaller steps that need to be taken.

Step 2: Prepare Your Finances.

Of course, real estate investing will involve a substantial amount of capital. Whether you intend to pay for a property in cash or go with financing options, you need to make sure that funding won’t be a problem.

Investors should consider not just the property price but other costs that go with purchasing a property, like closing costs, repairs, and marketing.

Step 3: Location Makes All the Difference.

Just because short term rentals are in high demand now doesn’t necessarily mean that all properties will generate a good return. Location still matters at the end of the day.

When picking out the right location, one needs to consider the existing market conditions. One cannot just choose a specific market based on hearsay or a blind recommendation. Smart investors go out of their way to carefully study their options to ensure they get the best possible investment property.

Step 4: Perform Your Due Diligence.

The great thing about real estate investing today is that we can already access technology that will make the research process a lot easier and more efficient.

A website like Mashvisor, specifically, helps real estate investors perform their due diligence by providing the most relevant information and accurate market data. It significantly cuts down the time and money spent on research and analysis.

Mashvisor subscribers enjoy access to a massive database that pretty much covers almost all real estate markets across the 50 states. It also provides real estate investment tools that speed up the process.

Its real estate heatmap feature gives investors a more detailed insight into specific markets and tells them which ones are hot and which ones are not.

Step 5: Search for Profitable Properties.

Once you’ve determined which market you want to invest in, it’s now time to shop for potential properties that align with your investment goals and criteria.

On top of the real estate heat map, Mashvisor also makes the search for profitable properties easier with its property finder. This feature lets investors look closely at neighborhood data to determine if it is worth investing in or not. Once you deem a neighborhood good enough to invest in, you can check out the different properties shown on the page and see if their details match what you’re looking for.

To learn more about how Mashvisor can assist you in finding profitable investment properties, schedule a demo.

Step 6: Do the Math.

The next thing to do once you’ve located a property that you like is to make sure the numbers add up. Data analysis is very crucial to any real estate investment as the numbers will determine whether you should proceed with your plans or if you should consider a different strategy.

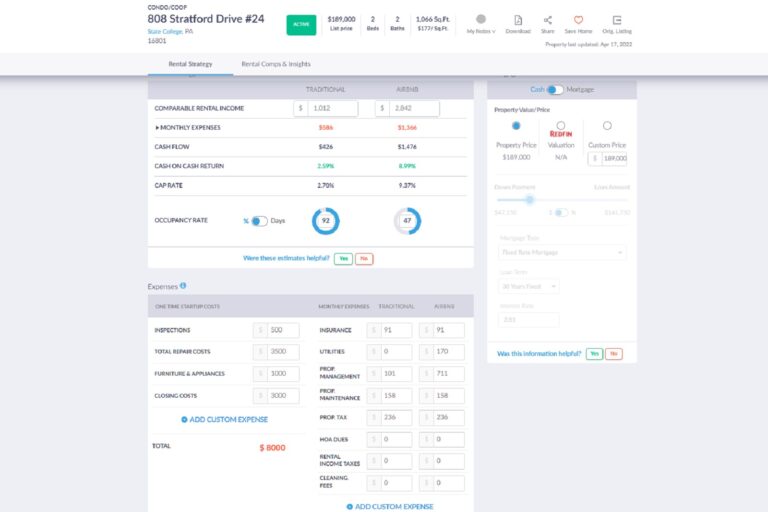

Fortunately, Mashvisor makes crunching the numbers very easy with its Airbnb calculator, which is specifically designed for short term rentals.

Do you have questions about Mashvisor? Read our FAQs and learn about our tools.

Mashvisor’s Airbnb Calculator makes crunching the numbers for short term rentals very easy.

Step 7: Make the Necessary Home Improvements and Updates.

If the math checks and you think you’re ready to do so, you can proceed with the transaction and close the deal.

Once the property’s been turned over to you, you will need to make certain improvements to the property to make it more appealing to potential guests.

Depending on the amount of work you want to get done on the property and how furnished it is, you might need to wait a few weeks before you can launch your Airbnb business.

Generally, short term furnished rentals rake in higher income but also require a bigger investment. Furnished short term rentals don’t need to be extravagantly decorated. You just need to make sure that the basics are covered. It will help make your property if you offer certain add-ons that will give you the edge over your competitors. Take time to check out what the competition offers and see how you can adjust to get guests to choose you.

Step 8: Determine a Competitive Price.

Part of performing due diligence is finding out what the competition is up to, including their rates and special discount packages. You can check out the Airbnb comps in the area to give you an idea of what the going rates are and see how you can make guests notice you among all the other listings online.

