Real estate investors have long understood the financial benefits of investing in foreclosed homes. Pre-foreclosure, auctions, and real estate owned (REO) properties provide a never-ending source of investment possibilities. Moreover, there are different investment strategies that can be applied to foreclosure homes to start making money in real estate. So, if you’re interested in buying an investment property, searching for foreclosed homes for sale can be a smart move! Before you jump into buying a foreclosure, however, make sure you read this. In this guide for investors, we cover the following:

- What does foreclosure mean?

- The benefits of investing in foreclosures

- Strategies for investing in foreclosed homes

- How to find foreclosure homes for sale

- Financing a foreclosure

- Steps to buying foreclosed homes

- Tips to success with foreclosure investing

What Is Foreclosure?

In order to understand the foreclosure definition, you need to first understand the foreclosure process. When someone doesn’t have enough money to pay for the purchase price of the property outright, they take out a mortgage loan, which is a contract for purchase money that will be paid back over time. If the borrower fails to make 3 consecutive mortgage payments, the bank will issue a Notice of Default and the pre-foreclosure stage begins. In this stage, the homeowner can sell the property via short sale to pay off the outstanding debt and stop the foreclosure process.

However, if the homeowner fails to sell within 2-3 months, the bank will take the property and try to sell it at a foreclosure auction. If it doesn’t sell there, the lender starts making moves to foreclose the property. This means the lender will take control of the property and require the former homeowner to vacate the house before offering it for sale in order to get paid the money owed. In an attempt to quickly sell the foreclosed homes, lenders usually sell them for much less than they might be worth and accept the highest bidder.

Benefits of Buying Foreclosed Homes

#1. Discounted Price

As mentioned above, in order to sell foreclosed homes as quickly as possible, lenders and banks list them for sale below market value. For real estate investors, this means savings! As a matter of fact, the average discount for a foreclosure (when compared to non-foreclosures) is about 15% according to USNews. In some states, the saving potential is even greater.

When you combine this benefit with the fact that home prices are rising in many cities in the US housing market, you can see why savvy investors consider foreclosed homes to be a bargain in the real estate investing business. You won’t be buying an investment property from another investor looking to make a return on investment, but from a lender who is looking to close the deal fast and doesn’t want to hold the property for a long time.

#2. Better Financing

When selling foreclosures, banks usually ask for payments in full when accepting offers. However, you still might be able to obtain financing for purchasing a foreclosed home for sale. First off, if you plan on financing the purchase with a mortgage, you’ll pay a lower down payment since the property is already cheap. In addition, buying a property below market value grants a real estate investor a lower monthly mortgage payment.

What’s more is that when buying a foreclosure, the bank might be willing to give investors better financing deals just to get rid of the property. This could mean you’ll also get lower closing costs and lower interest rates. All of these are compelling reasons to pursue a foreclosure investment– especially for beginners with little capital who are looking for cheap properties.

Related: 2 New Ways to Find Cheap Investment Property for Sale in 2019

#3. High Return on Investment

Of course, the goal of every real estate investor when buying properties is to see a good return on their investment. As a general rule in real estate investing, the less money you put up-front for an investment property, the greater your ROI is. And since foreclosures are listed at low prices, investing in them gives you a higher potential for making a good return on investment.

In addition, foreclosed homes are usually (not always) distressed and in need of repairs. This gives you the ability to add value to these properties through home renovations and improvement. And let’s not forget the benefit of real estate appreciation – properties increase in value the longer you hold them. Investors benefit from these two factors when selling foreclosed homes later on for a higher price and a good ROI.

How to Invest in Foreclosures

#1. Fix-and-Flip

This is one of the most popular real estate investment strategies for making a quick profit. Home flippers search for distressed properties to flip, and it just so happens that many foreclosures come in distressed conditions due to being neglected for a long time. This makes them perfect for a house flipping business because you can buy them at a very cheap price, work on renovating and adding value to them, and then sell them for a higher price and make profits quickly.

There are a few things to keep in mind here. First off, this is not a cheap investment strategy. While you can buy the property with little capital, you’ll need cash to renovate it. So, be sure to account for the costs of repairs before buying an REO foreclosure. In addition, don’t spend too much on unnecessary renovations only to end up lowering the asking price just to sell the property. You’ll be losing instead of making money in this case. So, make sure you identify improvements that will actually add value to the foreclosure investment and stick to your budget!

#2. Rental Properties

This is the investment strategy we recommend you go for, especially if you’re a beginner in the real estate investing business. Many beginner investors dream of owning a rental property for the many benefits they have to offer like monthly rental income, tax breaks, protection against inflation, and future appreciation. However, many don’t have the money to buy properties that are rent ready. A solution for savvy investors is to buy cheap foreclosed homes and turn them into rental properties.

