There’s no doubt that investing in multifamily properties continues to be one of the best ways to make money in real estate. There are a number of reasons why you might want to buy multifamily properties in 2020, be it a duplex, triplex, or fourplex. Easy financing, forced appreciation, multiple rental income streams, and higher occupancy rate are just a few reasons that attract investors to multifamily homes. Still, there are many factors that determine how profitable your multifamily real estate investment is. The following tools provided by Mashvisor, however, will help you in every step of the property search process and assure making smart investment decisions.

#1 The Real Estate Heatmap

The first factor that affects the profitability of small multifamily properties is the market in which they’re located. A real estate investor must find the best multifamily markets first and foremost. If you’ve found these markets, then finding profitable multifamily real estate for sale won’t be an issue. This requires you to run a housing market analysis to find a city with good investment potential, and then a neighborhood analysis to find the top-performing neighborhoods within that city. Usually, it’ll take you a few weeks to run these analyses as you need to collect the needed data and then carry out the necessary calculations using spreadsheets. Fortunately, this isn’t the case anymore.

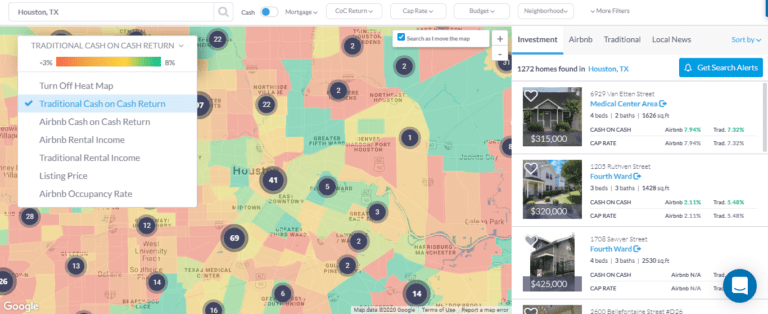

Mashvisor’s Real Estate Heatmap makes it so much easier to find the best markets for investing in multifamily properties. This tool gives you a visual analysis of how different neighborhoods in a city are performing according to certain metrics. You can adjust the results of the Heatmap tool based on listing price, cash on cash return, rental income, and occupancy rate. The top-perfuming areas are highlighted in green while the not-so-good areas in red. As a result, this helps investors run multifamily market research and find out the best neighborhoods in any US housing market quickly and efficiently.

Related: Real Estate Heat Map: A Revolutionary Tool for Neighborhood Analysis.

#2 The Rental Property Finder

After finding the best market, the next step is to find multifamily homes for sale. However, you’re not looking for just any property – you want one that is profitable to start investing in multifamily properties. You can, of course, do your property search using traditional methods, but those are not really efficient these days. Instead, if you want to be the one who finds these real estate deals before other investors, you need to use advanced investment property search tools. There are a number of real estate websites that provide search tools, and Mashvisor’s Property Finder is one of the best out there in 2020.

