One of the most important things to determine a property’s profitability is its NOI versus the amount invested. But what is NOI in real estate?

NOI is an acronym that stands for Net Operating Income. The NOI is a metric used by real estate investors to calculate how profitable a potential investment property is. No investor goes into business simply to break even. Generally, the assumption is that you invest in real estate to make money. For this reason, you must know how profitable a potential investment is before going all in.

Table of Contents

- What Is NOI?

- How to Calculate NOI

- When Is NOI Needed?

- What’s the Best Tool for Calculating NOI?

- How to Improve the NOI of a Property

Real estate investing is one of the oldest forms of generating wealth, and it still holds today. That’s why many people keep entering the real estate market. Investing in real estate offers plenty of advantages, including enjoying an additional income source that generates positive cash flow.

In this article, we will look to answer the question posed earlier: what is NOI in real estate investing? Afterward, we will show you how to calculate the NOI of your rental property to make sure that you stand to gain from it and not end up with a loss. Then, we will show you the best tool for calculating the NOI of your investment property.

What Is NOI?

NOI is short for net operating income. It is a real estate financial metric used to check whether or not a property is worth investing in. It is mainly used to determine the subject property’s income-generating potential.

When calculated properly, NOI can be a good way to compare different properties. It means when you want to buy a rental property and you are faced with choosing between two or more, the properties’ NOI can help you easily make that decision.

As an investor, the metric can help you know how much money a potential investment property will make you. Additionally, the NOI lets you know how much it will cost to operate the property. While the NOI is calculated annually, you can divide the annual number by 12 to see what you get on a monthly basis.

To put it simply, the NOI is a metric that tells you whether a property is worth spending money on or not.

Calculating the NOI of a property is simple. Just deduct the property’s operating expenses from the total revenue generated by the property. As mentioned earlier, you can compute your annual or monthly numbers, depending on your preference.

We will discuss how to calculate the NOI of a property in the following section.

Related: How to Find Good Investment Properties

How to Calculate NOI

It’s easy to calculate the NOI of a property. Use the formula below:

Net Operating Income (NOI) = Total Revenue – Operating Expenses

The total revenue is all the income generated by the property. Depending on the property use and set-up, some of the revenue includes parking fees, laundry services, and storage rentals.

The operating expenses indicate the amount it costs to operate the property and keep your business running smoothly. Depending on your use of the property and how you set it up, the expenses may include utility bills, property management fees, insurance, property taxes, repairs, and maintenance.

Example

Here’s an example of how you can calculate a subject property’s NOI:

Total Revenue

Let’s say that you are the owner of a 10-unit apartment building. The property generates $1,000 in monthly rental income for each unit. It gives you a total monthly income of $10,000 (10 units x $1,000 per unit). It means that the property could make you $120,000 annually (10 units x $1,000 per unit x 12 months).

Operating Expenses

Now let’s assume that the property incurs a total of $40,000 in annual operating costs. It already covers all the expenses associated with running a rental property business. They include property taxes, insurance coverage, utilities, maintenance and repair costs, and property management fees.

Net Operating Income

Using the examples stated above, let’s find out what the NOI is for your 10-unit apartment.

To calculate the net operating income (NOI), you need to subtract your operating expenses ($40,000) from your total revenue ($120,000):

NOI = $120,000 – $40,000

NOI = $80,000

As you can see, the NOI for your apartment building is $80,000 per year. It means that after paying for your property’s operating expenses, you will get $80,000 in profit per year.

A simple equation makes it easy to answer the question of what is the NOI of a property. Just know those two basic numbers—the revenue and the cost—and you will be fine.

When Is NOI Needed?

After answering the question of what NOI is and showing you an example of calculating a property’s NOI, we will now show you when this metric is needed.

Here are three situations where the NOI of a property is needed:

1. Property Valuation

Property valuation is defined as a professional opinion of a rental property’s value. Valuing properties is common in real estate because transactions occur frequently. It is typically carried out by a professional real estate appraiser.

When conducting a property valuation, whoever is looking at the property will need its NOI to come up with an accurate estimate of what the property is worth.

You can easily estimate a property’s value by dividing its NOI by its cap rate, which is short for capitalization rate.

Related: Real Estate Investing for Beginners—How to Calculate Cap Rate

2. Investment Analysis

A property’s NOI is also needed when you want to analyze how profitable a potential real estate investment will be.

You simply need to compare the NOI of the property to its purchase price. When you do so, you can accurately estimate whether or not a particular property is a good investment.

You can also use the 2% rule to evaluate a property’s profitability.

The 2% rule is a rule of thumb that states that for a rental property to be profitable, it should generate an income of at least 2% of its purchase price. It is not a hard and fast rule and may or may not be used, but it’s something to keep in mind as an investor.

3. Lending Decisions

Lenders use the NOI of a rental property to determine whether or not they would lend you their money. As mentioned above, the NOI is the amount of cash the property generates after removing all the expenses associated with the property.

That being said, if a lender calculates the NOI of a property and realizes that the NOI is a negative number, the chances that they’ll lend you any money is slim.

Therefore, the NOI indicates how much a lender is willing to lend to a borrower. The higher the NOI, the more likely that the property can generate enough cash for you to pay back the loan. It means that a higher NOI leads to greater possibilities of a lender allowing you to borrow money.