Step 9: Create Marketing and Management Strategies for Your Business.

Of course, you will need to have a sound strategy in place to make sure you remain relevant in the community. A good marketing plan will help make your property stand out and attract more customers. A good management strategy will help elevate your business and keep it running like a well-oiled machine despite occasional setbacks.

Step 10: Work with a Capable Team of Professionals.

Owning an Airbnb rental can be quite overwhelming if you do it solo. You can ease the burden by building a reliable team you can work with who will share the responsibility with you. You can hire a few individuals to help you manage the business, or if you’re an out-of-town investor, you can hire a property management team to take care of the day-to-day operations.

Step 11: Have the Property Listed on an STR Platform.

When you’re done with everything on this list, you can now have your property listed on Airbnb and other similar platforms. At this point, one of your priorities should be to market your property to vacationers to increase your Airbnb occupancy rate.

Take professional-grade pics of the property and its features. Make sure to mention its unique selling points to make it stand out from the other listings in your area. Be as accurate with your listing description as possible. Pretty soon, you’ll start getting inquiries from potential guests and entertaining guests in your vacation rental.

10 Cities With Cap Rates That Make Them Ideal for Short Term Rentals

According to Mashvisor’s March 2022 data, the following ten short term rentals markets provide the best return on investment. If you’re looking for an investment property, listed below are the markets that you would want to check out first:

1. State College, PA

- Number of Listings for Sale: 7

- Median Property Price: $437,828

- Average Price per Square Foot: $223

- Days on Market: 129

- Number of Short Term Rental Listings: 268

- Monthly Short Term Rental Income: $5,728

- Short Term Rental Cash on Cash Return: 8.02%

- Short Term Rental Cap Rate: 8.22%

- Short Term Rental Daily Rate: $497

- Short Term Rental Occupancy Rate: 52%

- Walk Score: 94

State College PA tops our list of places ideal for short term rentals with healthy cap rates. It is a place with a thriving tourism industry as it is an excellent place both for business and pleasure. However, it is also essential to note that STRs are only allowed in designated areas as stipulated in the local zoning ordinance.

2. Sheboygan, WI

- Number of Listings for Sale: 6

- Median Property Price: $202,600

- Average Price per Square Foot: $141

- Days on Market: 40

- Number of Short Term Rental Listings: 127

- Monthly Short Term Rental Income: $2,592

- Short Term Rental Cash on Cash Return: 7.48%

- Short Term Rental Cap Rate: 7.81%

- Short Term Rental Daily Rate: $315

- Short Term Rental Occupancy Rate: 45%

- Walk Score: 88

There is no shortage of visitors in Sheboygan, WI, especially those who love water sports and the great outdoors. Dubbed as the Malibu of the Midwest, Sheboygan offers a lot for Airbnb owners, especially since a lot more folks are renting out STRs for much longer periods now compared to the pre-pandemic market.

3. Bushkill, PA

- Number of Listings for Sale: 36

- Median Property Price: $331,909

- Average Price per Square Foot: $157

- Days on Market: 39

- Number of Short Term Rental Listings: 105

- Monthly Short Term Rental Income: $4,131

- Short Term Rental Cash on Cash Return: 7.57%

- Short Term Rental Cap Rate: 7.77%

- Short Term Rental Daily Rate: $323

- Short Term Rental Occupancy Rate: 50%

- Walk Score: 0

Owning a short term rental property in Bushkill is not prohibited. However, it is also important for investors to know that Lehman Township no longer issues new STR licenses. Investors who are interested in starting an Airbnb business in Bushkill can instead purchase older licenses that will allow them to operate. It is pretty unconventional but well worth it in the long run since the place constantly attracts visitors looking for outdoor adventures and family-friendly fun.

4. Galena, IL

- Number of Listings for Sale: 21

- Median Property Price: $445,852

- Average Price per Square Foot: $229

- Days on Market: 67

- Number of Short Term Rental Listings: 216

- Monthly Short Term Rental Income: $4,781

- Short Term Rental Cash on Cash Return: 7.41%

- Short Term Rental Cap Rate: 7.60%

- Short Term Rental Daily Rate: $269

- Short Term Rental Occupancy Rate: 63%

- Walk Score: 76

Galena in Illinois is worth visiting for its rich history and outdoor getaways. It is a charming town that used to be a mining community that later became a ghost town. It’s been fully restored and folks just can’t get enough of it. Investors would do very well to take advantage of the local charm, especially now that a lot of people are planning their spring vacations.