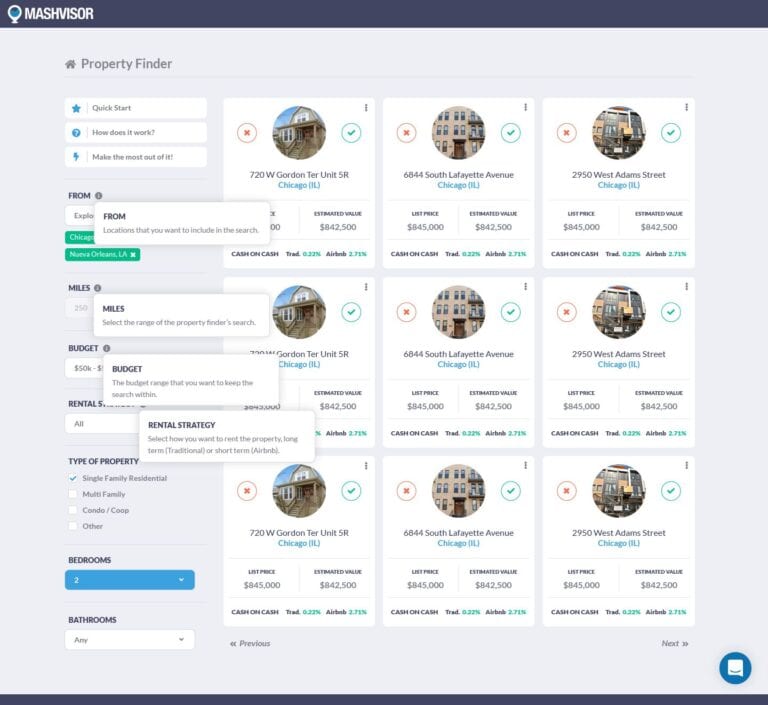

The Property Finder (also known as the Real Estate Deal Finder) is a tool that helps investors find investment properties for sale based on their preferences and search criteria. However, this tool provides more than just property listings. It uses machine-learning algorithms and real estate predictive analytics to find properties with the highest potential for profits. By setting the “multifamily property” filter, you can customize the tool to focus on finding just these properties. In addition, you can narrow down the search results as much as possible using filters like the location, budget, and desired number of bedrooms and bathrooms. The Property Finder will display all listings that match your criteria based on their performance so that the most profitable multifamily homes for sale are listed on top.

Sign up for a free Mashvisor account to start using the Rental Property Finder to find the most lucrative small multifamily properties in your market of choice.

#3 The Property Marketplace

Investors can’t ignore the fact that many of the best real estate deals take place off the market. Many investment properties are sold and bought without ever being listed on the MLS. Those who plan to start investing in multifamily properties should also consider looking for these off market deals. The only problem is, it’s not always easy to find off market multifamily for sale online. Luckily, Mashvisor’s Property Marketplace solves this problem to optimize the property search process even more. As the name suggests, this is a one-stop-shop for all real estate investors’ needs when it comes to buying off market properties.

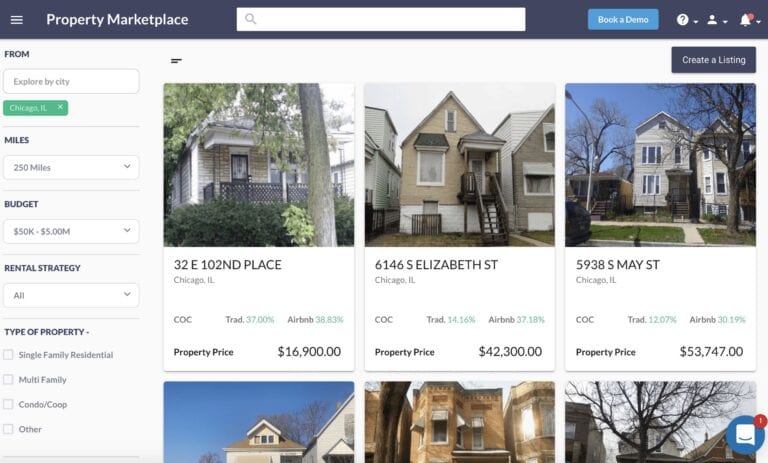

This tool provides a massive supply of off market listings in the US housing market including foreclosures, bank owned homes, short sales, and auctioned homes for sale. Just like the Property Finder, you can narrow down your search to match your criteria using filters such as location, type of property, and your budget. The Property Marketplace is one of the best investment property search tools to find multifamily real estate for sale below market value, analyze off market deals, and connect with property owners. In addition, if you’re thinking of selling you multifamily property, you can also list it on Mashvisor for free using this tool.

