Analysts at Goldman Sachs say that the US housing market downturn will worsen in 2023. It begs the question, “Will the housing market crash?”

Table of Contents

- What Has the US Housing Market Been Like This Year?

- Will the Housing Market Crash in 2023?

- Will 2023 Be a Good Time to Buy an Investment Property?

- Best Tool to Combat an Imminent Housing Market Crash

The housing market is already in a downturn, says the CEO of the National Association of Home Builders, Jerry Howard. According to Goldman Sachs economists, the US housing market will drastically slow down in the coming months, and price growth will eventually stall in the third quarter of 2023.

The above statements are just a few of the many housing market predictions for 2023 made due to the high inflation and interest rates recently. The high rates have made it necessary for prospective homebuyers to defer spending. Even though home sales will fall, and it is extremely possible for some markets, massive declines are almost impossible.

In this article, we will give you an overview of what you can expect to happen in the US real estate housing market in 2023. In the end, you will discover the best real estate tool from Mashvisor that will help you find profitable houses in the market at the best prices.

What Has the US Housing Market Been Like This Year?

This is what the US housing market has been like this year:

- The supply of houses for sale grew 27% in September.

- Sellers are not getting bids from prospective buyers as they were in 2021.

- Buyers are holding off buying properties due to the unpredictable state of the economy.

Also, the Federal Reserve did not help matters by raising interest rates to fight inflation.

Predicted Trends for 2022

In 2021, analysts predicted what the market would look like in 2022. Below are some of the housing market trends for 2022.

Higher Mortgage Rate

Trying to predict anything, especially the real estate market, is not easy. That is why the idea that interest rates at the end of 2021 would be around 3.5% was proven wrong when they hit 3.1% by the second week of December. But even with such a slight miscalculation, it is evident that the market was close to being right.

Then, the prediction for 2022 was that rates might stay low because of the market’s response to COVID. Amid the pandemic, we saw mortgage rates respond immediately, with the rates going up and falling according to the latest headline. However, with the increasing acceptance of vaccines, mortgage rates started to rise steadily.

The Executive Director of Capital Markets at Guaranteed Rates, Jeremy Collet, believe mortgage rates will remain at a historic low, despite their upward movement in recent months.

Therefore, the prediction for higher mortgage rates came true. It is due to the high level of inflation in over four decades. And, because of the Federal Reserve’s latest fiscal initiatives, mortgage rates could keep going up.

However, from a historical point of view, the average mortgage rate in the market today is still lower. Around five decades ago, the average mortgage rate was around 7.5%, compared to about 6.8% in late September. Average prospective homeowners are still better off. There’s no need for doom and gloom.

Low Inventory

For some time, the US housing market inventory raised concerns for many participants.

The average number of homes for sale in 2015 was consistently at around one million. However, in 2021, the number went down significantly to around 350,000 homes, on average. It can be attributed to the imbalance between demand and supply. The low inventory keeps driving demand up, including the prices of homes.

In 2022, the inventory of houses in the US is expected to remain low, driving demand and house prices through the roof. Builders cannot build houses as fast as people want them. With this in mind, the housing market can benefit greatly from an infusion of newly-built homes to increase inventory.

More Homebuyers

In 2022, more people will be looking to become homeowners. The current US administration will focus on making housing affordable for its citizens. The expectation was that a lot of innovations and technology would be made available so that more people could become homeowners.

The US government’s efforts will help manage the rising cost of houses in the market. However, given the bureaucratic nature of politics, there is the question of whether the said changes can be implemented quickly for potential homeowners to take action.

The expected increase in homebuyers is accurate. The demand for houses in 2022 will keep on growing. It is because, in July, people trying to sell their houses got, on average, three offers monthly. It was the same number of offers sellers received every month before the pandemic.

During the same month, the majority of the houses listed for sale stayed in the market for a maximum of 14 days. Additionally, some even sold for more than the asking price. It simply means that even though the prevailing interest rate is going up, demand for houses is still high.

Efficient Home Buying Due to Innovations

In the current market, real estate investors don’t need to go directly to a house before they are convinced that the house will be profitable. It is because the majority of the home-buying experience is done digitally now. Platforms using Artificial Intelligence technology are able to streamline the buying process for the investor and even make it cheaper.