5. Berkeley Springs, WV

- Number of Listings for Sale: 10

- Median Property Price: $426,810

- Average Price per Square Foot: $202

- Days on Market: 73

- Number of Short Term Rental Listings: 143

- Monthly Short Term Rental Income: $4,261

- Short Term Rental Cash on Cash Return: 7.39%

- Short Term Rental Cap Rate: 7.55%

- Short Term Rental Daily Rate: $216

- Short Term Rental Occupancy Rate: 67%

- Walk Score: 5

The beautiful and historic town of Berkeley Springs is the perfect place to relax and unwind with its picturesque views and one-of-a-kind spas. With travel restrictions easing and folks gearing up to make further trips amid a pandemic, it might be a good time to look for short term apartment rentals to buy.

6. McGaheysville, VA

- Number of Listings for Sale: 13

- Median Property Price: $447,131

- Average Price per Square Foot: $211

- Days on Market: 48

- Number of Short Term Rental Listings: 152

- Monthly Short Term Rental Income: $4,791

- Short Term Rental Cash on Cash Return: 7.40%

- Short Term Rental Cap Rate: 7.54%

- Short Term Rental Daily Rate: $345

- Short Term Rental Occupancy Rate: 55%

- Walk Score: 29

As one of the best short term rental markets in terms of STR cap rate, investing in McGaheysville is considered a good thing for real estate investors. Visitors keep a-coming because there are lots of fun things to do in the community. In addition, the median property value isn’t expensive compared to short term rentals Las Vegas, short term rentals Miami, and other more pricey markets.

7. Fairbanks, AK

- Number of Listings for Sale: 33

- Median Property Price: $301,787

- Average Price per Square Foot: $194

- Days on Market: 68

- Number of Short Term Rental Listings: 212

- Monthly Short Term Rental Income: $3,574

- Short Term Rental Cash on Cash Return: 7.24%

- Short Term Rental Cap Rate: 7.47%

- Short Term Rental Daily Rate: $133

- Short Term Rental Occupancy Rate: 70%

- Walk Score: 22

The great thing about owning a vacation rental in Fairbanks, AK is that Airbnb and other STRs are completely legal as long as you get a business license. Investing in Fairbanks―and in Alaska, in general―offers excellent opportunities for people looking to buy investment properties as the home sales in the state are relatively low and the local economy is on an upward trend.

8. Middletown, RI

- Number of Listings for Sale: 6

- Median Property Price: $660,650

- Average Price per Square Foot: $430

- Days on Market: 66

- Number of Short Term Rental Listings: 198

- Monthly Short Term Rental Income: $6,951

- Short Term Rental Cash on Cash Return: 7.24%

- Short Term Rental Cap Rate: 7.34%

- Short Term Rental Daily Rate: $447

- Short Term Rental Occupancy Rate: 56%

- Walk Score: 50

Although the median property price in Middletown, RI might be a bit more expensive than others, its higher STR monthly income, along with very good cash on cash return and cap rate, makes it worth the investment. As long as you secure a permit to run an Airbnb business and you’re working with a property management team (if you’re an out-of-town investor), you’re good to go.

9. Tobyhanna, PA

- Number of Listings for Sale: 27

- Median Property Price: $243,840

- Average Price per Square Foot: $162

- Days on Market: 45

- Number of Short Term Rental Listings: 281

- Monthly Short Term Rental Income: $3,029

- Short Term Rental Cash on Cash Return: 7.02%

- Short Term Rental Cap Rate: 7.27%

- Short Term Rental Daily Rate: $288

- Short Term Rental Occupancy Rate: 46%

- Walk Score: 25

Aside from the median property price being low, real estate investors may find that now is an excellent time to buy investment properties in Tobyhanna. It is a great place with relatively few residents that’s perfect for folks who want to enjoy some downtime away from the crowds. Tobyhanna is a progressive and growing municipality that shows much promise to investors.

10. Saugerties, NY

- Number of Listings for Sale: 13

- Median Property Price: $479,669

- Average Price per Square Foot: $260

- Days on Market: 121

- Number of Short Term Rental Listings: 230

- Monthly Short Term Rental Income: $5,315

- Short Term Rental Cash on Cash Return: 6.97%

- Short Term Rental Cap Rate: 7.12%

- Short Term Rental Daily Rate: $298

- Short Term Rental Occupancy Rate: 64%

- Walk Score: 80

The State of New York imposes stringent rules on Airbnb and other types of STRs that short term rentals NYC are mostly illegal. However, certain places in NY take a more balanced approach to STRs and Saugerties is one of them. In early 2022, a case was made by the town building department to allow special-use permits for STR regulation. It will enable the town to accommodate both STR operators and town residents without overstepping any of their rights.

The Bottom Line: Short Term Rentals

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.