#4 The Multifamily Investment Calculator

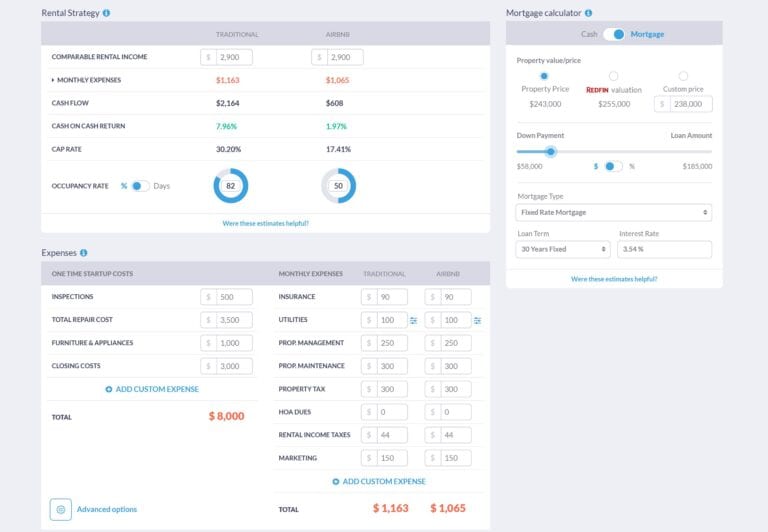

After finding a multifamily property for sale, investors should run all the numbers behind the deal to see what kind of ROI they can expect. Analyzing any rental investment requires calculating data like the listing price, potential monthly rent, rental expenses, cash flow, cap rate, and cash on cash return. This is a lot of property data so you can expect your rental property analysis to take time. But what if we told you there’s a tool that collects the data and runs the numbers for you? You’d definitely want to get your hand on this tool – and you can find it here on Mashvisor. Of course, we’re talking about the Multifamily Investment Calculator.

Another name for this tool is the Investment Property Calculator because it can analyze any type of property, not just multifamily homes. After finding multifamily properties like fourplex, triplex, or duplexes for sale, simply click on the listing to get access to this tool. There, you’ll find a readily available analysis which will help you evaluate a multifamily property and its profitability in no time. This analysis is based on rental comps data from the local real estate market. The Multifamily Deal Analyzer is also very interactive. Meaning, you can add and adjust numbers as you see fits and it’ll re-calculate the ROI metrics.

Related: Learn How to Evaluate Multi Family Investment Properties

This allows you to make quick comparisons between different properties based on these metrics and choose the one that has the best ROI potential. If you’re looking for a high cap rate multifamily real estate investment, for example, this tool will assure you’ve landed on the right property. Furthermore, it also provides other important property data that you’ll need when investing in multifamily properties. This includes tax history, the number of units in the property, number of parking spots, and the contact information of the listing agent. To start looking for and analyzing the best multifamily properties in your city and neighborhood of choice, click here.

#5 The Mashboard

Say that you’ve found a good off market multifamily real estate deal and want to get in touch with the owner to give them an offer. How can you find out who owns the property or find their contact information? The final tool that you need before you start investing in multifamily properties and which will help you in this step is the Mashboard. Mashvisor designed this tool for agents to help them find leads, but real estate investors will also find it useful. You can only get access to this investment tool, however, if you sign up with the Professional and Expert plan subscriptions.

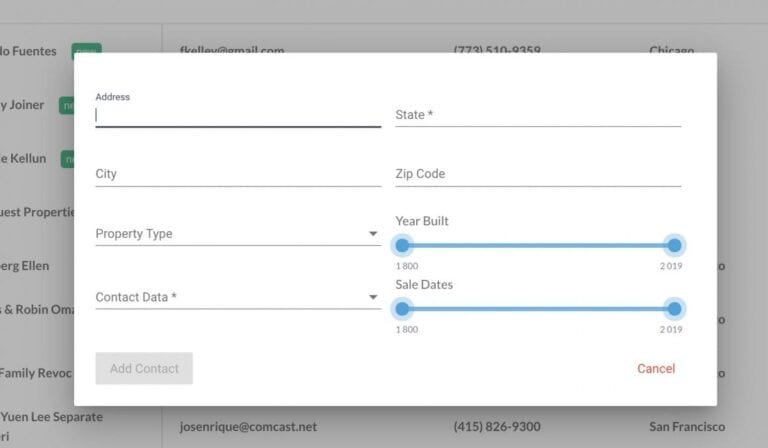

As mentioned, the Mashboard will give you access to homeowner data of any property you find on the platform as well as any off market property which you’ve manually entered. There are two ways to get your hand on homeowner data from this tool. First, you can look up the owner of a specific property by entering the exact street address. Second, you can look up property owners in a specific area by selecting the state, city, zip code, and other criteria. For both ways, you can select the type of contact data you want (address, phone number, email address, or all of them). Make sure to also use the property type filter and select multifamily property.

Related: How to Find Multi Family Property Owners

Investing in Multifamily Properties Made Easy

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.