There’s no doubt about it, small multifamily properties are a good real estate investment. Not only are they easier to manage on your own compared to large apartment complexes but they provide more rental income than a single-family home would. You even have a few different types to choose from: a duplex, triplex, or fourplex. So, as a real estate investor, you should consider purchasing small multifamily homes. The question, though, is how to buy them. To help you out, we put together a guide that will cover three important parts of the buying process:

- Where to invest in small multifamily homes

- How to find small multifamily properties for sale

- How to buy multifamily property with no money

Where to Invest in Small Multifamily Homes

First, it’s important to find a good location for investing in small multifamily properties. According to Mashvisor’s data, the 5 best multifamily markets are Manchester, NJ, Marco Island, FL, Naples, FL, Pasadena, CA, and Hemet, CA. These are the cities where small multifamily homes will generate the highest return on investment in 2020.

Manchester, NJ

- Median Property Price: $79,887

- Price per Square Foot: $3,864

- Price-to-Rent Ratio: 4

- Traditional Rental Income: $1,812

- Traditional Cap Rate: 14.6%

Marco Island, FL

- Median Property Price: $593,673

- Price-to-Rent Ratio: 10

- Traditional Rental Income: $4,981

- Traditional Cap Rate: 6.1%

Naples, FL

- Median Property Price: $368,536

- Price-to-Rent Ratio: 10

- Traditional Rental Income: $3,177

- Traditional Cap Rate: 6.1%

Pasadena, CA

- Median Property Price: $1,513,909

- Price per Square Foot: $645

- Price-to-Rent Ratio: 8

- Traditional Rental Income: $14,978

- Traditional Cap Rate: 5.1%

Hemet, CA

- Median Property Price: $410,314

- Price per Square Foot: $197

- Price-to-Rent Ratio: 13

- Traditional Rental Income: $2,582

- Traditional Cap Rate: 4.5%

How to Find Small Multifamily Properties for Sale

The next step of how to buy small multifamily properties for sale is learning how to find them. It’s best to use online real estate investment tools for your property search. Where can you find such investment tools? Right here, with Mashvisor! Mashvisor’s real estate investment software helps you find the most profitable properties by compiling data from multifamily comps and calculating returns for investment properties for sale. Let’s take a closer look at how Mashvisor will help you find multifamily properties in 3 steps.

-

Set the Multifamily Property Search Filter

When using Mashvisor’s property search tool, the first thing you need to do is enter the market you wish to invest in. Then, you will be presented with a map of the city’s neighborhoods along with all of the investment properties for sale. To narrow down the selection to small multifamily homes for sale, use Mashvisor’s multifamily property search filter. This will ensure that you only see the following types of small multifamily rentals on the map:

- Duplex for sale

- Triplex for sale

- Fourplex for sale

In addition, Mashvisor’s property search tool includes other important filters. These filters will help focus your search on the exact small multifamily properties you are looking for:

- Year built

- Number of bedrooms and bathrooms

- Square footage

- Traditional and Airbnb rental income

- Property status (for sale, pending, sold, foreclosure)

Related: How the Property Filters at Mashvisor Make Your Property Search Easier

Before you begin picking specific multifamily properties for sale, you must complete another step.

-

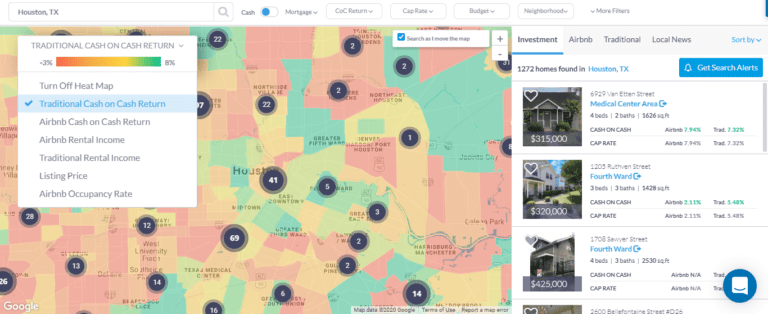

Conduct a Neighborhood Analysis

Next, you must conduct a neighborhood analysis. To perform this analysis, turn to Mashvisor’s heatmap. Mashvisor’s real estate heatmap will match you with the best area to invest in based on real estate data and analytics. This tool highlights which neighborhoods are the best for multifamily properties based on a few different filters:

- Listing price

- Airbnb cash on cash return

- Traditional cash on cash return

- Airbnb rental income

- Traditional rental income

- Airbnb occupancy rate

Mashvisor’s heatmap analysis tool guarantees that you won’t be scouring through hundreds of listings in dozens of different neighborhoods. Instead, with a few filters, you will find the best multifamily market in a matter of minutes.