This shouldn’t include any major renovations as in the fix-and-flip strategy. Instead, focus on reasonably priced repairs that make the property livable and able to generate rental income and positive cash flow. Then you’ll be a landlord and you’ll need to find a tenant to occupy the property and pay monthly rent. When it comes to managing your investment property, you can either do it yourself or hire a professional property manager to make your rental income passive.

Related: Buying Foreclosed Homes to Rent Out: A Step-by-Step Guide

#3. Wholesaling

The last real estate investment strategy you can follow to make money from investing in foreclosed homes is wholesaling. As a wholesaler, you look for distressed homeowners who are looking to sell their property. Instead of buying the property, you assign it to a contract. Then, you need to find an end-buyer and sell him/her the contract. How can this work for you? Well, if you find a house listed as a Notice of Default (NOD), you can contact the homeowner and make a deal before the bank starts the foreclosure process!

This investment strategy is great if you’re looking to invest in real estate without buying and owning a property. It also provides a way to get into the real estate investing business with little money. However, it’s not as easy as it sounds. To succeed in real estate wholesaling, you need to know how to find pre-foreclosure homes, have negotiation skills to make good deals with sellers, and a network of buyers ready to make a purchase. If you believe you have what it takes, this can be a great way to invest in foreclosures.

How to Find Foreclosures for Sale

#1. Newspapers

These are good sources because foreclosures are typically posted in local newspapers. When used well, they allow investors to get into the process before the general public. For example, if a home is listed as a Notice of Default (NOD), you can contact the homeowner and work out a purchase before the property goes to auction. The drawback, however, is that you will probably need to be an all-cash buyer if you come in at this stage of the foreclosure process. Plus, the competition from other buyers can be heavy for these properties.

#2. Foreclosure Websites

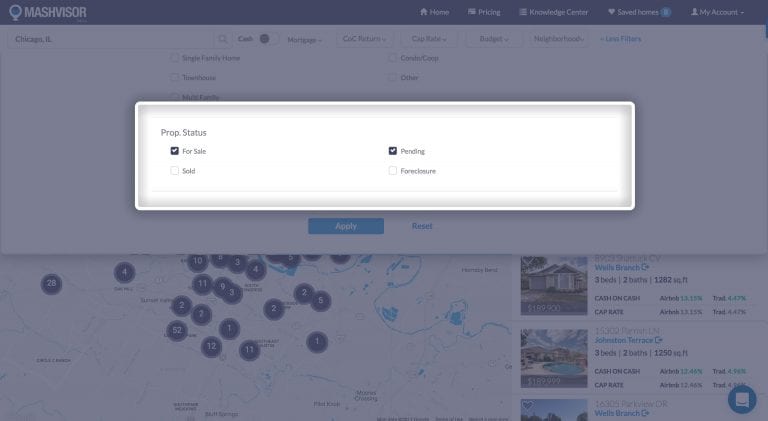

There are actually websites that specialize in providing REO foreclosure listings. The advantage of such websites is that they allow you to find many prospective properties quickly. Some websites even provide investment tools and calculators to help you further in your search and property analysis. Mashvisor, for example, allows you to search for foreclosures in any city of the US housing market. You can do this with an easy-to-use filter on the search platform:

Alternatively, you can visit the Mashvisor Property Marketplace that is centered around foreclosure listings and other off market real estate.

Visit the Mashvisor Property Marketplace today to find and analyze the foreclosed home you’ve been searching for!

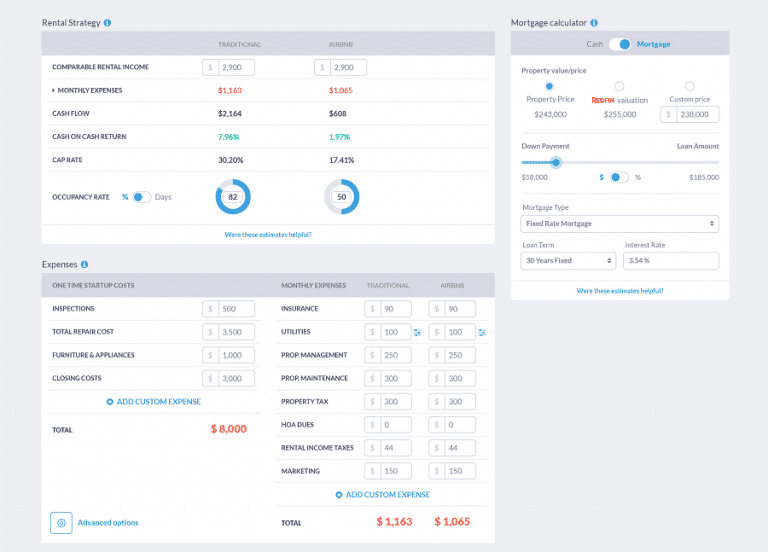

Then, using our Investment Property Calculator, you’ll get data regarding what ROI you can expect from investing in foreclosed homes in terms of the cap rate, cash on cash return, and more! This will help you make sure that you’re buying a foreclosure that will actually make money as an investment property.

