Understanding what is a good cap rate and how to find properties with above-average ROI is key to making profitable real estate investments.

Investors can evaluate the profitability of rental properties through return on investment (ROI). ROI measures the income generated by investment properties compared to their price and operating expenses. The two main metrics of profitability in real estate are cash on cash return and cap rate. Here, we’ll tackle what constitutes a good cap rate for income properties in 2023.

Table of Contents

- What Is Cap Rate?

- How to Calculate Cap Rate

- What Is a Good Cap Rate?

- What Factors Impact the Range of Good Cap Rate

- Why Is Cap Rate Important?

- Where Can You Calculate Cap Rate?

- Finding Rental Properties With Good Cap Rate

Cap rate is one of the most important ROI measures in real estate investing. Previously, we discussed what cap rate is and how to calculate cap rate. So, now it’s time to look at what is a good cap rate for residential rental properties.

To give you enough background information, we’ll also go briefly over the cap rate formula and what factors affect the metric and its value. In addition, we’ll discuss why the cap rate is such a key measure in both single family and multifamily rental property investing.

Importantly, we’ll show you how Mashvisor can help you calculate the ROI on Airbnb and long term rental properties faster and more accurately than ever before. Moreover, we’ll touch on how to use our platform to search for investment properties for sale with readily available analysis, including cap rate calculations.

Without further ado, let’s dive right in!

What Is Cap Rate?

Before we answer “What is a good cap rate for rental property in 2022 and 2023?”, we need to cover the basics: “What is cap rate?”. Cap rate, short for capitalization rate, is a return on investment measurement for rental properties regardless of how they are financed. The last part is very important.

Because the cap rate does not consider the down payment and the monthly mortgage payments, it’s easier to calculate than other metrics like cash on cash return. However, it is the cap rate’s major limitation that should be taken into account by real estate investors. After all, how you pay for your single family or multifamily property is a major part of what ROI you get.

The capitalization rate calculation is based on the rental income, rental expenses, and market value of a residential (or commercial) rental property. (You can check out the exact formula below). In other words, the cap rate tells rental property investors how much of the property’s value they are receiving in profit after accounting for operating costs.

Like other measures of return on investment of rental properties, cap rate is expressed as a percentage. Understanding the cap rate of investment properties is vital to ensure making money in real estate, regardless of the rental strategy (long term or short term).

Therefore, real estate investors need to know how to calculate it with the cap rate formula, which is what we will cover next.

How to Calculate Cap Rate

To be able to understand if a property can generate what is considered a good cap rate, you first need to know how to calculate the said return on investment metric. Actually, the cap rate calculation is much simpler than other ROI calculations in real estate investing, like cash on cash return or internal rate of return.

So, let’s take a look at the cap rate formula and an example of how to use it in your rental property investment decisions:

Cap Rate Formula

Based on the definition, here is the cap rate formula:

Cap Rate = Net Operating Income/Current Market Value x 100%

The cap rate formula consists of two main factors: the net operating income (NOI) and the current or fair market value (FMV) of the rental property. What do the factors mean?

NOI is the difference between the annual rental income and the annual rental expenses of a rental property.

NOI = Annual Rental Income – Annual Rental Expenses

To calculate the rental income, all you need to do is to multiply the monthly rental rate by 12 for long term rental properties. For short term rental properties, you need to multiply the average daily rate by the number of days for which you are able to rent out your property.

Meanwhile, the rental, or operating, expenses are the costs associated with owning and renting out investment properties. They include property tax, income tax, home insurance, maintenance, repairs, property management, and much more. If you invest in vacation rentals for sale, you must also factor in things like cleaning, restocking, linen laundry, and utilities.

Financing costs, like mortgage payments, do not classify as operating expenses.

The second factor, FMV, or fair market value, simply refers to the value of the investment property at a certain time. Essentially, the FMV is the price that you pay for your rental property.

Cap Rate Calculation Example

Let’s test what we’ve learned with a quick example:

A real estate investor is wondering whether she should buy a property that is listed for $500,000 to rent out on a long term basis. After doing some investment property analysis, she predicted that the rental could generate $40,000 in annual rent and would cost $10,000 to run during that time. What is the expected cap rate of the property?

Cap Rate = (40,000 – $10,000)/$500,000 x 100% = 6%

If the real estate investor purchases this income property, she will have a cap rate of 6%. The main question remains: “Is 6% a good cap rate?”

What Is a Good Cap Rate?

Now, we can finally answer the focus question of this article: “What’s a good cap rate for rental property?”

Generally speaking, a good cap rate in residential real estate investing is anything from 8% to 12%.

Wondering why?