Related: This Heatmap Will Show You Where to Invest in Real Estate

-

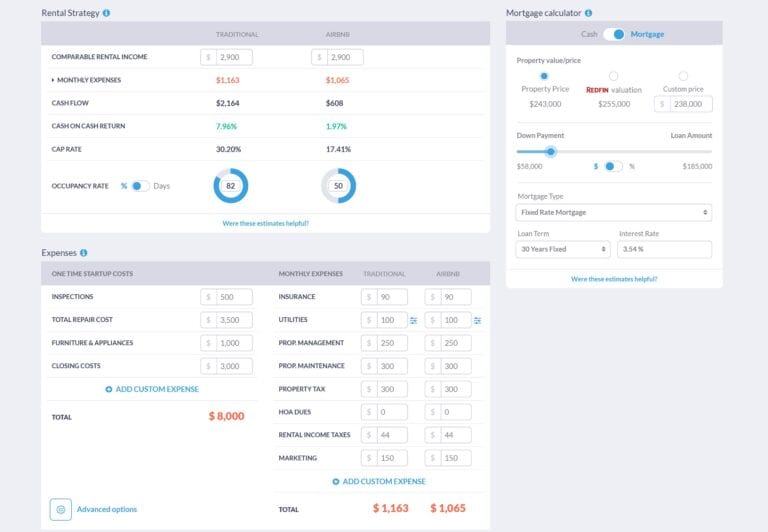

Analyze Small Multifamily Properties for Sale

Finally, after settling for an investment location, you can start narrowing down properties to purchase. Picking a property to buy, however, can be difficult. You may be faced with just two properties for sale or a dozen. So, what’s the solution? In order to differentiate between various listings, you need to perform a multifamily real estate investment analysis. Once again, Mashvisor is here to help with that. Mashvisor’s multifamily investment calculator, also known as the multifamily deal analyzer, is all you need for this analysis. Mashvisor’s calculator will perform a quick and accurate analysis of all small multifamily properties in any area. The analysis provides many pieces of information, such as:

- Property type

- Days on market

- Year built

- Number of bedrooms and bathrooms

- Presence of heating and cooling systems

- Tax history

- Airbnb rental income

- Traditional rental income

- Monthly rental property expense estimates

- Airbnb and traditional cash flow

- Mortgage calculator

- Airbnb and traditional cash on cash return

- Airbnb and traditional cap rate

- Optimal rental strategy comparison (Airbnb or traditional)

- Airbnb occupancy rate

- Investment payback balance

- Real estate comps

How to Buy Multifamily Property with No Money

So, you now know where and how to find small multifamily properties for sale. But what if your financials do not meet the requirements for standard small multifamily loans? Luckily, you can still buy small multifamily properties. The catch, however, is that it must be done through an FHA loan.

An FHA, or Federal Housing Administration, loan allows those with little investment money to become small multifamily owners. It does so by reducing the usual requirements of conventional mortgages. For starters, FHA loans have a 580 credit score requirement, which is considerably lower than the conventional 620 to 660 score requirement. Secondly, you can qualify for low down payments with FHA loans. If your credit score is below 580, for instance, you will qualify for a 10% down payment instead of the typical 20% to 25%. A credit score of more than 580, however, grants a 3.5% down payment.

FHA loans, however, come with a caveat. A property purchased through the loan must be used as a primary residence for one year after purchase. If you plan on buying small multifamily properties, you can commit to house hacking to make this work. In other words, you can reside in one unit and rent out the rest. By house hacking small multifamily properties, you will be essentially living for free and earning cash flow through rental units!

Related: The Ultimate Guide to House Hacking

To start searching for the best small multifamily cash flow properties, CLICK HERE to start your FREE trial with Mashvisor!