Purchasing an investment property can be a great way to make money in real estate. But in order to ensure a successful real estate investment, an investor must always evaluate the property and its profitability before buying it. Here’s where a real estate investment calculator comes in handy!

Keep on reading as we explain what a real estate investment calculator is, how it works, and how it helps investors make the best real estate investing decisions.

What Is a Real Estate Investment Calculator?

A real estate investment calculator – also referred to as real estate return on investment calculator, investment property calculator, or rental property calculator – is an online tool designed to help investors analyze potential real estate investments for profitability. It provides them with all the important numbers that they need to assess the performance of an investment property.

Using a real estate investment calculator is easy. All you have to do is input some basic information about a certain investment property, such as the purchase price, the financing method, the cash down payment, and some other real estate costs. Then, the calculator outputs all the numbers you need to decide whether or not to go for the property. Basically, this tool can be thought of as an investment property evaluator: it tells you if a certain income property is a good investment to buy.

Why Do Investors Use a Real Estate Investment Calculator?

Both experienced and beginner real estate property investors use a real estate investment calculator because not only is it easy to use, but it also saves them so much time and effort when it comes to performing all the necessary calculations. In fact, before real estate investment calculators existed, investors would spend hours collecting data on the real estate market and investment properties; then they would use countless Excel spreadsheets to compute all the important numbers and determine the profitability of an investment property. Today, the real estate investment calculator does all this work for you within minutes, eliminating the need for spreadsheets.

Accuracy is another reason why property investors use a real estate investment calculator. When doing calculations manually, there’s always the risk of making a mistake. And worse than this is the risk of multiplying that mistake when using spreadsheets. However, by using a calculator, you avoid making mistakes. In fact, the real estate investing calculator developed by Mashvisor uses traditional and predictive analytics, as well as comparative and historical data, to provide its users with the most accurate results. This allows investors to accurately forecast the return on investment from their next investment property purchase, and thus make the best real estate investing decisions.

Related: Why an Investment Property Calculator Is Better Than Spreadsheets

What Are the Key Calculations of a Real Estate Investment Calculator?

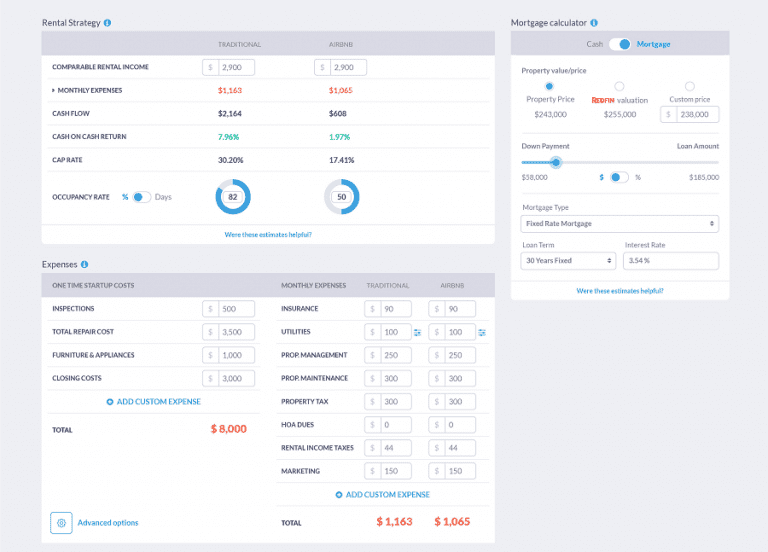

Mashvisor’s real estate investment calculator displays three main outputs, or real estate metrics, that every real estate investor needs in order to determine if a certain income property makes for a good investment.

-

Cash Flow

Cash flow is the difference between the monthly rental income and the monthly rental expenses of a real estate investment property. It is an important metric in investment property analysis because it basically tells you how much profit you can expect from a certain investment property. Mashvisor’s real estate investment calculator calculates cash flow while taking into account all the different rental property expenses such as mortgage payments, insurance, property taxes, and maintenance costs.

As a real estate investor, your goal is to make money, so you should always aim for investment properties with positive cash flow. Negative cash flow means that an investment property has higher expenses than rental income, which represents a loss for the investor. Mashvisor’s calculator essentially works as a cash flow calculator and allows you to quickly determine if a rental property will yield a positive cash flow.

Related: How to Find Positive Cash Flow Properties

-

Cash on Cash Return

Cash on cash return is a measurement of the return on investment based on the initial cash invested in the property. It is calculated by dividing the net operating income (NOI) by the initial cash invested. Basically, cash on cash return tells you how much money you’re earning back each year if you put a certain amount of cash down. So, if you take out a mortgage loan with a 15% down payment to finance your investment property, the cash on cash return will be calculated based on the down payment. Mashvisor’s investment property calculator also allows you to add other initial investment costs to the cash on cash return calculation, such as commission fees and closing costs.

What is a good cash on cash return, you may ask? Real estate experts recommend investing in real estate rental properties with a cash on cash return of 8% or higher to ensure a profitable investment. And with Mashvisor’s calculator, you can easily find these investment properties anywhere in the US housing market.

Related: What Is a Good Cash on Cash Return in 2020?

-

Cap Rate

Cap rate, or capitalization rate, is the ratio of the NOI to the current market value of the property. It is considered to be the purest form of return on investment since its calculation doesn’t take into account the financing method. So, in other words, the cap rate estimates an investment property’s returns as if the entire cost of the property has been paid off in cash.

According to real estate experts, income properties with a cap rate within the range of 8-12% make for good real estate investments.

Mashvisor’s Real Estate Investment Calculator: Extra Features

Mashvisor’s real estate investment calculator also offers additional features that aren’t found in any other calculator.

-

Neighborhood Analysis

What makes Mashvisor’s calculator different from other real estate investment calculators is that it provides investors with real estate data at the neighborhood level. With the neighborhood analysis feature, you can search for any neighborhood you’re interested in and get all the important real estate investing metrics for that neighborhood. These metrics include the median property price, the average rental income, occupancy rate, cap rate, cash on cash return, and more. As a result, you can use this data to compare different neighborhoods at the same time and ultimately decide which neighborhood suits your search criteria best.

-

Investment Property Analysis for Multiple Properties

After selecting a neighborhood, the investment property analysis feature allows you to gain insight into each investment property for sale in that neighborhood. Mashvisor’s investment property calculator provides readily calculated real estate metrics for thousands of investment properties across the US real estate market. This allows you to compare different investment properties based on the real estate metrics mentioned above (rental income, rental expenses, cap rate, cash on cash return, etc.) and choose the one that has the best potential for returns.

-

Optimal Rental Strategy

The rental strategy plays a key role in determining how profitable an investment property will be. There are two main rental strategies you could opt for when it comes to investing in real estate rental properties: traditional (long-term) rentals and Airbnb (short-term) rentals. Using predictive analytics, Mashvisor’s calculator can help you determine which rental strategy is optimal for a given property. In fact, all the above real estate metrics are shown for both the traditional and Airbnb rental strategies, which allows you to make quick comparisons and choose the rental strategy that yields higher returns.

Conclusion

A real estate investment calculator is a must-have tool for every real estate investor. Whether you are a beginner investor considering buying your first investment property, or an experienced investor searching for your next income property, using a real estate investment calculator will help you forecast your potential return on investment efficiently and make smart investment decisions.

Now that you know how a real estate investment calculator works, check out Mashvisor to start using the best investment calculator out there.