When it comes to real estate investment strategies, you have two options; you can either choose long term investment strategies or short term investment strategies. But which one is the better option? In this post, we will break down the pros and cons of both long term and short term investments.

Additionally, we will introduce you to some of the most popular strategies for each type. This should help you make the final decision as to which is better for you.

Short Term Investments

What are the pros and cons of a short term investment strategy?

Advantages of a Short Term Investment Strategy

- Quick return on investment – You can make a profit much faster compared to holding onto the investment property for several years and relying on real estate appreciation.

- Higher earnings – Short term investments usually have a higher return on investment compared to long term investments.

- Personal development – A short term investment strategy requires a lot of work in a short amount of time. So in the process of completing the strategy, you will typically be able to grow your knowledge of the local real estate market, construction, financing, and negotiating. In addition, you will expand your network by working with real estate agents, attorneys, inspectors, insurance brokers, contractors, and attorneys.

- No management required – With short term investment strategies, you won’t have to worry about handling tenants or managing a rental property.

Disadvantages of a Short Term Investment Strategy

- High risk – You could lose a lot of money. This is especially true of the fix and flip real estate strategy (more on this strategy below). This could be due to unanticipated expenses during renovation or capital gains tax.

- Holding costs – This disadvantage is, again, specific to the fix and flip strategy. The investment property might not sell as fast as you expected. As a result, you might end up incurring costs related to loan repayments and maintenance, all of which will be paid from your own pocket.

- Stress – The process of buying an investment property, possibly renovating it, and finding buyers quickly can be very time-consuming and stressful. Short term investments are definitely active investments.

There are two common short term investments in real estate; fix and flip and real estate wholesaling.

Fix and Flip Real Estate

As the name suggests, fix and flip involves buying a house below market price, renovating it, and then selling it for a profit. If done properly, a house flip can be a very lucrative way of making money in real estate.

The first step is to find the right real estate market to buy a house. A good market for flipping houses is one where you can find discounted properties. At the same time, you should be able to flip them for a good ROI – meaning, there should be a high demand from buyers.

Once you’ve identified the ideal investment property in your market of choice, organize for a home inspection to determine the renovation cost. You should also conduct a comparative market analysis to estimate the after repair value (ARV) of the investment property.

Next, consider your financing options. You can choose between paying in cash, conventional financing, home equity loans, hard money lenders, and private money lenders. It’s also a good idea to look into rehab loans like FHA 203k loans.

After buying the investment property and renovating it, set a price and find a buyer.

Related: Real Estate Investment Strategies Guide: Fix and Flip

Wholesaling Real Estate

Unlike fix and flip, wholesaling doesn’t involve buying and owning an investment property. All you need to do is find a great real estate deal, and then get the property under contract with the seller. You will then look for an interested buyer and sell them the contract at a profit.

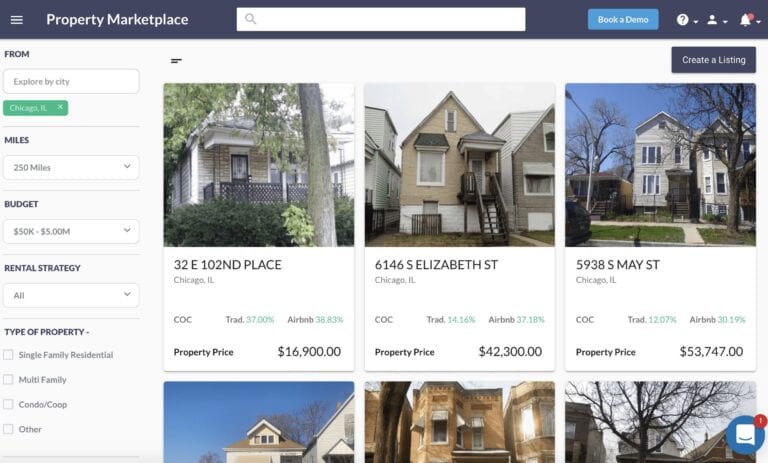

The best properties for wholesaling are foreclosures or bank owned properties. You can find such off-market deals on sites like Mashvisor’s Property Marketplace, FSBO, and Craigslist. Consider hiring a real estate agent to help you negotiate a good deal for the contract.

To find buyers, you can use bandit signs, newspaper ads, flyers, and networking. Once you’ve found a buyer and agreed on the price, you can visit the title company’s office and close the deal.

Long Term Investments

Why are long term investments good? Why might they not be the best choice for you? Let’s look at some of the advantages and disadvantages of this type of real estate investment strategy.

Advantages of Long Term Investments

- Passive investment – Once you’ve bought one or two long term investments, the work can end there. You can enjoy the positive cash flow or just the appreciation without having to put in a lot of time or energy.

- Equity – Long term investments allow you to build equity in your investment property over time.

- Tax benefits – With a rental property investment strategy, expenses such as loan interest, insurance, legal fees, property taxes, repair costs, and even property depreciation are tax-deductible.

- Hedge against inflation – As inflation rises, your rental income (if you choose to rent out the property) and the value of your long term investments will also increase.

Downsides of Long Term Investments

- Tenant problems – If you go with a rental property investment strategy, bad tenants can cause a lot of trouble, including damaging your investment properties.

- Vacancy – This can be an issue with both of the popular long term investment strategies. With the buy and hold strategy, your property will always be vacant and you will have to pay for upkeep from your pocket. Once in a while, you might lack tenants if you’re running a rental property. This also means that you will have to pay expenses from your pocket.

- Depreciation – Due to factors such as political unrest or natural disasters, your property might end up losing value over time.

