While you’d rarely hear anyone talk about cash on cash return outside the world of real estate investing, it’s a common metric in the industry. Stocks and most other investments are often evaluated by the return on investment (ROI), not the cash on cash return. In order to calculate the ROI, you need to know all the money that you made from an investment in addition to the cash that you invested. However, you cannot possibly know how much a rental property will bring you in total before you sell it.

Table of Contents

- What Is Cash on Cash Return?

- Understanding Cash on Cash Return

- How to Calculate Cash on Cash Return in Real Estate

- What Is a Good Cash on Cash Return?

- Cash on Cash Return vs Other Real Estate Investment Metrics

- The Best Cash on Cash Return Calculator for Rental Properties

- 20 Best Markets for Cash on Cash Return Investments in 2023

Thus, it does not make much sense to talk about ROI when deciding whether to purchase a certain investment property or not. Instead, the most popular and relatively easy metric to use in real estate investing is the cash on cash return. But what does cash and cash return mean? And what is a good CoC return? In this article, we’ll cover everything you need to know, including its definition, pros and cons, and formula. We’ll take a look at how to calculate CoC ROI manually, as well as using the top real estate investment analysis tools. We’ll also discuss what a good CoC value is. Last but not least, we’ll rank the best US cities for long term and short term rentals with good cash on cash return. Let’s dive right in!

What Is Cash on Cash Return?

Also called the equity dividend rate or the cash yield, cash on cash (CoC) return is a metric used for income-generating real estate assets. It is calculated by dividing the annual cash flow before tax generated by an investment property by the entire amount of cash invested. Then, the result is multiplied by 100 so that the return is expressed as a percentage. Real estate investors use cash on cash return to measure the net cash flow produced by a property as a proportion of the total amount invested. The CoC return indicates the potential return from a property in a simple form. In principle, the higher the CoC return figure, the healthier the property investment. For the uninitiated, cash on cash return is different from return on investment (ROI). ROI takes into consideration the entire investment amount, including debt, but we’ll talk more about it later on.

The cash on cash calculation is used equally widely in residential and commercial real estate investing. It is the measure of choice for investors who borrow money in order to purchase a real estate asset, as other return metrics do not usually take the method of financing into consideration. This is what makes cash on cash return a superior metric but also one that is slightly harder to calculate than cap rate, let’s say. In terms of usage, the CoC formula can be applied at both the property and the market (city or neighborhood) level. It means that investors can use it to choose the top locations for buying a rental property in addition to the most profitable listings for sale. Just like any other real estate metric, it comes with advantages and disadvantages. So, let’s take a look at them:

Benefits of Cash on Cash Return

The main advantages of the cash on cash return include the following:

- It allows investors to find the best short term and long term rental markets, including both cities and neighborhoods.

- It supports investors in their selection of the top-performing rental properties for sale in any market by comparing different available opportunities.

- It helps investors understand how the amount of cash invested affects the profitability of their property. Generally speaking, the more equity an investor has, the lower the return on investment will be.

- Investors can use it to choose the best loans for investment property, meaning the financing options that will yield the highest return possible.

- Landlords and Airbnb hosts can make use of it even after purchasing an income property to ensure that their investment continues to perform well and outperform the market average.

- It is not as hard to calculate as its alternatives, such as the internal rate of return (IRR).

Downsides of Cash on Cash Return

Meanwhile, the most important disadvantages of the CoC return are:

- It is significantly more difficult to calculate than other return on investment metrics in real estate, like the cap rate.

- Because it factors in pre-tax cash flow, the cash on cash return does not take into consideration the impact of taxes on the profit derived from real estate deals. Meanwhile, taxes can have a significant effect, especially in markets with high income tax rates and property tax rates.

- Investors need access to a lot of long term and short term rental data in order to calculate the cash on cash return expected from one or more properties.

Related: How to Estimate Rental Income Using Mashvisor

How to Calculate Cash on Cash Return in Real Estate

The CoC return calculation considers the annual long term or Airbnb rental income before tax less the expenses that come with owning and managing a rental property. Let’s take a look at the mathematical formula for calculating the CoC return:

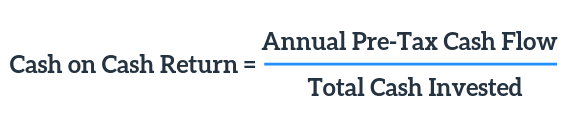

Cash on Cash Return Formula:

The formula for calculating cash on cash return is as follows:  Where:

Where:

- The Annual Pre-Tax Cash Flow is simply the annual rental income minus the operating expenses. The annual rental income is all the money you collect from renters over a year. The operating expenses include mortgage payments, insurance, property management, maintenance, repairs, utilities, travel costs, home office expenses, etc.

