What are the pros and cons of buying tax delinquent properties? Read all you need to know about such properties and finding them in your area.

The housing market offers investors a variety of strategies and investment approaches. In fact, making money in real estate can be achieved through a wide range of creative methods. Some of these methods can be highly profitable, and many of them are relatively untapped.

Table of Contents

A prime example of such effective strategies is investing in tax delinquent properties. It might seem counter-intuitive, but purchasing tax delinquent homes can yield a very high return on investment if you implement this real estate investment strategy correctly.

This article will give you a detailed overview of tax delinquent property and show you how to find the best real estate investment opportunities near you.

Related: Finding Investment Properties Without the MLS

What Are Tax Delinquent Properties?

As the name suggests, tax delinquent properties refer to homes for which property taxes have not been paid. As a result, the county where the income property is located places a tax lien on it.

Owners of properties are expected to pay their property taxes promptly. If an owner fails to make payments on time, the unpaid amount will be considered overdue and incur a 10% penalty charge as well as a one-time administrative charge in the event of the second payment.

Opting for these off-market properties offers savvy investors the chance to find real estate deals that are difficult to get through more traditional routes, such as the MLS or REO. However, let’s first focus on what tax lien is and some pros and cons of putting efforts into tax yield investments.

How to Find Tax Delinquent Properties in Your Area in 6 Simple Steps

Finding tax delinquent property for sale is not as straightforward as searching for regular income properties. However, the process is not that complicated either. In fact, you will be able to find tax delinquent homes for sale in a matter of days once you grasp each step of this investment property search process. Here is how you can purchase tax delinquent homes in your area.

1. Determine if the Area Is Profitable for Investing

The very first thing you need to do is to determine if your location of choice is fit for real estate investing. While there may be plenty of investment opportunities in many locations, not all of them will fit your needs as an investor. You need to be wiser in picking a town or city to invest in.

In choosing the right investment location, you need to be on the lookout for the following, especially if you plan to start a rental property business:

- Median property price

- Monthly rental income

- Cash on cash return

- Cap rate

- Occupancy rate

- Short term rental rules and regulations

- Economy, tourism, and future developments

- Educational institutions

- Crime and safety

Analyzing Investment Properties With Mashvisor’s Market Finder

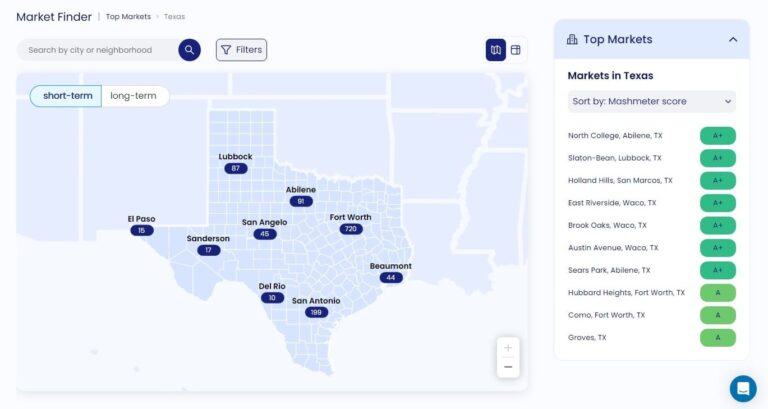

One of the easiest ways to spot a profitable investment market is by using Mashvisor’s Market Finder. Mashvisor is an online real estate platform specially-designed to help real estate investors and professionals find the best deals on any market. Its Market Finder tool allows investors like you to quickly pinpoint real estate markets that will give you a good return on your investment.

Mashvisor’s Market Finder gives you a bird’s eye view of different markets near your location of choice. It saves you lots of time and resources during the research process.

Searching for properties in any real estate market—even tax-delinquent properties—is made easier with Mashvisor’s Market Finder tool.

2. Check Out Your Local Tax Delinquent Property List

The first step of the process is getting access to the tax delinquent property list in your county. These lists are compiled in every jurisdiction across the US housing market and are a matter of public record.

However, access to these lists differs widely from one area to the other. For example, certain counties provide easy and convenient access through websites, whereas others prefer to maintain these lists as physical archives.

If your area falls in the second category, it is highly advisable to hire a list provider to do the necessary digging for you. The service they provide is relatively affordable, and more importantly, it will save you the hassle of manually sifting through public records for a parcel number.