Before, you must go through lots of information before deciding whether you should buy a home or not. But now, due to AI, all you need to do is locate the home you want and the AI will provide all the information about the market that you need to make an informed buying decision.

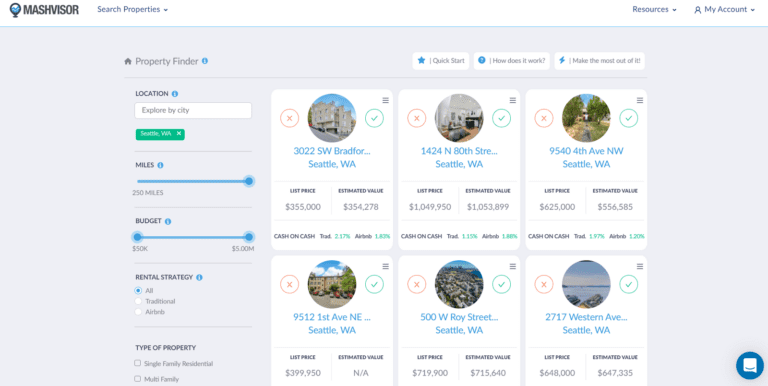

With the advancement of technology, it’s easy to see why the use of AI continues to grow in popularity. Mashvisor is one of the platforms that use AI technology to make the process of buying a home easier for the investor. Its Property Finder tool makes it easier for buyers to look at a property and analyze its neighborhood before deciding to buy the house.

Therefore, to answer the question, will the housing market crash? Take a look at the following trends, and hopefully, you will get a clear understanding of where the market is going.

Will the Housing Market Crash in 2023?

The jury is still out on whether the market will crash or not. Some analysts predict that the housing market will crash in 2023, while some are still skeptical. However, many analysts agree that there will be low inventory.

Therefore, there are no clear answers as to whether the housing market will crash in 2023. But if the rise in inflation continues, mortgage rates will go up, affecting the US housing market. And if things don’t go up quickly, it will continue into the 2024/2025 housing market.

The bubble of 2006 was mainly caused by poor lending from banks. But today, there are stricter rules for lending and the possibility for another housing bubble is slim.

Direct Quotes From Experts About the Housing Market in 2023

Here are some direct quotes and responses to the question, “Will the housing market crash in 2023?”

Armstead Jones, Strategic Real Estate Advisor at Real Estate Bees

“If the Federal Reserve keeps increasing interest rates, we will have a slowdown on housing sales but not a crash. The market will get to a point where builders stop producing housing stock because there is no demand for the housing.”

“Crash indicates little to no investor confidence in the market. Lenders will find ways to make mortgages work but no qualified borrowers who can afford sales prices. That complete slowdown will make the Federal Reserve restore lower rates to build confidence in the housing market.”

Andy Feiwel, Real Estate Agent With Compass in NYC

“Crash is a very dramatic and charged word; there will be nothing resembling a crash in the housing market. There is no single housing market; housing is extremely regional, city to city, and even block to block. Certainly, prices have peaked in many markets and a correction is happening where prices have spiked to unsustainable levels.”

“However, a lack of supply is a pervasive factor mentioned in many metro areas that will keep prices firm, along with a strong underlying rental market. Supply is being further constrained by homeowners that have locked in low-interest rates and do not want to sell and then borrow at the current higher mortgage rates.”

“Additionally, real estate is an asset class that is exactly what you want to own in an inflationary market; part of the weakness in the stock market is a reaction to this, and people are putting their money into real estate and building their cash positions.”

Alex Shekhtman, LBC Mortgage CEO & Founder

“As a housing market expert, I am confident in saying that the market will not crash in 2023. The market is cyclical, and we are currently in the later stages of the current cycle. However, this does not mean that there will not be a sharp correction.”

“We have already seen home prices begin to level off in some of the most overheated markets, such as San Francisco and Seattle. This is to be expected as we approach the peak of the cycle. However, a full-blown crash is unlikely. The next few years will be challenging for buyers and sellers alike, but those who are prepared for a slower market will be able to weather the storm.”

As you can see, the consensus is that there will be a slowdown in the sale of houses in 2023, but the likelihood that there will be a market crash is slim.

Will 2023 Be a Good Time to Buy an Investment Property?