- The Total Cash Invested is all the cash that you must pay in order to make your rental property operational. It means the amount of money to pay to purchase it (down payment), closing costs, rehab costs, and loan fees (if you take a loan from the bank).

Let’s look at examples of the cash on cash return calculation in real estate that will hopefully make things clearer:

Calculating CoC Without a Loan:

To better illustrate the cash on cash return calculation, let’s consider the following investment scenario: You buy a rental property that costs $250,000, and you pay the full amount in cash (yes, you are one of those few lucky people with $250,000 available to invest in real estate). You need to pay another 5% in closing costs and rehab costs. Don’t forget to factor the rehab costs in. It doesn’t make sense to calculate the cash on cash return on your property if you ignore the rehab costs because you cannot rent it out if it’s not in good condition. So, they add up to $12,500 in additional costs. Thus:

Total Cash Investment = $250,000 + $12,500 = $262,500

You can charge $2,100 of rent per month for your rental property. So:

Annual Rental Income = 12 x $2,100 = $25,200

Estimating the operating expenses at a third of the rental income is fair, leaving you with the following:

Annual Pre-Tax Cash Flow = 2/3 x Annual Rental Income = 2/3 x $25,200 = $16,800

Cash on Cash (CoC) Return = Annual Pre-Tax Cash Flow/Total Cash Investment = $16,800/$262,500 = 6.40% So, the CoC return that you could generate from this rental property is 6.40% if you paid the entire amount in cash.

Calculating CoC With a Loan:

Let’s face it. How many of us can actually take $262,500 out of our pockets to pay for a rental property in cash? Not that many, right? That’s why we should also look at the more realistic scenario and see how the COC formula works there. This is where an investor needs to take a bank loan to finance the purchase of their property. To compare the two cash on cash returns (with and without a loan), we’ll consider the same property as above. So, we’re buying the $250,000 rental property and paying 25% in cash as a down payment:

Down Payment = 25% x $250,000 = $62,500

We include the same closing and rehab costs of 5% of the total value, adding up to $12,500. Now:

Total Cash Investment = $62,500 + $12,500 = $75,000

Don’t get confused now. When working out the cash on cash return calculation, we only consider the cash money that we pay right away, which means the down payment. You should not include the bank loan here. Now, we need to calculate the annual pre-tax cash flow. In addition to the rental income (with a plus) and the operating expenses (with a minus), we need to add the debt service to the equation (with a minus). Assuming an 8% interest loan yield:

Debt Service = 8% x $187,500 = $15,000

So:

Annual Pre-Tax Cash Flow = $16,800 – $15,000 = $1,800

New CoC Return

To get the new COC, simply calculate:

Cash on Cash Return = Annual Pre-Tax Cash Flow/Total Cash Investment = $1,800/$75,000 = 2.40%

Thus, the CoC return that you will generate from the rental property if you take out a bank loan for 75% of the price is 2.40%.

Manual Calculations

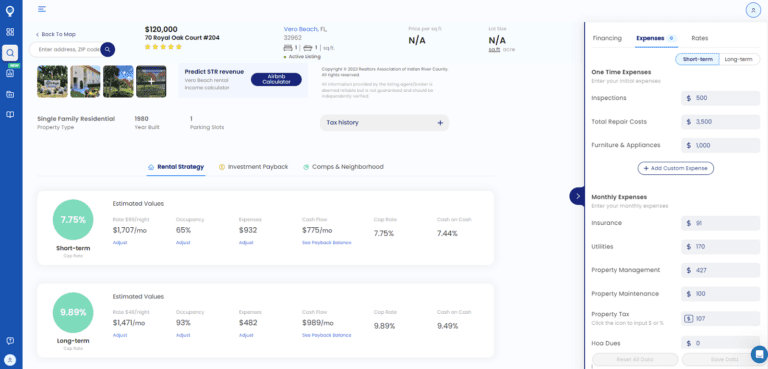

If math is not your forte, you might be starting to worry about how to calculate cash on return for a rental property or any property that interests you. There is no need for manual calculations with Mashvisor’s investment property calculator. The cash on cash return real estate calculator will provide you with readily available CoC return for properties of your choice based on your preferred rental strategy (long term or short term). We’ll talk more about all the functionalities of the Mashvisor tool in a bit.