Related: How to Find Out Who Owns a House in 6 Steps

3. Try County Auctions

For nonpayment of property taxes, a municipality may foreclose on a property. Consequently, the property is sold at auction. Here, you may be able to purchase the foreclosed property if you pay those taxes back.

If the tax deficit is not excessive, you will likely compete with nearby real estate investors in a bidding war. As long as the final price is within your price range, you can still make a profit.

The highest bidder must finalize the transaction immediately. In addition to the participation fee, you must also have the remaining balance available.

Before the auction, you should thoroughly investigate the property for any additional liens. You cannot afford unexpected expenses such as a mortgage or a workman’s claim. It is vital to examine the property’s condition. Determine whether your county permits prospective buyers to inspect the property prior to the auction.

Moreover, if you have local property inspectors or a contractor for restorations and remodeling in your network, be sure to bring them with you when inspecting the property.

4. Sort Out Property Owner Information

Once you get access to the tax delinquent properties for sale list, you will have all the information pertaining to property ownership. It includes the names of owners as well as the property address. That said, you still need to make sure that the listed address matches the owner’s mailing address. To get this information, you should check the tax record trail.

Another way to get ownership information on tax delinquent properties is to use Mashboard.

How Does Mashvisor’s Mashboard Work?

Mashboard is fundamentally an online marketplace and property/lead management center. The distinctive feature of the Mashboard property management application is its integration of the three parties required for any real estate transaction: agents, buyers, and sellers.

This highly advanced tool allows real estate investors to identify property owners in any area, providing them with everything from valid emails and phone numbers to mailing addresses. Additionally, the tool’s dashboard enables direct contact with owners.

Buyers will primarily use Mashboard to discover off-market properties and for-sale-by-owner houses. It also lets them access information about the homes and their proprietors.

On the other hand, sellers will likely use the tool as a marketplace to promote their properties and easily find prospective purchasers.

And when it comes to agents, it will assist them in locating and qualifying business prospects swiftly and effortlessly.

5. Mail Property Owners

Direct mailing is the most effective way to contact delinquent property owners. Keep in mind that these owners are on the verge of losing their homes, so your letter should be short and straight to the point. You should make your intentions clear in the first line.

In fact, the letter should not include anything other than your purchase offer and contact info. To achieve a higher response rate, make sure that the phrasing conveys a sense of urgency. Owners are more likely to take action if they receive a letter with an urgent tone.

6. Assess the Owner’s Level of Motivation

Receiving a response does not necessarily mean the owner is interested in a delinquent tax sale. In some cases, owners might still be exploring other options and are simply curious about your offer.

To gauge their level of interest, inquire about the property’s value and then ask them about their desired sale price. If the asking price is substantially lower than the estimated value of the home, then it means the owner is highly motivated to offload the property as quickly as possible.

The Best Practices That Will Help You Ensure a Smooth Real Estate Deal

Just like with anything in real estate investing, closing a tax delinquent sale is predicated on implementing a good strategy and sticking to tried and proven methods. Here are some best practices that should make the process of finding tax delinquent properties much more efficient:

- If you are still waiting for a response, follow up on your initial letter by sending a more detailed postcard.

- If the initial mail blast yields a low response rate, stay consistent and commit to doing multiple mailing campaigns.

- Hire a professional to appraise the home before finalizing your offer.

Since you do not own the property, you are not responsible for its maintenance or tenant relations. On the opposite side, you risk not repaying the debt. You must consider the possibility that the proprietor will declare bankruptcy. When a property owner declares bankruptcy, the IRS and other creditors with claims on the property may become involved.

Your tax lien would then be declared useless, as any additional creditors would be repaid prior to you.

Therefore, you must consult with a real estate lawyer and learn as much as you can about local regulations. When it comes to tax lien certificates and the actions you need to take from the moment you buy the debt, each state has its own set of requirements.

Related: When and Why Do You Need a Home Appraisal?

Conclusion

Finding and analyzing real estate deals can seem overwhelming for a beginner. This is especially true when dealing with unconventional real estate investments such as tax delinquent properties. But once you understand all the moving parts of this strategy and apply the guidelines outlined here, you should be able to find and close a deal with relative ease.

You also don’t need a lot of money to get started with tax lien investment. Many REITs would cost thousands of dollars, and getting a house mortgage requires a hefty down payment. That might tie up years of savings. Tax lien certificates are inexpensive, costing only a few hundred dollars.

Get access to Mashvisor’s database and other tools to get you on your way to a thriving real estate investing career. Sign up for a 7-day free trial today, followed by 15% off for life.