What’s the Best Tool for Calculating NOI?

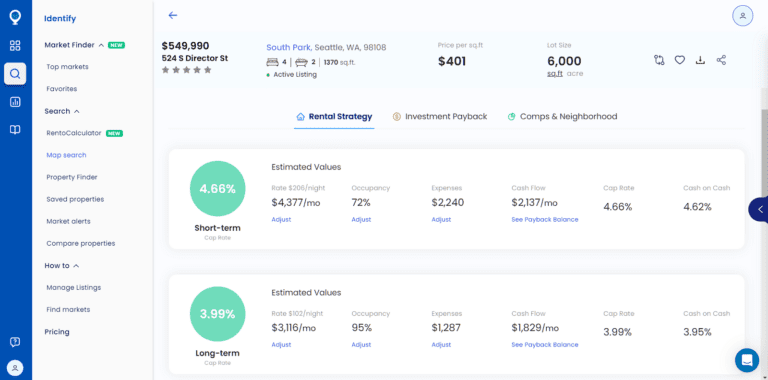

The best tool for calculating the NOI of a real estate property is Mashvisor’s calculator. It is a powerful real estate market tool for both experienced and first-time investors. The calculator uses data sourced from highly reputable websites to ensure you make an informed decision regarding potential investment property.

One of the calculator’s best features is the neighborhood analysis feature, which provides investors with in-depth data about a neighborhood of their choice. Furthermore, the tool takes into account factors like a property’s location, traditional or Airbnb occupancy rate, cash on cash return, and rental income taken from rental comps.

Mashvisor’s database is regularly updated to ensure that users only get highly accurate data, giving them highly realistic results when they make their ROI projections and revenue calculations.

Mashvisor’s calculator also provides investors with a wide range of tools used to analyze rental properties. You can use the tools to calculate the NOI of a potential rental property and compare them to other rental properties.

With the calculator, you not only determine the NOI of a property, but you can also choose the best location and neighborhoods to invest in. Plus, it is affordable. You can try it out first before committing.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Mashvisor’s calculator is a valuable tool real estate investors can use to calculate the NOI of a property.

How to Improve the NOI of a Property

Some investors, especially beginners, make the mistake of buying an investment property before calculating its NOI. There’s no need to panic, though. The issue can be easily remedied.

If you already have a property and its NOI is not as high as you thought it would be, you can take some steps to improve it.

1. Reduce Operating Expenses

Perhaps the best way to bring up your property’s NOI is to minimize your operating expenses. Lowering your expenses will give you more wiggle room for your finances and give you a significant increase in your savings resulting in an increased NOI. A penny saved is a penny earned, after all.

There are several ways to go about it. For one, you can lower your electric bill by using solar power as an alternative power source. Additionally, if you’re working with a property management company, consider reevaluating if their services are worth it. You can find more affordable ones that provide better services.

Related: Top 7 Airbnb Property Management Companies in 2023

2. Increase Rent

Easily the first thing investors do when trying to increase the NOI of their property is to raise their rental rates. However, we advise that you do so with caution because renters don’t take too kindly to rent increases. If you have a long-term rental, look at the comps first to see if you’re undercharging for your property. And if you’re running an Airbnb business, use Mashvisor’s Dynamic Pricing tool.

But if you like to increase your rent with minimal resistance, you can make upgrades to your property. Take a good look at your rental home and find areas where you can add updates, like the kitchen, so that you can justify increasing the price. Your tenants might be disgruntled at first, but once they see the improvements, they eventually won’t mind the price hike.

Another tactic you can use to justify the increased rent is to improve customer service. This way, your tenants or guests will feel like they are getting their money’s worth, even if they have to pay a little more.

3. Find Additional Income Sources

There are many ways to make some extra cash with your rental property to increase its NOI. You can charge for parking, add a little extra rent for pets, or even provide additional services like running errands for extra cash. You can also hire a cleaning service to tidy up the property every day.

But make sure that the amount you pay for the cleaning service is added to the rental income, plus more. With all the said add-ons, renters won’t mind if they pay a little extra.

The point is there are many ways to improve the NOI of your rental property. Be innovative. You will surely think of something.

Final Thoughts on NOI

In conclusion, NOI is a metric real estate investors use to calculate the profitability of a rental property. If you want to become a successful real estate investor and rental property owner, do not ignore the metric. It can spell the difference between owning a property that makes you money and owning a property that will drain all your resources.

We hope that we answered the question of what is NOI with this article. We also hope that you found it helpful to know how to calculate the NOI of any rental property. You were shown the various scenarios where the NOI of a property is needed and the best tool for calculating the NOI of a real estate property.

After reading this article, you should be able to understand what NOI is, and you should know how to calculate the NOI of any of your properties without the help of an appraiser. Plus, you should’ve learned when you need to do the calculations. But, if you want to make the process of getting a profitable property easier, use Mashvisor’s calculator.

Mashvisor can help Airbnb hosts and real estate investors successfully manage their properties by providing top-notch real estate tools to make their investments profitable. The tools include the Property Finder, Market Finder, heatmap, and Dynamic Pricing. Use these and watch your career as a real estate investor soar.

Schedule a demo with Mashvisor and get access to its tools and improve your success as an investor.