Comparing CoC Return With and Without a Loan

Just because, in our example, the loan reduced the cash on cash return significantly, it doesn’t mean that it will always happen. Sometimes, taking a loan can actually increase the CoC return; it all depends on the price, the loan amount, the expected monthly rent, etc. It means that you need to make a cash on cash calculation for every particular property and every specific loan that you consider. It will allow you to choose the optimal combination of property and financing method for your situation. Related: How to Do Investment Property Analysis

You can use Mashvisor’s cash on cash return real estate calculator to determine the CoC return for your preferred properties based on your preferred rental strategy (long term or short term).

What Is a Good Cash on Cash Return for a Rental Property?

Before we can answer the question of what is a good CoC return, it’s important to consider a few different factors. For one, short term rentals and traditional rentals will vary – sometimes drastically – in terms of their cash on cash return even within the same market.

Another consideration to make is that the average city-level cash on cash return is not necessarily the same as the cash on cash return for an individual rental property. There are numerous factors that play into getting a good CoC return for a specific income property for sale. Some of these include the price of the property, the details of your financing, the marketing strategy you will apply for attracting renters, and the rent you will be able to charge.

In general, most experts agree that between 8-12% is a good cash on cash return. This, however, is calculated based on an individual property. City level averages might not show a cash on cash return in this range, so it’s important to do calculations for each specific income property that you consider buying.

Ultimately, both Airbnb and traditional rentals are showing a good return on investment this year. Mashvisor’s nationwide real estate data is showing a good cash on cash return for both sectors of the US rental market, though the traditional housing market has proven itself to be the strongest throughout the pandemic.

For traditional investment properties, real estate investors can expect a cash on cash return falling in the range of 1.59%-8.17% at the city level. A good return for traditional investments will look like anything above 3%. The range for Airbnb investment property cash on cash return is fairly vast as well, from 1.59% to 9.69% at the city level. A really good cash on cash return for Airbnbs will be anything 4-5% or higher. In the following section, we’ll take a look at what other measures you should consider in your analysis.

Cash on Cash Return vs. Other Real Estate Investment Metrics

CoC return is one of the many numbers used to evaluate the profitability of residential real estate investments. Other metrics that should be included in your decision are:

Cash on Cash Return vs. Cap Rate

Besides cash on cash return, there is another measure that real estate investors use to calculate the rate of return from their property investments. The other metric is called capitalization rate or cap rate, for short. In real estate investing, the cap rate is also used as a measure of the risk associated with a particular investment property. Cap rate refers to the ratio between the net operating income (NOI) of an income-producing real estate asset (such as a rental property) and its current market value (CMV) or sales price. As such, the cap rate works under the assumption that a property is purchased all in cash.

Cap Rate Formula

The mathematical formula for the cap rate is as follows:

Cap Rate = Net Operating Income (NOI)/Current Market Value (CMV) x 100%

or

Cap Rate = Net Operating Income (NOI)/Sales Price x 100%

It is important to note that cash on cash return and cap rate are not interchangeable. Calculating the CoC return involves two scenarios: purchasing an investment property 1) in cash and 2) with a mortgage loan. On the other hand, the cap rate calculation does not take into account the method of financing (cash vs mortgage). Thus, the latter is much easier to calculate. That’s why investors tend to use the cap rate as a preliminary metric to start sifting through multiple markets and properties for sale. Then, they introduce the cash on cash return when thinking about a smaller number of locations and listings. Because the cap rate measures both return and risk, a good value is considered between 8% and 12%. Related: Understanding NOI/Cap Rate & How to Calculate Them

Cash on Cash Return vs. Return on Investment (ROI)

Another widely used metric in real estate is the return on investment (ROI). It measures the overall return on the entire invested amount, both cash and debt. This makes it different from both the cap rate (which looks at the property price) and the CoC return (which looks at the cash investment). So, ROI considers yet another aspect of the profitability of a rental property and needs to be included in a comprehensive investment property analysis.

Cash on Cash Return vs. Internal Rate of Return (IRR)

The final metric that real estate investors like to look at before deciding in favor of or against a certain investment is the internal rate of return (IRR). The internal rate of return measures the total interest earned on the amount of invested money. The IRR calculation involves the total income earned from a property throughout its entire life, making it hard to calculate when first getting started. The IRR formula is much more complicated than the CoC return formula.