It is because the 8%-12% range is able to provide enough ROI for profitable rental property investments without adding too much risk. You should know that the cap rate measures not only the return on investment but also the risk associated with a particular asset investment in real estate.

The said correlation between ROI and risk makes perfect sense: The more risk you take on, the higher the potential reward in case things work out. Meanwhile, in case you don’t want to risk too much, you can’t expect to make a fortune. After all, there is no free lunch in the investing world.

Through experience, real estate investors have figured out that a cap rate between 8% and 12% brings a good balance between risk and reward. Of course, if, as a beginner real estate investor, you don’t want to raise the stakes too high, you can go for a rental property with a slightly lower cap rate. Just make sure that you still generate positive cash flow.

Otherwise, you’ll be losing money instead of making money from your income property. And it makes no sense.

Also, if you’re an experienced investor with a significant portfolio that you can fall back on if needed, you can aim for a property with a cap rate above the conventional good level of 12%.

In other words, when you buy an investment property, you should always consider your personal situation, as well as individual preferences, to decide if the cap rate is good.

What Factors Impact the Range of Good Cap Rate?

The cap rate is not a simple metric of return in real estate in the sense that it can get affected by many different factors. The following are the most important criteria that determine what is a good cap rate in any particular situation:

Location

As you probably already know, location impacts just about everything in real estate. It includes property prices, rental supply and demand, rental rate, occupancy and vacancy, operating expenses, and financing options.

As we’ve seen in the cap rate formula, most of the above variables are present in the calculation of this ROI measure in one way or another. So, they all affect the capitalization rate.

Thus, it should come as no surprise that location affects the answer to “What is a good cap rate?” For example, what may be considered a good cap rate in a metro area is usually very little in a suburban area. We can explain this through the risk factor.

When you buy long term or short term rentals for sale in a busy city like San Francisco or New York, you can expect a vacancy rate close to zero. It means very low risk, so the expected cap rate is also low.

At the same time, if you purchase an investment property in a small market, you might face prolonged vacancy periods, and the relatively higher cap rate will compensate you for it. It is because once tenants come, you can charge them a higher rental rate as one of the few rental options.

Rental Strategy

The rental strategy also changes the range of what is a good cap rate, even within the same market.

Airbnb rentals, for example, tend to generate higher rent compared to long term rentals since they are rented out on a daily basis. However, they also cost more in ongoing rental expenses as hosts need to cover cleaning, restocking, laundry, and professional property management.

The level of risk between the two rental strategies is very different, too. With short term rentals, you might face a low Airbnb occupancy rate during the off-season. At the same time, your long term rental might retain the same tenants for years as long as you’re a good landlord.

Because of the said differences, the range of a good cap rate will differ depending on the rental strategy. In general, the good cap rate for vacation rentals is higher than the good cap rate for their more traditional counterparts.

Property Type

The property type also impacts what is a good cap rate in rental property investing. For instance, multifamily rentals generally come with lower cap rates than single family homes. It is explained through the risk of vacancy.

When you invest in a multifamily property, you own a few rental units, and the chances of all of them ending up vacant over the same time is minimal. So, you are expected to generate some sort of rental income at all times.

Meanwhile, when you own a single family home, if you don’t manage to get a tenant or a guest, your revenue is zero, but you still need to cover the mortgage and the expenses. It is a major risk that must be compensated by a substantial cap rate in case things don’t work out.

It’s clear that narrowing down what is a good cap rate in every particular situation is difficult due to the many factors to consider. Do you rent out a multifamily property in an urban area on a long term basis or a single family home in a suburban market on a short term basis? Therefore, the generally accepted range of 8% to 12% is applicable in most situations.

Why Is Cap Rate Important?

Why even bother finding out what is a good cap rate? There are four main reasons why it’s important to consider the said return on investment metric when buying a long term or short term rental property.

1. Calculate Return on Investment

As previously mentioned, the cap rate is one of the two main forms of ROI in real estate investments. Without the cap rate, a real estate investor cannot determine whether a property they are considering buying offers a good investment opportunity. Alternatively, once they own a property, the cap rate helps evaluate how profitable an income property is.

So, the first reason that makes cap rate so important is that it helps ensure that the money you put into investment properties brings you sufficient profit.

2. Compare Real Estate Markets and Investment Properties

Since it’s a form of ROI, cap rate can be used to distinguish between different markets and different investment properties for sale based on expected profitability. Real estate markets with higher average cap rates for rental properties are ideal for the respective strategy. The same holds true for both cities and neighborhoods.

Meanwhile, income properties with higher cap rates will be more profitable than those with lower cap rates. The best real estate investments always achieve high ROI levels. So, when buying a property, it’s crucial to conduct rental property analysis to choose the best opportunity in the local market.