With the way the housing market is going today and the analysts’ predictions, it is crucial to know if 2023 will be a good time to buy an investment property. The previous section shed some light on answering the question, “Will the housing market crash in 2023?” Now, let’s see if 2023 is a good time to buy an investment property.

To answer the question, it is important to see it from different angles. This is so that when 2023 rolls by and things change, you will be equipped to handle the changes. Therefore, we will attempt to provide you with answers from three angles: If the housing market crashes, if housing prices drop, and if prices rise.

If the Housing Market Crashes

In 2023, if we see a housing market crash, mortgage rates will be the most important factor for an investor when trying to buy a home. With the Federal Reserve raising interest rates several times this year, mortgage rates follow suit. In addition, we can expect a rate increase again before 2022 ends, as Jerome Powell, Chair of the US Federal Reserve since 2018, mentioned in a recent speech.

If mortgage rates keep going up, economists will start seeing a familiar type of fear brought about by a potential housing market recession. Even though it is clear that the housing boom of the COVID era has come to an end, house sales will be slow, and if it continues, we can expect another recession.

Still, the probability of a recession is slim, because as mentioned earlier, the housing market foundation today is stronger than before. The laws for borrowing are stricter, and there are fewer home defaults. Therefore, even though there are talks and fears about a recession in the housing market, it’s unlikely that it will occur.

If Housing Prices Drop

Before we talk about whether 2023 will be a good time to buy an investment property if housing prices drop, let’s discuss when prices will decline. According to the law of demand and supply, prices will drop as soon as the demand for houses is met. It is how the housing market works.

According to Up for Growth, in housing markets like California, Texas, Florida, New York, and Washington, the demand for houses is high but the inventory is low. However, there is usually a decrease in demand when the economy is weak. Unless there is too much inventory, then demand will increase.

If housing prices drop, some markets in the US will bear most of the impact. According to Zillow, the areas where home prices are expected to decrease the most include Fairbanks, Alaska (-7%); Lake Charles, Louisiana (-6.1%); Minot, North Dakota (-6%); and Mount Gay-Shamrock, West Virginia (-5.1%). Therefore, if you want to buy an investment property in 2023, avoid the said areas.

If Housing Prices Rise

If housing prices rise by, say, 5% to 15%, within a few years, the inflation rate will increase to 4%, according to a NAR survey of over 20 top US economic and housing experts. When it happens, it will be another strong year for growth in housing prices. In fact, housing prices have gone up by 19.2% in the last 12 months. The figure is at the far end of the spectrum compared to the average annual growth of US homes since 1987.

And even though the price of houses in the US rise, demand will not fall. People buying up most homes today are millennials in their prime homebuying years. They constitute 43% of homebuyers and are the fastest-growing segment in the country. Plus, they are no longer hesitant to buy their first homes.

Will 2023 be a great time to buy an investment property? Let’s consider the factors we just looked at one by one. If the market crashes, it won’t be as bad as what happened in 2008. If prices fall, demand will rise. So, using this information at your disposal, you should buy a house in 2023.

According to Newsweek, the markets that would be most affected by an increase in house prices include Albany, Georgia (4.1%); New Bern, North Carolina (4.1%); Augusta, Georgia (3.8%); Hartford, Connecticut (3.7%); and Casper, Wyoming (3.3%).

Using AI technology, Mashvisor’s Property Finder tool will help you find the most profitable property in the best neighborhood faster and easier than ever.

Best Tool to Combat an Imminent Housing Market Crash

So, will the housing market crash in 2023? It’s hard to say. Some arguments favor the market crashing, and others see the opposite. Some analysts who predict that the market will crash also say that the chances of that happening are slim. Whichever way it goes, you should be prepared.

So far, we’ve examined the state of the housing market as it is today. We’ve looked at a few responses from experts as to whether the market will crash in 2023 or not. Finally, we’ve tried to find out to see if 2023 will be a good time to buy an investment property. If and when you choose to buy an investment property in 2023, you need the best tool to guarantee a profitable investment.

This is where Mashvisor comes in. Mashvisor offers various tools to help real estate investors find the best-suited property that is also profitable. Its Property Finder tool, with the help of AI technology, will help you find the most profitable property in the best neighborhood faster and easier than ever.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.