The Best Cash on Cash Return Calculator for Rental Properties

Given the complexity of calculating CoC real estate return on multiple markets and properties when buying an investment property, it’s important to find a good tool that can help with the process. Due to the availability of various investment property calculators on the internet, you should get access to the most reliable one that will help you make accurate and reliable calculations for your rental properties. Mashvisor provides a cash on cash return calculator to make the process easy and stress-free for all real estate investors out there. Mashvisor’s calculator shows the average long term and short term CoC return for rental properties in your preferred city or neighborhood. With the most comprehensive and updated data used in analyzing both rental strategies, property investors will be able to choose the optimal investment approach and make the most informed decision. Importantly, the rental property analysis conducted by the Mashvisor investment property calculator is not limited to the cash on cash return only but also includes:

- Property price

- Startup costs (broken down)

- Rental income

- Monthly recurring expenses (broken down)

- Cash flow

- Cap rate

- Occupancy rate

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

20 Cash on Cash Return by City: Best Investments in 2023

To give you a headstart in your real estate investment journey in 2023, we ranked the top US cities for buying rental properties this year. These are the markets that yield the highest cash on cash return by city at the moment. We used nationwide real estate market analysis conducted by Mashvisor to reflect the situation in July 2023. Our data comes from reliable sources like the MLS, Zillow, Redfin, Hotpads, Airbnb, and public records. In our ranking, we focused on markets with the following:

- Median property prices below $1,000,000 for affordability

- 100 or more active rental listings to ensure strong markets

- The highest CoC return values at the moment for maximum profitability

10 Cities With the Highest Cash on Cash Return for Long Term Rentals

The 10 best long term rental markets in 2023 are:

| City, State | Long Term Rental Cash on Cash Return | Median Property Price | Average Price per Square Foot | Days on Market | Number of Long Term Rental Listings | Monthly Long Term Rental Income | Long Term Rental Cap Rate | Price to Rent Ratio |

| Immokalee, FL | 7.76% | $335,479 | $239 | 102 | 122 | $2,921 | 7.88% | 10 |

| Berkeley, NJ | 5.73% | $296,529 | $230 | 49 | 114 | $2,221 | 5.83% | 11 |

| Lehigh Acres, FL | 5.70% | $359,650 | $221 | 100 | 541 | $2,427 | 5.79% | 12 |

| North Lauderdale, FL | 5.39% | $309,532 | $238 | 91 | 159 | $2,429 | 5.49% | 11 |

| Rochester, NJ | 5.37% | $270,110 | $207 | 56 | 296 | $2,012 | 5.51% | 11 |

| Port Charlotte, FL | 5.33% | $436,811 | $262 | 96 | 329 | $2,725 | 5.41% | 13 |

| South Fulton, GA | 5.31% | $281,621 | $186 | 74 | 380 | $2,058 | 5.41% | 11 |

| Odessa, TX | 5.27% | $356,444 | $153 | 201 | 422 | $2,288 | 5.38% | 13 |

| Aiken, SC | 5.25% | $385,923 | $186 | 105 | 227 | $2,114 | 5.35% | 15 |

| Margate, FL | 5.22% | $327,029 | $245 | 62 | 242 | $2,369 | 5.33% | 12 |

Source: Mashvisor, July 2023

10 Cities With the Highest Cash on Cash Return for Short Term Rentals

The 10 best short term rental markets in 2023 are:

| City, State | Short Term Rental Cash on Cash Return | Median Property Price | Average Price per Square Foot | Days on Market | Number of Short Term Rental Listings | Monthly Short Term Rental Income | Short Term Rental Cap Rate | Average Daily Rate | Short Term Rental Occupancy Rate |

| Marrero, LA | 8.42% | $314,733 | $169 | 47 | 1,898 | $3,607 | 8.58% | $213 | 53% |

| Rileyville, VA | 8.37% | $357,598 | $241 | 34 | 111 | $4,272 | 8.50% | $219 | 60% |

| Broadview, IL | 8.07% | $265,250 | $213 | 74 | 311 | $3,574 | 8.23% | $174 | 61% |

| East Lansdowne, PA | 7.69% | $205,507 | $141 | 97 | 733 | $2,371 | 7.94% | $132 | 53% |

| Florida City, FL | 7.52% | $396,061 | $268 | 104 | 111 | $4,579 | 7.62% | $170 | 56% |