3. Estimate Payback Period

The cap rate can also estimate how long it will take to cover the property payment fully. This is known as the payback period in real estate investments. After that, you will actually start making money from your investment property. To get the figure, you need to divide 100 by the cap rate of the property. The answer you obtain will be the payback period in years.

In the previous example, the payback period of the property is 17 years (100 divided by 6).

4. Evaluate Risk

Lastly, the capitalization rate helps you evaluate and quantify the risk associated with buying a certain real estate investment property. While every investment comes with its own risk, it’s crucial to keep the risk to a minimum.

So, especially as a beginner, don’t be tempted to buy properties with a cap rate above 12%.

Where Can You Calculate Cap Rate?

Now that you know the answers to what is a good cap rate, how to calculate it, and why it is important, you might be left with one question: “Is there an easy way to calculate cap rate?” While calculating the capitalization rate is much easier than calculating the cash on cash return, it still requires access to high-quality data and a lot of time.

The process can get particularly complicated and lengthy if you’re considering multiple potential real estate markets and properties. Furthermore, beginner investors usually lack the required resources to obtain up-to-date, reliable, comprehensive long term and short term rental data.

Luckily, the Mashvisor real estate investing app can calculate the cap rate of rental properties more accurately and efficiently. Indeed, there are two things that Mashvisor can do for investment property buyers in this regard:

1. Calculate Cap Rate Easily

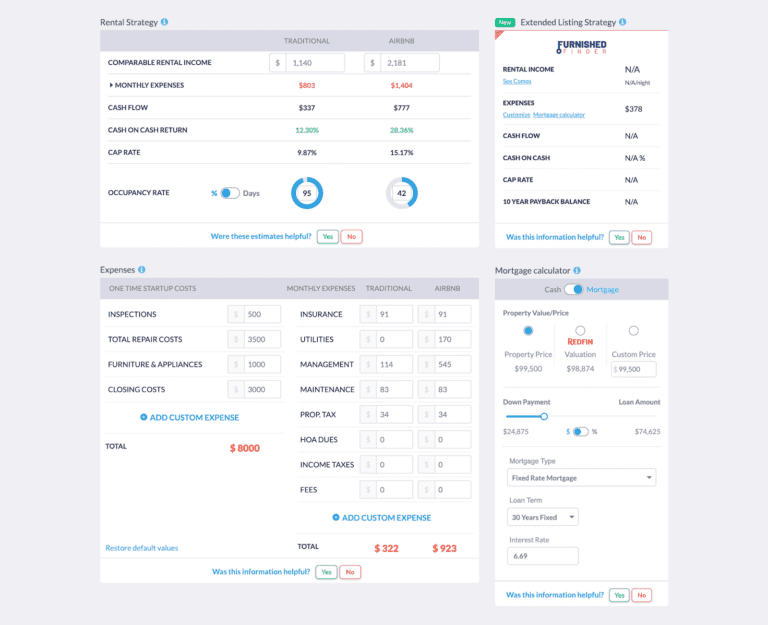

First of all, the Mashvisor rental analysis calculator conducts AI technology-driven investment property analysis on MLS listings and off market properties nationwide.

When looking up a property on the platform, you’ll find all of the important metrics, including the cap rate. Importantly, the analysis is conducted for both possible rental strategies—short term or long term. This way, you can compare both strategies and choose the best one for a particular property.

Note that the analysis is based on the performance of similar active rental properties in the area. These are known as rental comps in the real estate investment business. The data used by Mashvisor comes from reliable public sources like the MLS, Airbnb, RentJungle, Redfin, and public records.

2. Find Rental Properties With Good Cap Rate

Second, Mashvisor helps investors conduct rental property search focused on properties with a good cap rate. On the investment property search engine, you can enter your criteria, including the range of cap rates. Within seconds, you’ll get a list of available properties for sale that offer a cap rate within your expected range.

This way, you save an average of three months of real estate research and analysis.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Finding Rental Properties With Good Cap Rate

Experts’ US housing market predictions point out that 2023 will be a great year for real estate investments. However, not every property you buy is guaranteed to turn into a profitable opportunity. You must analyze the potential of multiple properties before choosing the best one. And one of the main factors to consider is the cap rate.

A good cap rate may vary depending on the market and property type. But remember that 8%-12% is the best range overall. The said range is enough to guarantee positive cash flow and above-average ROI without adding too much risk.

And if you need to find rental properties with a good cap rate, make sure to check out Mashvisor. We can help you both search for profitable listings and conduct detailed rental property analysis. These features ensure that your income property will help you make money with real estate.

To discover the full potential of Mashvisor in helping you find and analyze rental properties with a good cap rate, schedule a free demo with our team.