#3. Real Estate Agents

Another excellent source for finding foreclosure listings is real estate agents. However, keep in mind that you need to work with an agent who specializes in the foreclosure process and field. The advantage of working with this type of agent is that they’ll inform you as soon as foreclosed homes hit the market. The downside is that there are not many real estate agents who are actually specialized in foreclosures and it can be hard to find one.

#4. Mortgage Lenders

In real estate investing, the best deals are those done directly with the property seller – in this case, it’s the bank. This can actually simplify the whole process as banks and mortgage lenders will allow you to inspect the REO foreclosure before making an offer. However, keep in mind that foreclosed homes are sold “as is” so you can’t negotiate certain repairs. Moreover, banks may not be entirely cooperative with your offer – sometimes, they prefer to wait and see if they get better ones.

#5. Government Agencies

This includes government-owned mortgage lenders and insurers like Fannie Mae, Freddie Mac, the FHA, and VA. The advantage of turning to these agencies is that they usually have a large number of foreclosure listings available and can provide the opportunities to buy foreclosed homes before they hit listing services. Some agencies may also offer you financing! However, the process of purchasing a foreclosure from a government agency tends to be very rigid and could take a longer time.

How to Finance a Foreclosure

So, you’ve found a foreclosure investment property for sale which you want to buy. While banks usually request payments in full when accepting offers, you still have options to finance a foreclosure including:

#1. Commercial Loans

Also referred to as fix-and-flip loans, this financing option is generally provided by banks. The advantage is that they’re specifically designed for investors of foreclosure properties. Meaning, you can use these loans to buy and renovate properties. Even better, they can be used repeatedly. The downside, however, is that banks typically require that you have a history of success buying and selling properties. So if you’re a first-time real estate investor, this is not a source for financing a foreclosure for you. Another downside is that down payments to obtain this financing can be high (as much as 35%). Therefore, these loans are more convenient for experienced foreclosure flippers.

#2. FHLMC HomeSteps Loans

This is another good financing option for investors buying foreclosed homes. With this property financing method, you can buy a foreclosed single-family home with a down payment ranging from 15% – 25% of the purchase price. Moreover, these loans don’t require appraisals or mortgage insurance and loan terms run for up to 30 years. The downside, on the other hand, is that these loans are only available in 10 states – Alabama, Florida, Georgia, Illinois, Kentucky, North Carolina, South Carolina, Tennessee, Texas, and Virginia. Moreover, investors can only use these loans to buy properties owned by Freddie Mac.

How to Avoid Investing in a Bad Foreclosure

#1. Research the Neighborhood

Many think that foreclosures are located in run-down neighborhoods, but that’s not always the case. And as an investor, you still need to keep “location, location, location” in mind before purchasing a foreclosure as it’s an important factor for successful real estate investing. Therefore, research the neighborhood or area where the property is located to make sure it’s a good location for buying an investment property. After all, regardless of which investment strategy you choose, someone is going to live in that property and you want to be able to find that buyer or tenant.

So, after finding foreclosure listings, make sure they’re located in good neighborhoods where people want to live. A few things to look for to identify good neighborhoods include the market’s overall conditions, low crime rates, school district rating, walkability, availability of public transportation, and vacancy rates. Basically, you want to see a demand for housing in the neighborhood before you purchase a foreclosure to make sure you can make money from renting out or selling this investment property.

Related: Location Location Location: What Makes for the Best Place to Invest in Real Estate?

#2. Check Comparable Properties

Before making an offer on a foreclosure investment property, you should evaluate the listing price just as you’d do with any other real estate purchase. The best way to do that is by looking at comps. Real estate comps are properties similar to the one you’re targeting that are located in the same neighborhood and were recently sold. Checking at least 3 – 4 comps allows investors to understand the market’s condition, know what similar properties have sold for, and write a competitive offer based on that.

In addition, reviewing real estate comps allows investors to compare the foreclosed property to others to determine its potential for making profits. For example, by looking at what similar homes in the area rent for, you’ll have an idea of what rental income you can expect to earn from buying foreclosed homes there. You’ll also have an idea of the best price to sell the property for after flipping it – if that’s your strategy of choice.

Looking for comps to analyze foreclosure investment properties in your housing market? Start out your 14-day free trial with Mashvisor to get a detailed list of comps for any listing you find on the platform!

#3. Get a Home Inspection

While foreclosures are sold “as is”, you still need to know the deficiencies in the property. So, bring in a competent home inspector to give you a detailed list of everything wrong with the property. An inspector should also give you a breakdown of how much it will cost in order to complete home renovations. This helps investors know whether investing in the foreclosure is actually profitable, or if it’s likely to turn into a money pit.

Do you have more questions on foreclosures in real estate investing? Don’t hesitate to leave them in the comments below!