| Parma Heights, OH | 7.15% | $209,192 | $137 | 50 | 132 | $2,552 | 7.35% | $135 | 56% |

| Westover, WV | 7.13% | $233,360 | $150 | 28 | 101 | $2,567 | 7.29% | $154 | 50% |

| Brook Park, OH | 7.10% | $234,225 | $138 | 47 | 132 | $2,839 | 7.25% | $130 | 61% |

| Lyons, IL | 7.04% | $294,730 | $213 | 47 | 184 | $3,225 | 7.20% | $166 | 58% |

| Temple Hills, MD | 7.03% | $374,934 | $254 | 90 | 161 | $4,165 | 7.13% | $211 | 60% |

Source: Mashvisor, July 2023

For a quick recap of what constitutes a good cash on cash return, watch our video below:

Using Cash on Cash Return in Real Estate: Summary

Because of its simplicity and ease of use, combined with comprehensiveness, cash on cash return is a very helpful metric when doing investment property analysis. Real estate investors can use the CoC return to look for potentially lucrative deals. Finding an investment property with a good cash on cash return can mean several thousands of dollars per month in future income. To help ensure that you’ll be successful in your investing journey, you can take advantage of Mashvisor’s rental property investment tools. Our cash on cash return calculator can help you make beneficial and smart decisions related to real estate investing. With the calculator, you can find the most profitable short term and long term rentals for sale in any US city.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

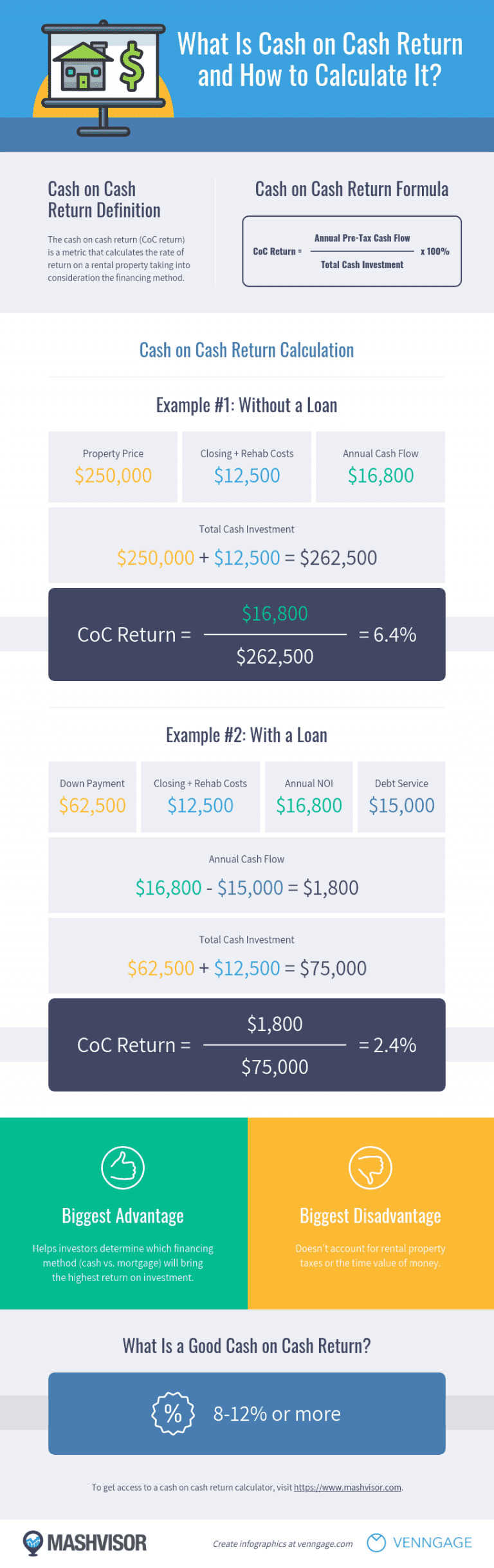

For a comprehensive explanation of the cash on cash return in real estate, have a look at the real estate infographic below. Our “What Is Cash on Cash Return and How to Calculate It?” infographic shows the following:

- The cash on cash return definition

- The CoC return formula

- CoC return calculation example: without a loan

- CoC return calculation example: with a loan

- The biggest advantage of using CoC return

- The biggest disadvantage of using CoC return

- What is a good cash on cash return for rental properties?