Buy and hold and renting out are the best long term investments in real estate. Let us examine how each of these long term investments works:

Buy and Hold Real Estate

This is an investment strategy where real estate investors buy a property and hold on to it for a long duration. They can rent out the property for several years or simply leave it vacant and eventually sell it for a profit once it appreciates.

To find a good investment property for this strategy, you’ll want to look for one in a real estate market where properties are set to appreciate. Check out these 5 best cities for real estate appreciation.

Financing options for buy and hold properties include traditional lender financing, private money lenders, seller financing, and FHA purchase loans.

After acquiring the property, how you manage it will depend on whether you plan on renting it out. If you wish to rent it out, you can become a landlord or hire a property manager. Otherwise, the property will only require maintenance and upkeep from time to time.

Renting Out

As mentioned above, you can buy an investment property and rent it out. That way, you can benefit from both appreciation and cash flow.

A residential rental property could be a single family home, condo, multi family home, or an apartment. Once you decide on the type you want to buy, find a suitable neighborhood. Besides using online tools to analyze neighborhoods like Mashvisor’s real estate heatmap, you should also consider other factors such as school ratings, crime rate, accessibility, and population growth.

It would be advisable to work with a licensed real estate agent that has access to investment opportunities available in the multiple listing service (MLS). You could also check online listings or work with a wholesaler to identify great off-market deals.

Related: Why It’s Better to Buy and Hold Real Estate and Rent it Out

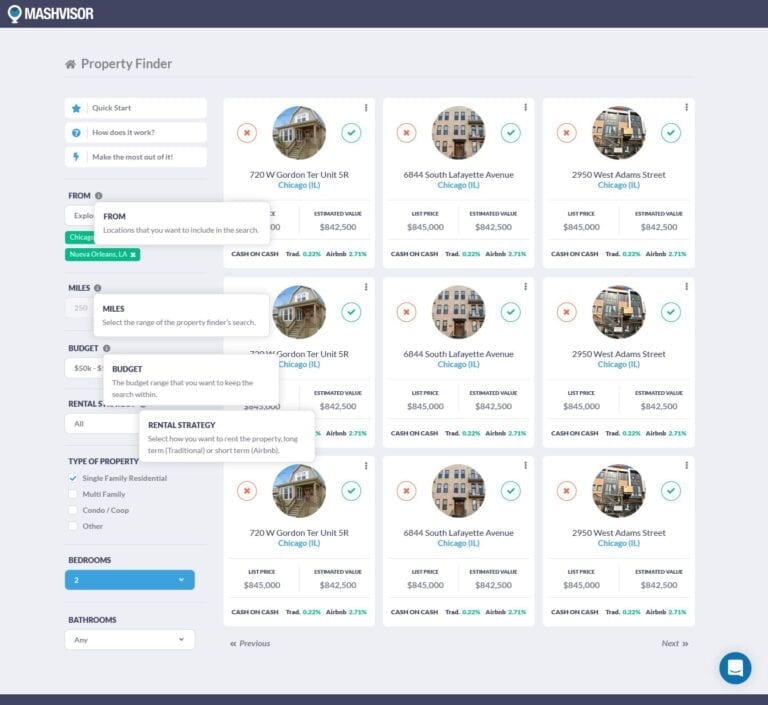

Mashvisor’s Property Finder tool will come in handy for locating profitable investment properties. You can set filters like your budget and the type of property you’re looking for. The tool will then produce a list of high return rental properties for sale in the location of your choice.

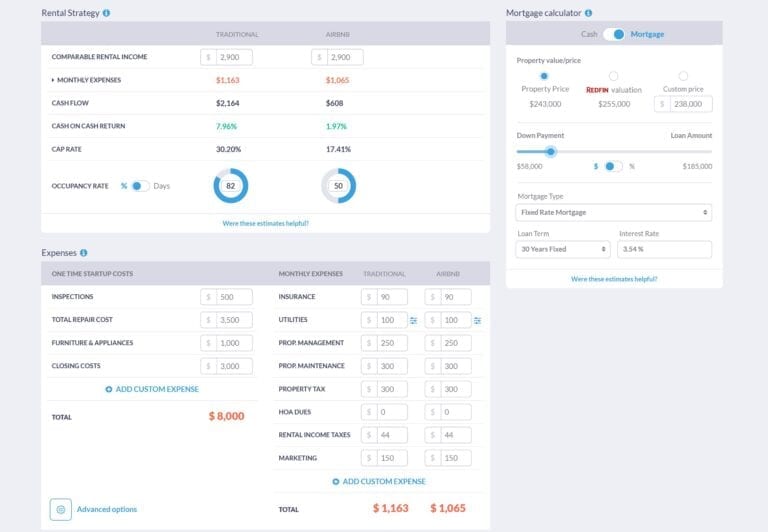

Mashvisor’s investment property calculator will help you calculate the cash flow, cap rate, and cash on cash return of different investment properties for sale. It will also help you determine the optimal rental strategy for an income property.

Once you have identified and purchased cash flow properties, you will then need to prepare a lease, find tenants, and manage the day-to-day running of the rental. These tasks can be delegated to a professional property management company.

So, Which Is Better?

So, which is the best way to invest money? When all is said and done, long term investing is a much better option in 2020 compared to short term investments. Long term investments are less risky, provide an opportunity to earn long term passive income, and allow you to leverage property equity.

Among the options for long term investments, it’s best to combine the buy and hold and rental investment strategies so you can benefit from both cash flow and appreciation.

To make faster and smarter real estate investment decisions, click here for a 7-day free trial followed by a 15% discount for life on your subscription.